TL;DR

- After a tough 2022, premium subscription streamers are in the middle of reorienting their business model from content commissions to distribution.

- The days of multi-million dollar paychecks for show creators seem to be over as content must now wash its face in metrics for ARPU (Average Revenue Per Unit).

- A greater focus on franchise content — sequels and spinoffs — and linear TV-like schedule releases can help streamers counter high churn rates.

READ MORE: From Artificial Intelligence to Profitability: 5 New Rules for Streamers in 2023 (The Wrap)

Netflix’s decision to cancel high profile drama 1899 after just one season came as a shock to fans and a reality check to content producers that streaming shows will be cut to a different cloth from now on.

Just as consumers don’t have an endless budget to subscribe to streaming services, so content providers are no longer willing to open the checkbook if the numbers don’t add up.

And those numbers have changed along with the way success is measured.

“The enthusiasm for streaming among consumers is still there, but I think the assumption that all these platforms are going to continue to grow and add subscribers every quarter is gone,” Hub Entertainment Research founder Jon Giegengack told Lucas Manfredi at The Wrap. “I’m not entirely sure why people thought it would go on forever, but we’ve reached the point where that’s not guaranteed.”

Netflix’s first subscriber loss in over a decade last April caused a shock wave that sent streamers back to the drawing board. Revised strategies include a shift of focus from pure subscriber growth to profitability and average revenue per user.

“Ultimately, companies need to generate cash so that they can pay the bills and not go bankrupt,” David Offenberg, an associate professor of finance at Loyola Marymount University, told The Wrap. “I think the focus will be on ARPU [Average Revenue Per Unit] for the rest of eternity at this point. We’re done with focusing on subscribers. And if you’re not at scale yet, your chances of getting there are pretty slim.”

Netflix was the first to alter course and has succeeded in leading the competition on ARPU. Figures in the article show Netflix has an ARPU of $16.37 in the US and Canada, followed by Hulu’s ARPU of $12.23 and Warner Bros. Discovery of $10.66. Disney+ has lagged behind its rivals with a domestic ARPU of just $6.10.

Another universal tactic is to adopt different pricing tiers with many streamers introducing a free or lower cost ad-supported option.

Additionally, many streamers are increasingly leveraging bundled services. The average household has 12.5 different entertainment sources that they consume, according to a Hub Entertainment survey of TV consumers. These sources include streaming TV, social media, gaming, music, sports, podcasts, audiobooks and reading.

Companies that are able to super-aggregate these services into bundles will have an edge, Manfredi maintains. Notable examples of super bundles include Amazon Prime, which offers benefits like access to Prime Video content and free delivery on Amazon purchases, and Apple One, which includes AppleTV+, iCloud storage, Apple News, Apple Music, Apple Arcade and AppleFitness+.

The cancellation of major shows like 1899 is far from unique and speaks to the fact that streamers can no longer afford to have an endless library of shows and movies

“As profitability and ARPU take center stage moving forward, streamers have learned that they will need to be more mindful about their content spend and what that investment is going towards,” says Manfredi.

1899 was an expensive show to produce and required an entirely new and unique virtual production volume to be built in Berlin. Likewise, the multimillion-dollar deals that have been awarded to show creators like Ryan Murphy, Shonda Rhimes and Rian Johnson, “are a thing of the past,” according to Morning Consult entertainment and media analyst Kevin Tran.

“Streamers need to make better use of the intellectual property they already own while also keeping in mind moving forward that sheer quantity of content is now far from a compelling differentiation factor,” he says.

On the flip side, Tran warns that pulling content could make showrunners and actors “more hesitant to work with a company that they view as too eager to axe pricey or declining shows from their streaming platforms” and potentially anger fans of those shows.

