TL;DR

- A new video trends report from TiVo finds that discovering new and relevant video content is a bigger issue than what we pay each month for the programs we want to watch.

- As the number of video services continues to climb, demand is increasing for free or ad-supported options.

- A majority of North Americans say they have too many services in their bundle and the rate of change at which content jumps in and out is damaging their overall viewing experience.

READ MORE: New TiVo Video Trends Report (TiVo)

Consumers are so overwhelmed by the choices of content that discovering it has actually become a bigger headache than paying for it.

A new Video Trends Report from TiVo also finds that a majority of North Americans say they have too many services in their bundle and that the rate of change at which content jumps in and out is outright damaging to their overall viewing experience.

“We’re at an inflection point in the digital entertainment industry as consumers seek to take advantage of the flood of content choices and service types available, but now wrestle with the paradox of choice,” explains Scott Maddux, VP of global content strategy and business at TiVo owner Xperi.

READ MORE: Number of Video Services Used By Consumers Surpasses Double-Digits for First-Time, TiVo Video Trends Report Finds (Xperi)

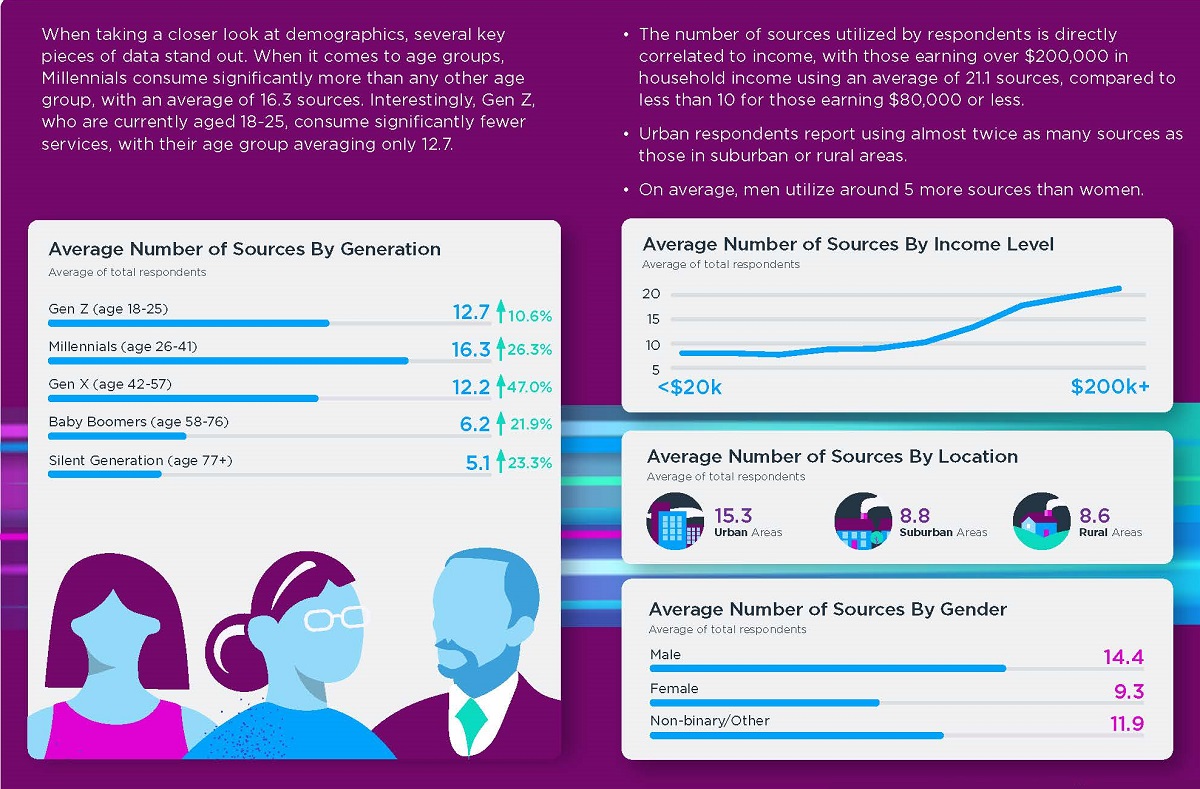

While SVOD use has declined by more than a quarter in the last six months, the average number of video services used by consumers has grown, with free and ad-supported streaming becoming the beneficiaries. Per the report, consumers source their video viewing from an average of 11.6 services up from 8.9 a year ago.

