TL;DR

- Ericsson predicts 91% of the North American market will have adopted 5G by 2028.

- The company is betting that mobile subscriptions have started to level off, betting that the next six years will only add 800 million new subscriptions.

- Advances in mobile technologies could quintuple data used by 2028.

If you consider your smartphone a multimedia/multipurpose technology device, then Ericsson’s mobile reports are for you. The latest edition is available here.

Here’s the explanatory overview: Global 5G growth amid macroeconomic challenges.

North America and northern east Asia (e.g. China, South Korea, Taiwan) lead the way in 5G adoption, for now. India is expected to be a big player as it continues efforts to launch its own high-tech future, one that embraces all of the country not just a few select well-educated metropolises. Similarly situated countries, such as Indonesia and Nigeria, are also showing strong early adoption numbers.

The report says, “In 2028, it is projected that North America will have the highest 5G penetration at 91%, followed by Western Europe at 88%.”

In terms of current usage, “North America and North East Asia are expected to have the highest 5G subscription penetration by the end of 2022 at around 35%, followed by the Gulf Cooperation Council countries at 20% and Western Europe at 11%.”

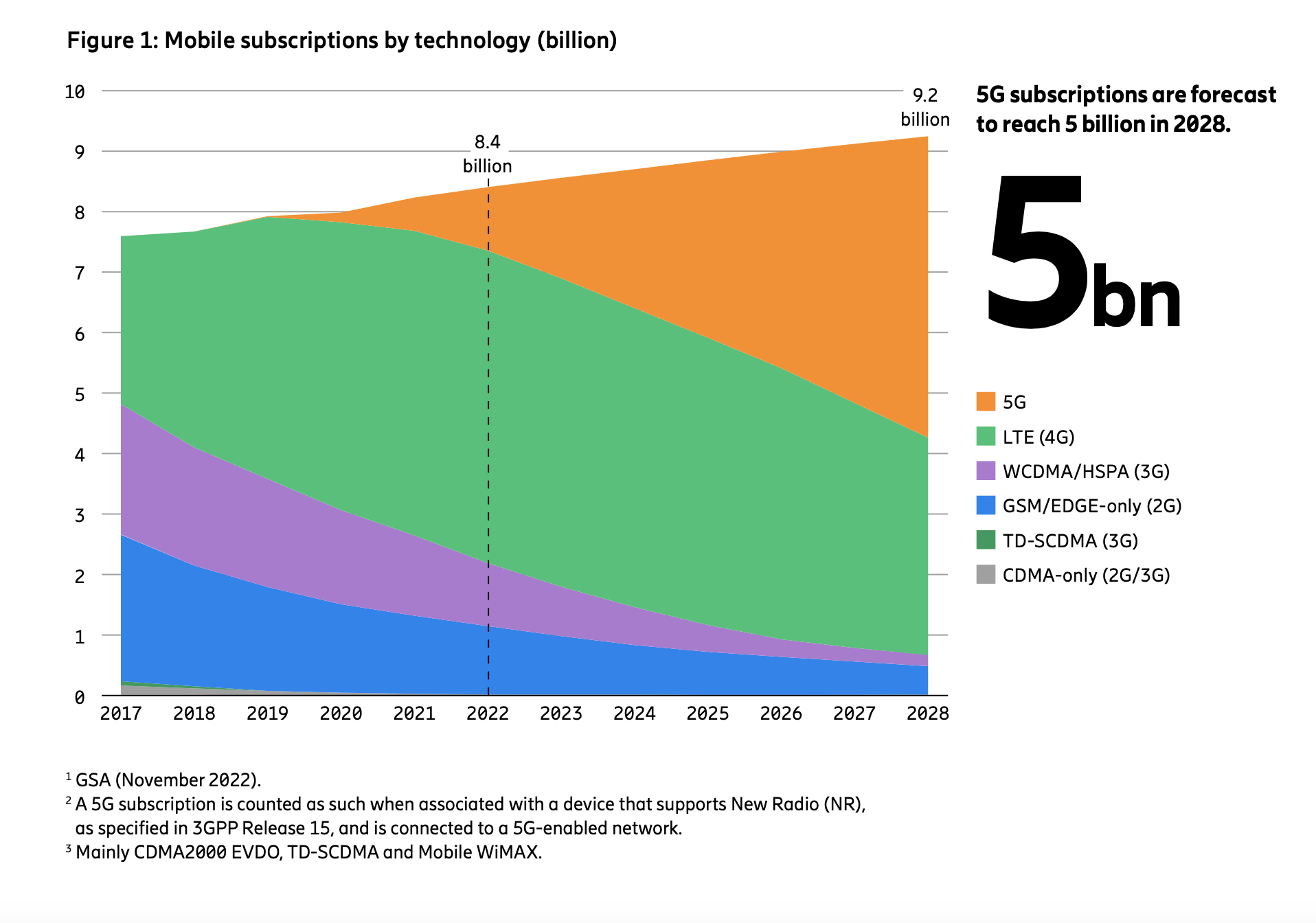

By 2028, Ericsson expects 5 billion 5G subscriptions worldwide.

There is also a prediction that mobile subscriptions (mostly smartphones) will reach 9.2 billion in 2028, up from 8.4 billion calculated for this year. That doesn’t sound like a lot of growth, indicating that nearly everyone who wants a mobile subscription probably has one; remember that there are more than 8 billion people on planet Earth as of 2022.

The report’s “5G in South East Asia and Oceania: A closer look” section looks into that region and the plans to move many, if not all, of those developing countries (referring to notably The Philippines, Malaysia, Thailand, Vietnam and Indonesia) into the first world on the wireless front over the next several years. Ericsson thinks that total mobile data traffic in that region will quintuple between now and 2028.

(BTW, that’s why Ericsson may have underestimated its 2028 figures. There are going to be a lot of new people hopping onto the wireless train in the next few years.)

5G Driving Mobile Data Growth

That’s the where. As to the why, perhaps the most interesting section is “5G to drive all mobile data growth.”