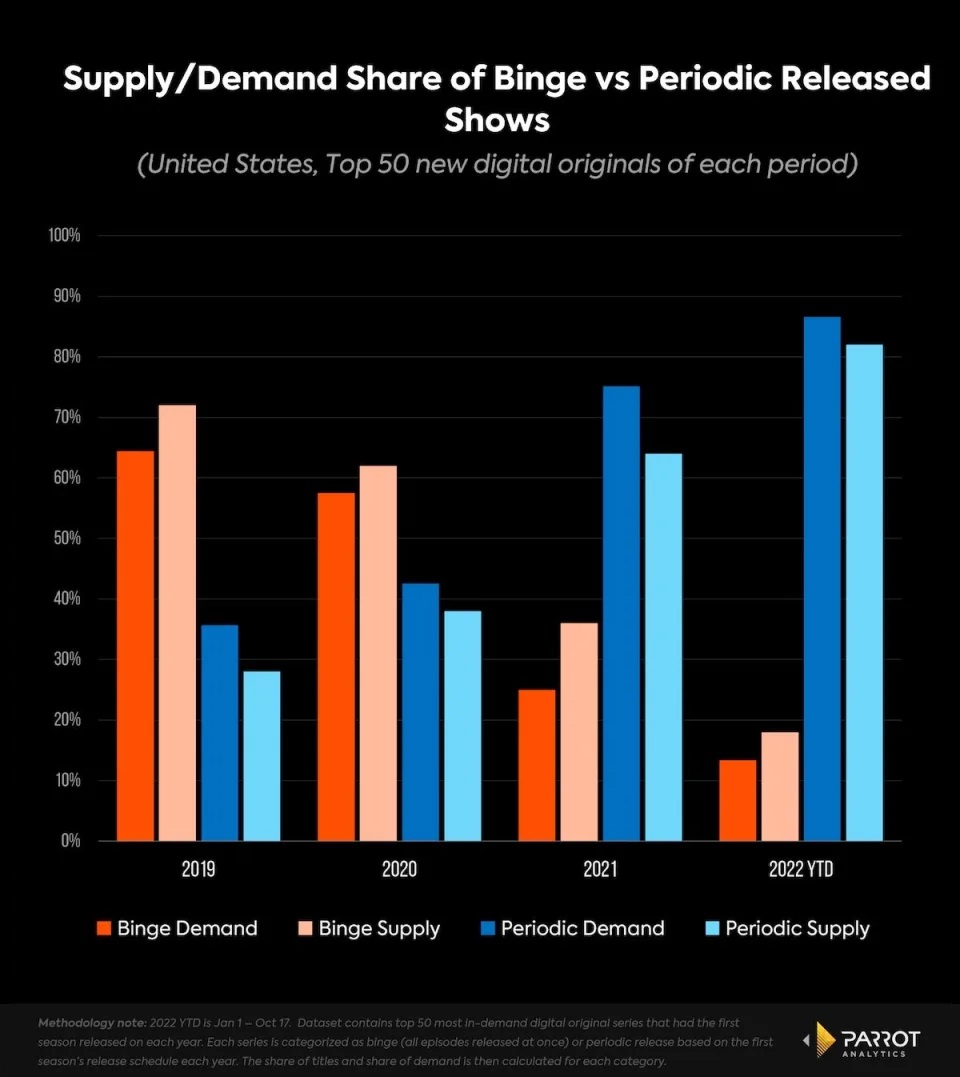

Manfredi also thinks that the days of binge viewing are largely over. It makes more sense for streamers to drop episodes, especially of its most popular content, over a period of months to eke out subscriber engagement. Netflix’s two-part release of Stranger Things S4 last year was a case in point.

“If people can binge watch a whole show and then drop their subscription until the next season comes out, that’s a pretty tough calculation if you have to come up with a brand new, super expensive show to reengage them every time,” Giegengack said. “If you parse those shows out and the episodes come out once a week, or maybe starting with two like they do on Paramount+ to get people hooked, and then parse them out further apart after that, each piece of content that you’re investing with can keep people engaged for a longer period of time.”

Churn is still a huge issue for all streamers. In the third quarter of 2022, cancellations across Netflix, Hulu, AppleTV+, Disney+, Discovery+, HBO Max, Paramount+, Peacock, Showtime and Starz grew to 32 million, according to Antenna. The figure represents a “significant expansion” from 28 million cancellations in the previous quarter and 25.2 million cancellations in the same quarter a year ago.

