TL;DR

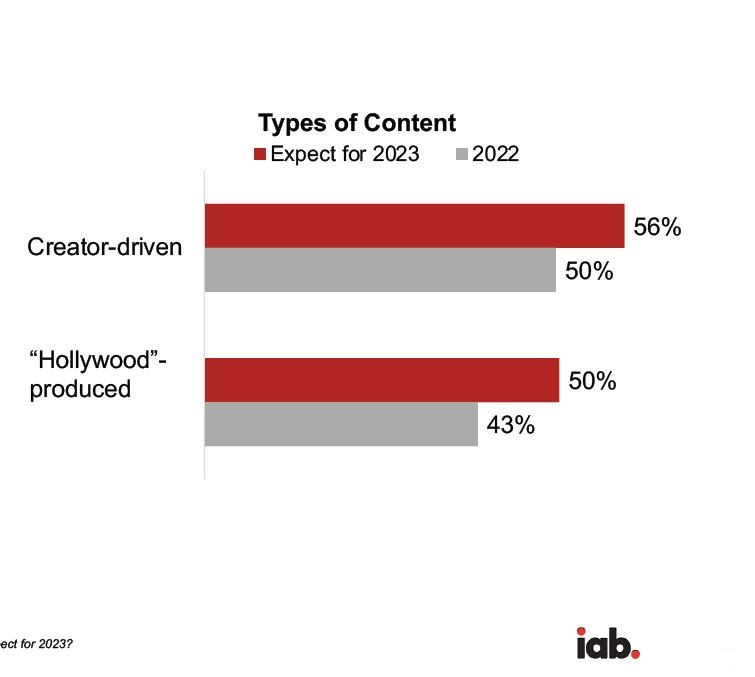

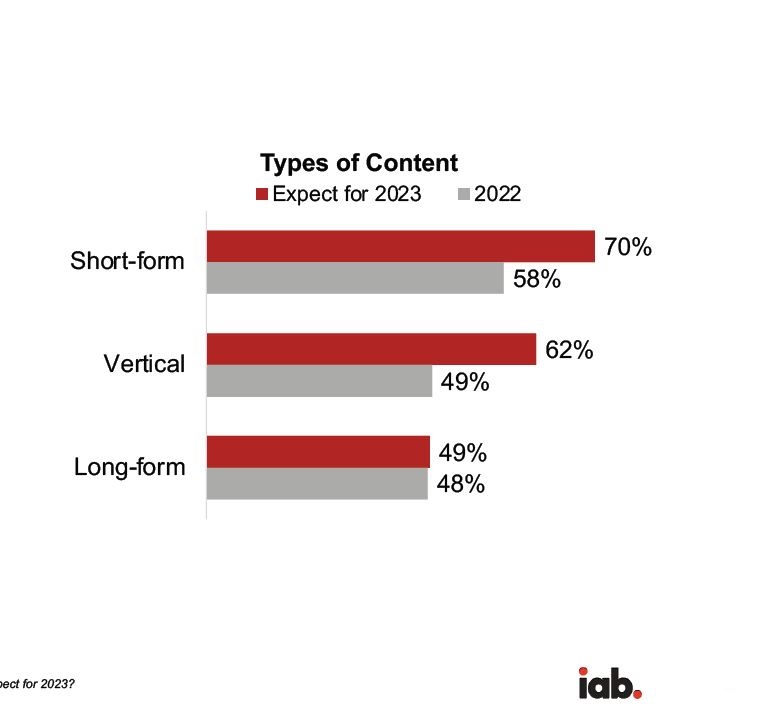

- Most TV/video buyers consider creator content to be premium and many tap the same budget resources and measurement approaches used for “Hollywood”-produced content.