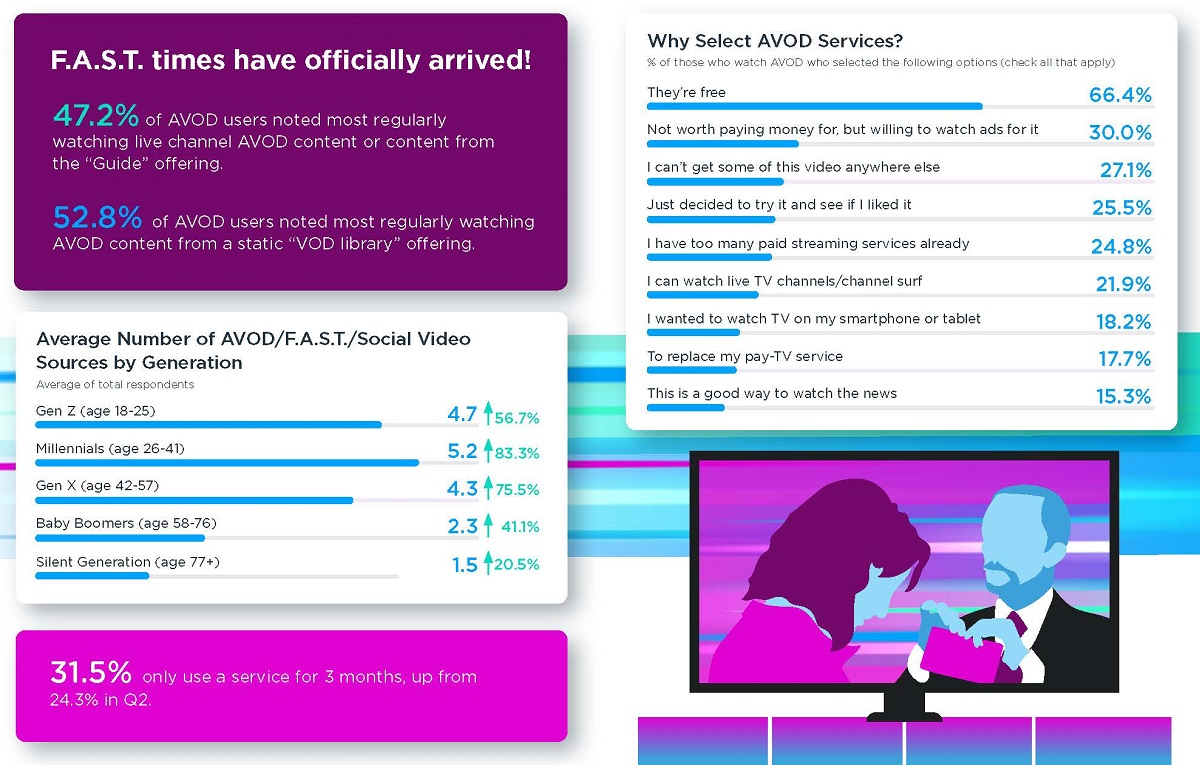

Adoption of totally free video services, including AVOD and FAST, has grown by almost 70% year over year. Some 64% of consumers now use at least one AVOD or FAST service, driven largely by millennials, up from 60% a year ago.

Subscribers to pay-TV use a significantly higher number of sources on average, at 12.7, compared to an average of 8.3 services for broadband-only respondents (i.e., cord-cutters).

Video choices in this report range from broadcast TV and “virtual multichannel video programming distributors” (vMVPDs) such as YouTube, Pluto TV, and Sling to social media apps and AVOD.

The number of choices may benefit consumers, but it has led to content discovery becoming even more complex and varied. Frustration is boiling over. It is not only about having too many options to juggle and not being able to find suitable content quickly, it is also expressed in how frequently movies and TV shows appear and disappear (or shift from free to pay) on the services they subscribe to.