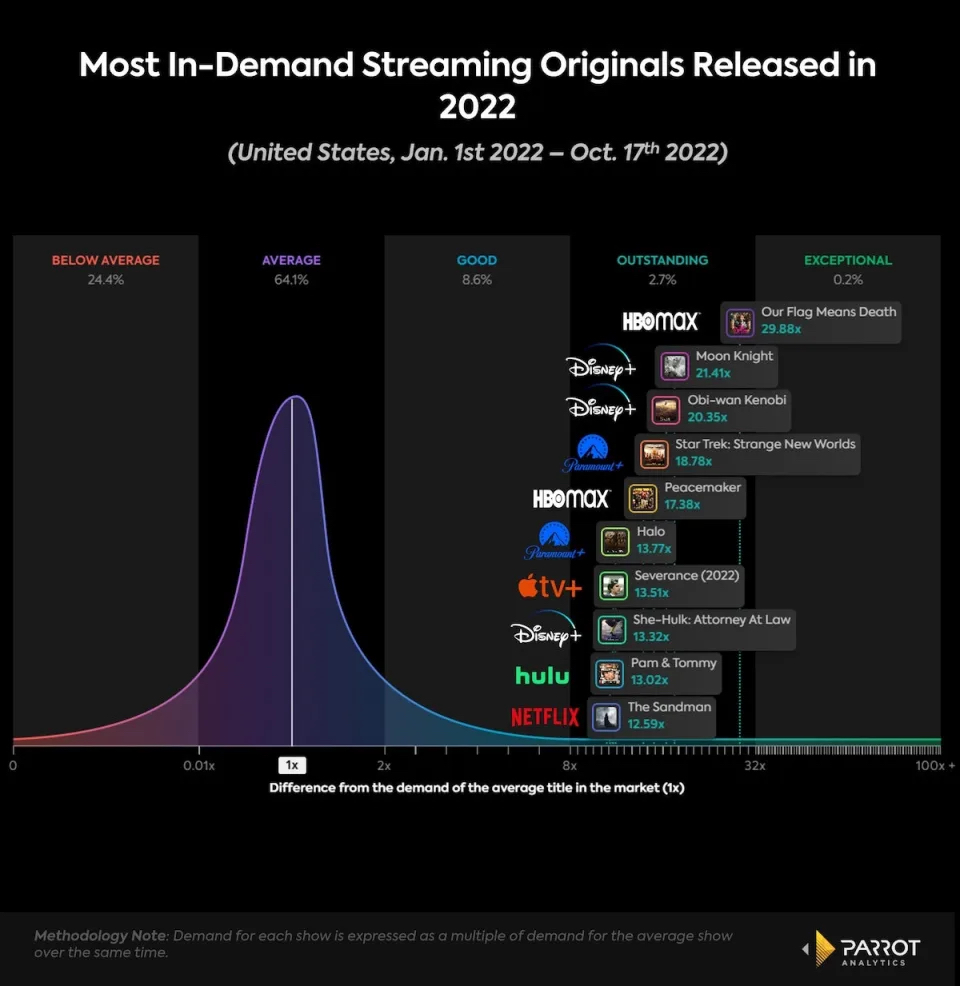

In a bid to counter churn, Manfredi detects a new urgency around commissioning franchises. One poll suggests 75% of people are likely to cycle subscriptions in the next six months with the main stated reason being that there was only one title on a given streamer that they were interested in viewing.

“A reliable way to retain subscribers is to keep them connected to things that they know and love,” Lionsgate Television Group vice chairman Sandra Stern told The Wrap. “I think for streamers particularly that is a really major objective.”

Disney+ has mastered this strategy with regular output of new Marvel Studios shows such as Loki and She-Hulk: Attorney at Law and new Star Wars series like Andor. Netflix has scored success with Wednesday and Paramount+ continues to earn mileage from Yellowstone spinoffs. Look out for Peacock’s John Wick universe spinoff later this year.