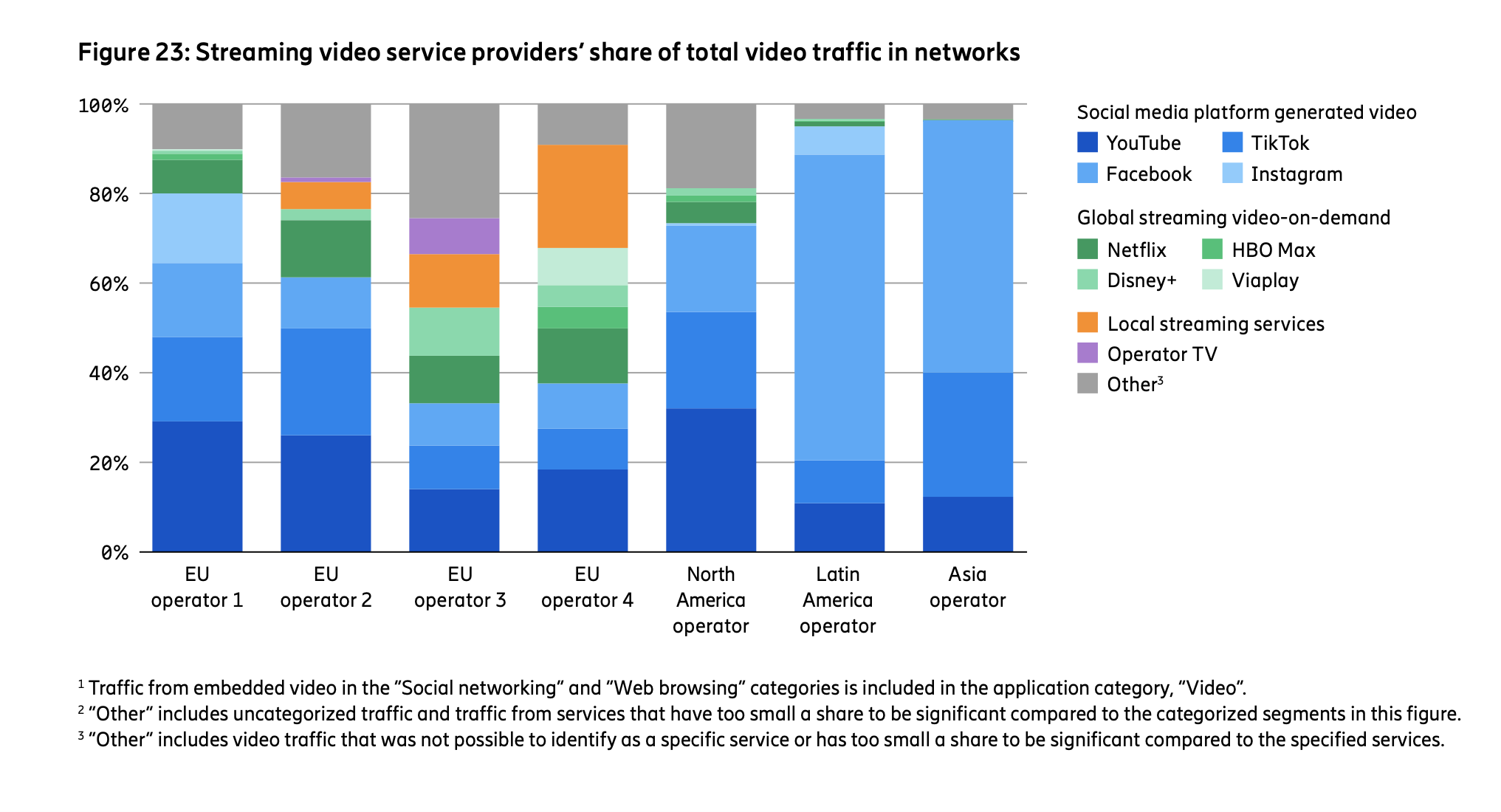

That assessment probably doesn’t surprise anyone, but the incline of the rise should open eyes. In other words, what we’ve seen in the explosion of mobile device data usage over the last five years is a ripple compared to a coming tsunami in the next five years. Much of that will be in video, accounting for as much of 80% of mobile network traffic.

4G continues to grow as well, but the report predicts it will peak soon with a gradual decline in its market as 5G is implemented in more locales, regions and countries, along with the usual gradual tech swap out takes over.

“Fixed Wireless Access” is also a growing sector, per Ericsson. These are broadband wireless access points, currently numbering around 100 million, at businesses or on towers for public and private use.

Besides human users, smart devices for the Internet of Things are continually developing. Ericsson expects that market to get hotter, possibly by five times by 2028, with over 300 million access points by then. Northern east Asia is a particular hot spot for them.

5G Roadblocks

Among the things slowing even faster deployment, depending on the country involved, includes making radio frequency spectrum available.

Lower, less RF-efficient bands, below 7 GHz, are the first auctioned off, but they realize the weakest, though cheapest, performance. These bands propelled 3G and 4G in most technologically capable countries and are the technology breeding grounds for developing countries.

Now it comes time to fill out the 7 GHz group and move to the 24 GHz band and above, where 5G can flex its muscles. Being able to operate in multiple bands allows for efficient service uses — low-bandwidth items, for instance IoT and voice-only traffic, can flow unimpeded while high-bandwidth-hungry video and gaming services can operate in the same network on a higher frequency band.

AR for Mobile

The report touches on augmented reality for mobile devices (think Pokémon everywhere 24/7!) and a slow acceptance of improved smart glasses and visors. Ericsson acknowledges the technology and its support ecosystem have yet to mature.

Looking forward, the report says: “As the AR ecosystem develops, traffic arising from AR usage could significantly impact the current forecast. The amount of traffic that will be generated over mobile networks, in addition to mobile broadband and fixed wireless traffic, will depend not only on the uptake and utilization rates of the applications, but also where the critical functions mentioned in the ‘AR devices’ section take place.”

That other processing location will be in a vast network of edge services and network-inhabiting hard and soft virtual processors — all utilizing 5G technology and networks.

On a less technical note, the report also describes a growing practice in flexible bundle packaging for services. These can include gaming, content aggregation, differing speed levels, shorter contracts, to appeal to consumers have more choices among service providers.