TL;DR

- In a SXSW presentation, media analyst Evan Shapiro said no one knows exactly where M&E is going: “They’re just throwing business models at platforms.”

- The winners will be the companies with multiple revenue streams and that cater to multiple generations of consumers, namely Apple, Google and Amazon.

- Losers include advertising-based social media companies like TikTok along with Spotify and Roku.

“Nobody knows anything.” The famous William Goldman aphorism about Hollywood can just as aptly be applied to the business brains leading the world’s biggest media and entertainment companies.

The traditional certainties around consumption and distribution have been upended and no one really has a clue what new formula will work.

“We are reassembling this ecosystem in real time, but because none of even the big players, not Apple or Amazon, know exactly where it’s going, they’re not really assembling for something,” said analyst Evan Shapiro. “They’re just throwing business models at platforms.

“There’s no way Netflix thought they’d be taking ads right now. There’s no way that Facebook thought they would be peaked by now. There’s no way that Disney thought that they would surpass Disney Netflix in total subs worldwide in less than three years.”

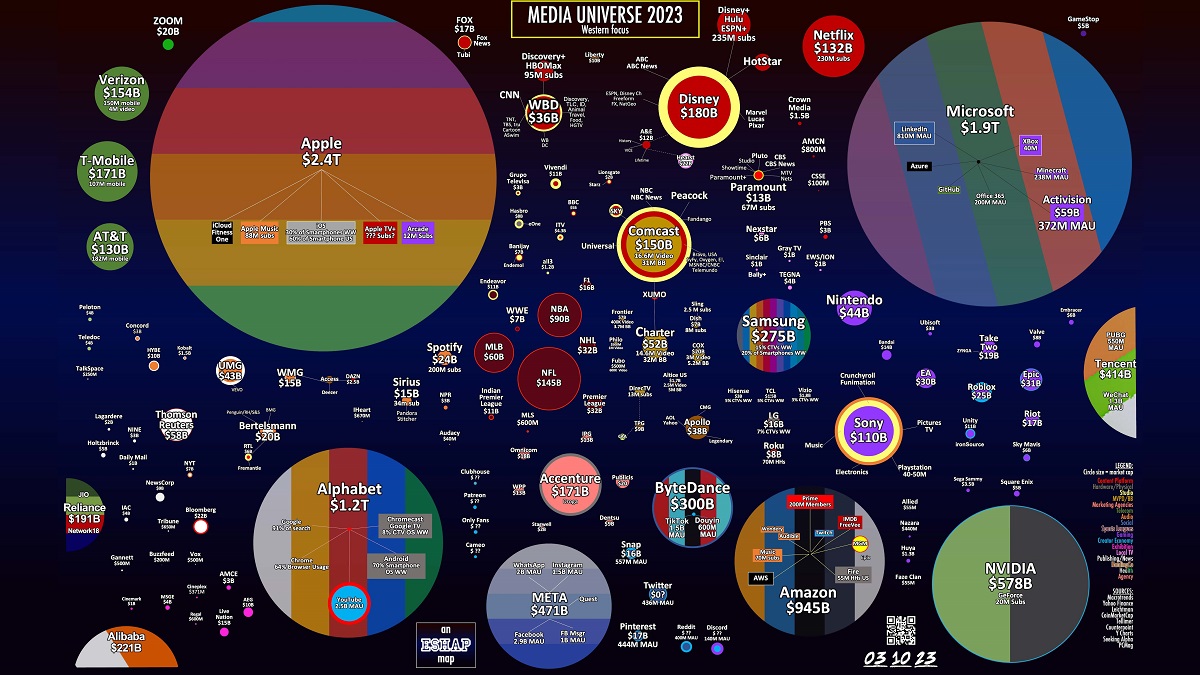

Shapiro, who calls himself a “Media Universe Cartographer,” was speaking at SXSW on stage with Steven Rosenbaum, head of the Sustainable Media Center.

“No one can predict the future of media — especially right now,” said Shapiro, who nonetheless tried.

“In the last couple of years, the underpinnings of the media economy have come undone,” he said. “In its place we have this free-form system of asymmetrical consumption, an unlimited supply of content on many different devices all the time, not all tethered to fundamental economics or sound business principles.”

Cable TV and the triple play bundle with broadband and voice services was the mainstay of the TV ecosystem for decades — but not any more.

“The entire system has become unmoored,” Shapiro said. “Everybody is trying to move into television and audio and gaming and social media simultaneously, and they’re trying to raise the same dollars and eyeballs. But… no one can figure out their own business model anymore,” he added.

“They’re hoping that when they add advertising to Connected TV, it’s going to replace the old model. They’re hoping that when they add subscription to premium ad free streaming that it’s going to replace the old cable system. It’s not going to do that.”

Even so, Shapiro took a stab at which companies will be the eventual winners and losers.

Apple, for instance, will be a winner by investing more in content to get consumers to buy its hardware. The company is going after Spotify and is also going after gamers, he thinks.

Another winner is Google. That’s because “the fastest growing operating system on connected televisions on the face of the Earth is Google TV, the same company that controls 70% of your phones. So, Google is going to be incredibly influential for at least the next 10 years.”

He also picks Alphabet as a winner because of the continued dominance of YouTube as viewing shifts to Connected TV.

“YouTube is by far and away the biggest platform out here. So as everything moves off linear television to CTV, who do you think’s going to win this battle? Google has the largest share of all video on CTV. That duopoly they have in phones, they’re trying to recreate in TVs.”

And Netflix? Well until the end of last year it was still a one-revenue business, unlike Alphabet, which also has a cloud business and many other revenue streams besides.

“Because they have many different elements to their business they have an opportunity to see the other side of what’s being reshaped,” he said.

Amazon will be fine, too, because “the number one fastest growing sector of the advertising economy is retail media. Amazon has grown an ad business that’s bigger than all of Paramount and all of Warner Bros. Discovery. The $37 billion in advertising last year on Amazon, was predominantly because this is a retail media business.”

Winners will also cater to multiple generations of consumer.

“By the end of this decade, Generation A will be starting to come into the workforce,” Shapiro said. “So you have to think about them not just as consumers. Generation A and Generation Y are responsible for TikTok, they’re responsible for Roblox, they’re responsible for Fortnite, they’re responsible for enormous consumption shifts.”

The losers on the other hand include social media companies whose entire revenue stream has been predicated on advertising in a model that is not necessarily designed for the next turn.

“I don’t see how they all come out of it entirely whole. I think TikTok implodes under its own weight [because of regulatory issues].”

He added, “I don’t know how Spotify survives as a standalone company a year from now. I have trouble seeing how Roku [survives, since it’s another company] entirely tied to one business model. Roku have no expansion outside the United States and it’s really basically hampering their ability to grow.”

All streaming services are subject to churn. He called this the biggest issue facing the ecosystem.

“Serial churning is the new channel changing. If you’re not scratching the itch of the consumer on a day to day basis, then you’re f***ed.”

READ IT ON AMPLIFY:

Who Is Watching What and Why?

Content is Still It For Subscribers and Streaming Services

For Viewers, Streaming Is About Content Discovery, Not Cost

NAB Show Introduces Its “Programming Everywhere” Conference

Connected TV Is Both an Answer and a Question For Premium Streamers

Viewing Behavior is Changing, Here’s How to Adapt

Discussion

Responses (1)