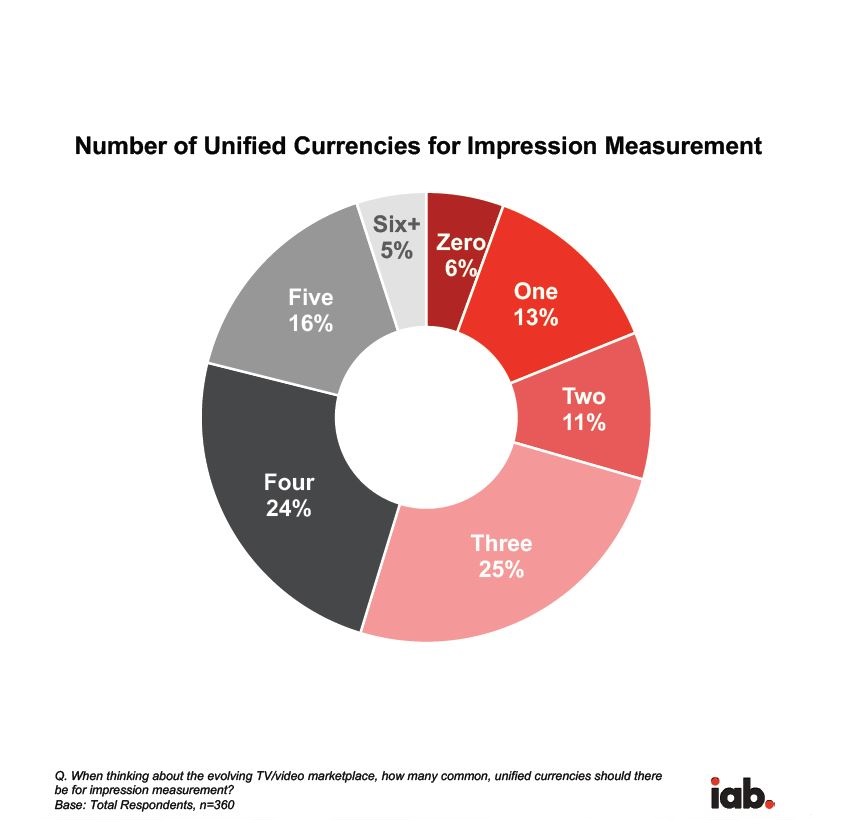

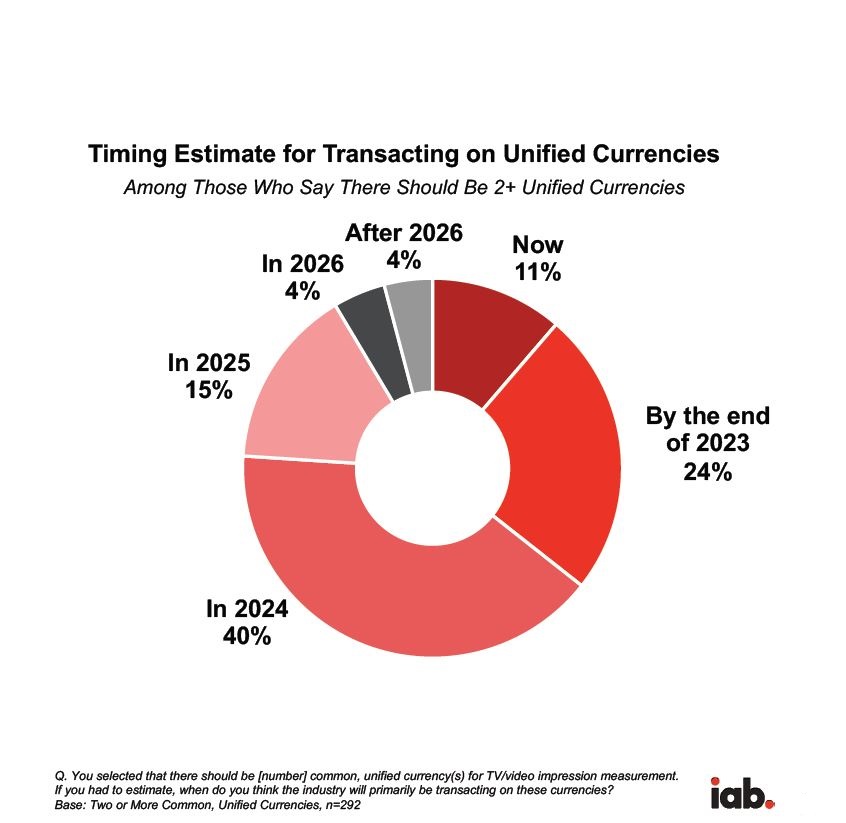

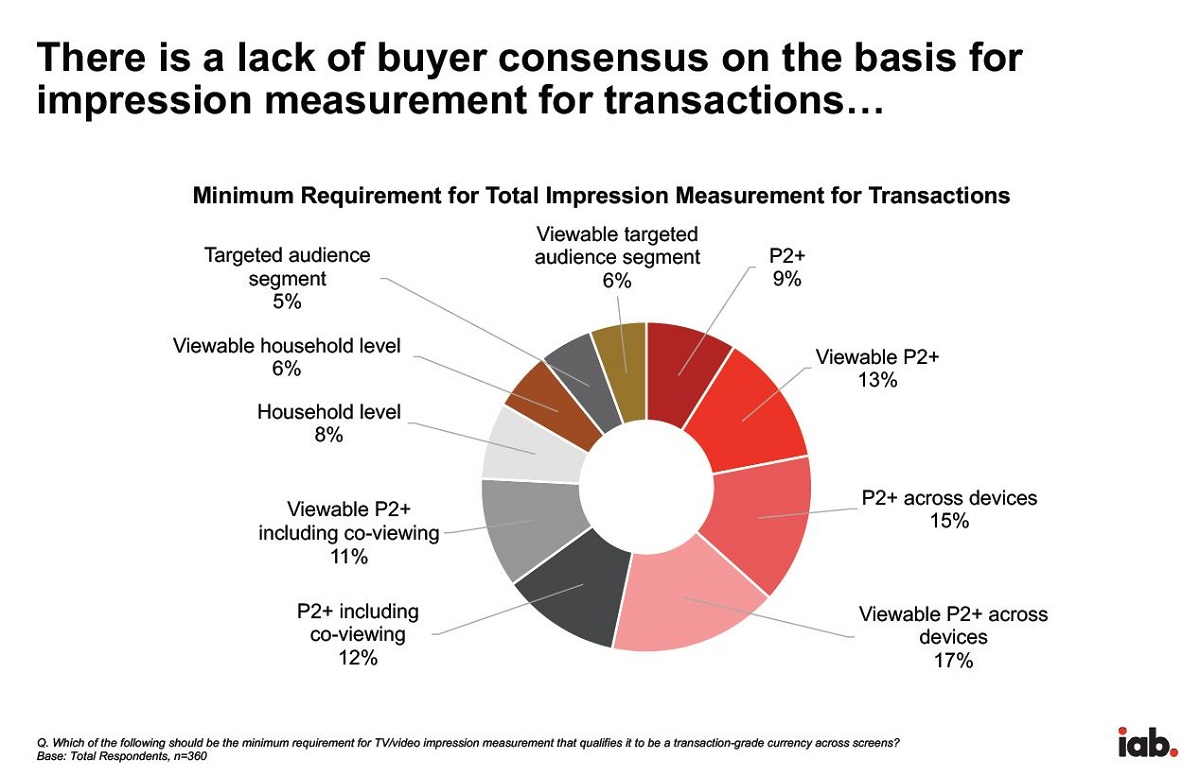

- A multi-currency market for video impression measurement is imminent, however there is little consensus among TV/video buyers on how to define currency.