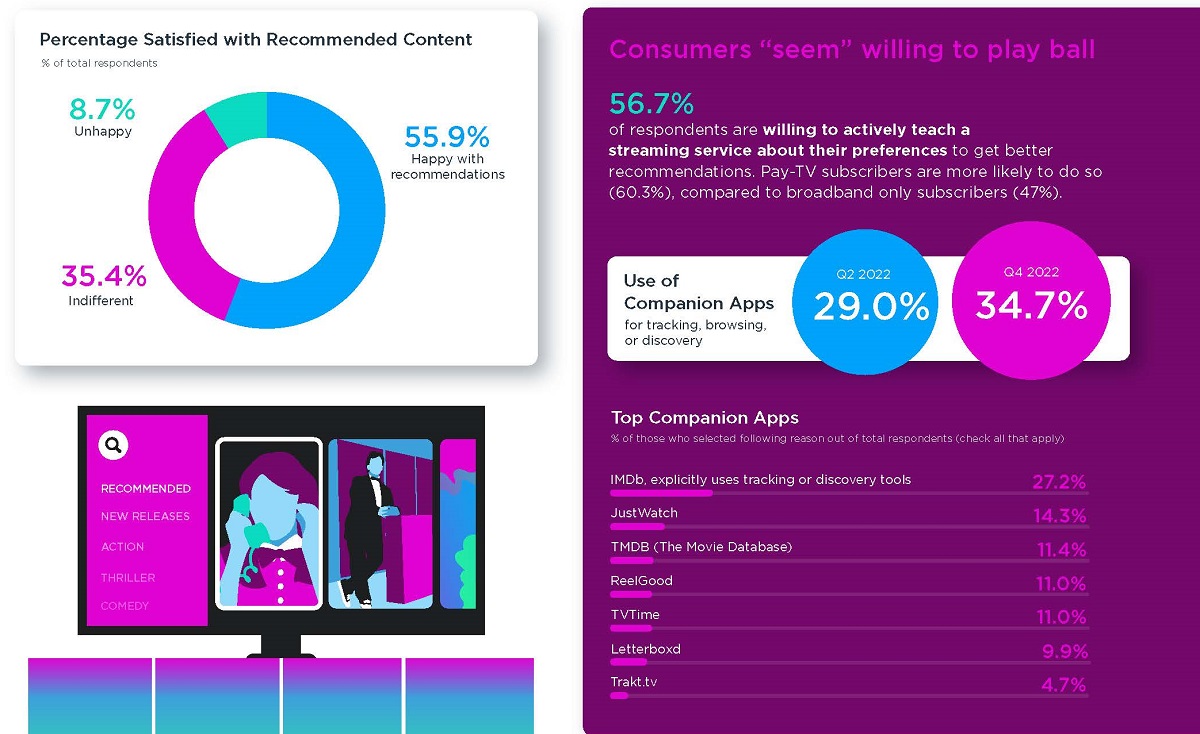

Right now, almost half of survey respondents find new TV shows and movies by word of mouth (47.9%) or through ads seen on other shows they watch (46.5%). From there, just over a third (35.6%) turn to social media, and about a third (32.2%) rely on display ads on the home screen of online video services. Suggestions in “my TV channel guide or other menus” is cited by just over a quarter (27.1%) of those surveyed, and more than half (55.9%) of those who follow recommendations to find content say they’re satisfied with the suggestions.

Some people are willing to “actively teach” a streaming service about their preferences to get better recommendations. Pay-TV subscribers are more likely to do so (60.3%), compared to broadband-only subscribers (47%).

Spend on Video Continues to Rise

The bigger picture for video entertainment providers is that despite the cost of living crisis, demand for content remains a “moderate to high priority” for most people. Overall spending on entertainment has actually increased to $189.38 per month. This is up almost $20 from a year ago.

While some (17%) respondents appear to be evaluating and adjusting their entertainment spending more often, and more than 30% claim that the wider cost of living has caused them to reduce overall entertainment spend, a massive 84.8% say they have no plan to reduce their entertainment spend or don’t know whether or not they will reduce their entertainment spending.

Much of this spend is being focused in the home and on the home TV. To support this, respondents to TiVo’s report says they are investing in their home setup, with one-third purchasing a new TV in the last six months.

Additional interesting information from the Video Trend Report:

More than half of people (53%) prefer to binge watch a whole season of a TV show when all episodes are dopped at once, compared to 24.7% who prefer episodes to be released once a week.

Fewer than half of respondents cite pay-TV as their primary way of watching local content, the first time this has dipped below 50% in a TiVo survey.