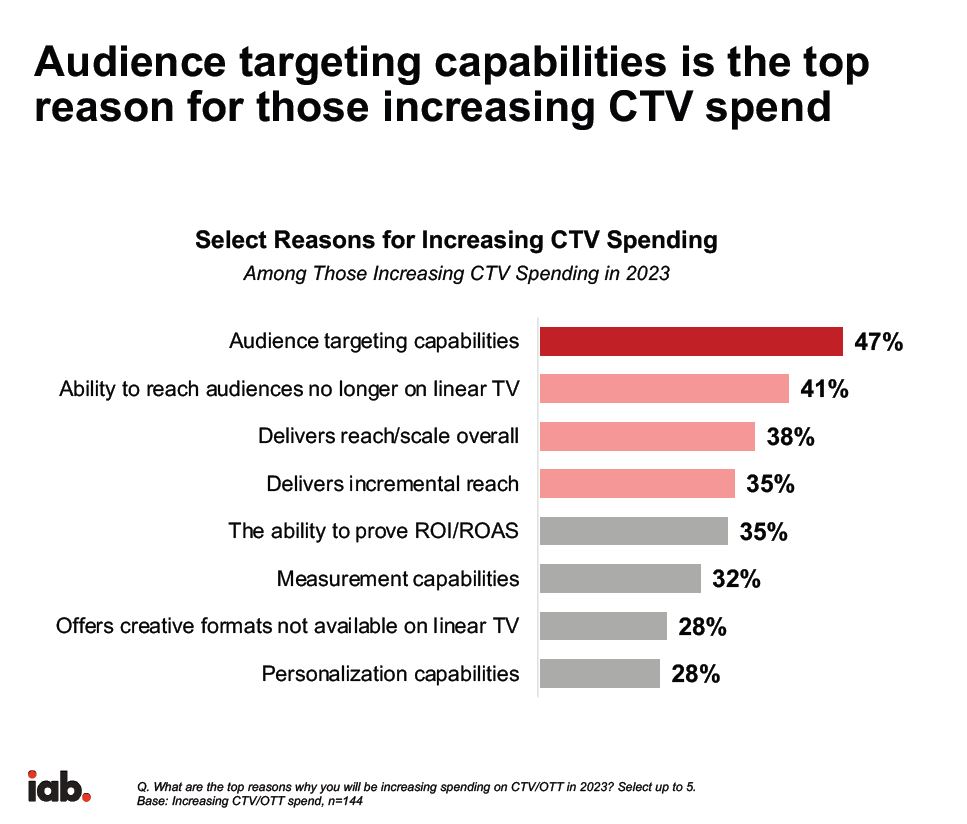

- CTV continues to distinguish itself within the TV/video landscape by being the go-to channel for audience targeting, measurement and scale.

READ MORE: 2022 U.S. Digital Video Ad Spend Grew Twice as Fast as Digital Media Overall, Projected to Hit $55.2B in 2023, According to IAB’s 2022 Video Ad Spend & 2023 Outlook Report (IAB)

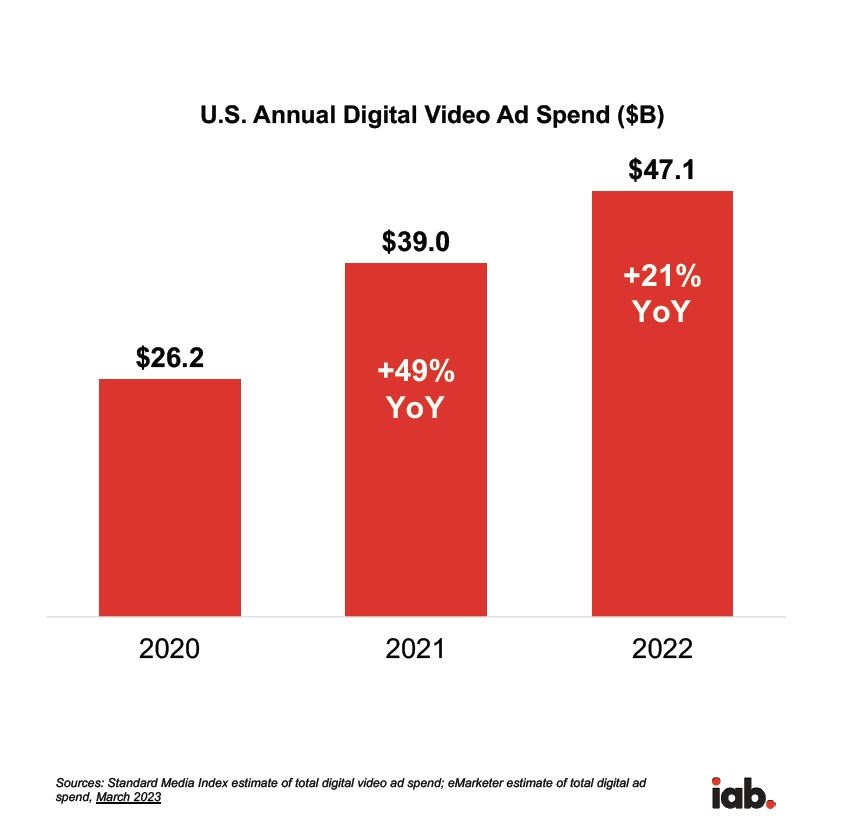

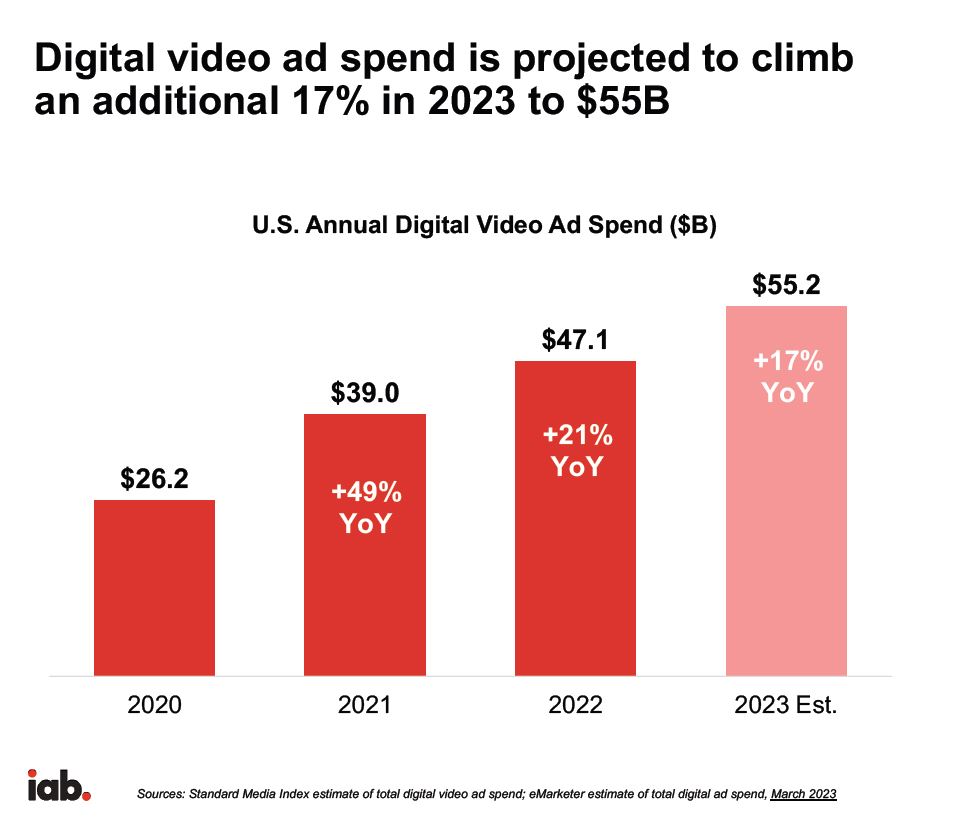

US digital video ad spend increased 21% year-over-year in 2022 to $47.1 billion and is projected to rise 17% in 2023 ($55.2 billion), according to the latest report from the Interactive Advertising Bureau (IAB).

The report also revealed that although a multi-currency market is imminent, there is little consensus on how it will be defined.

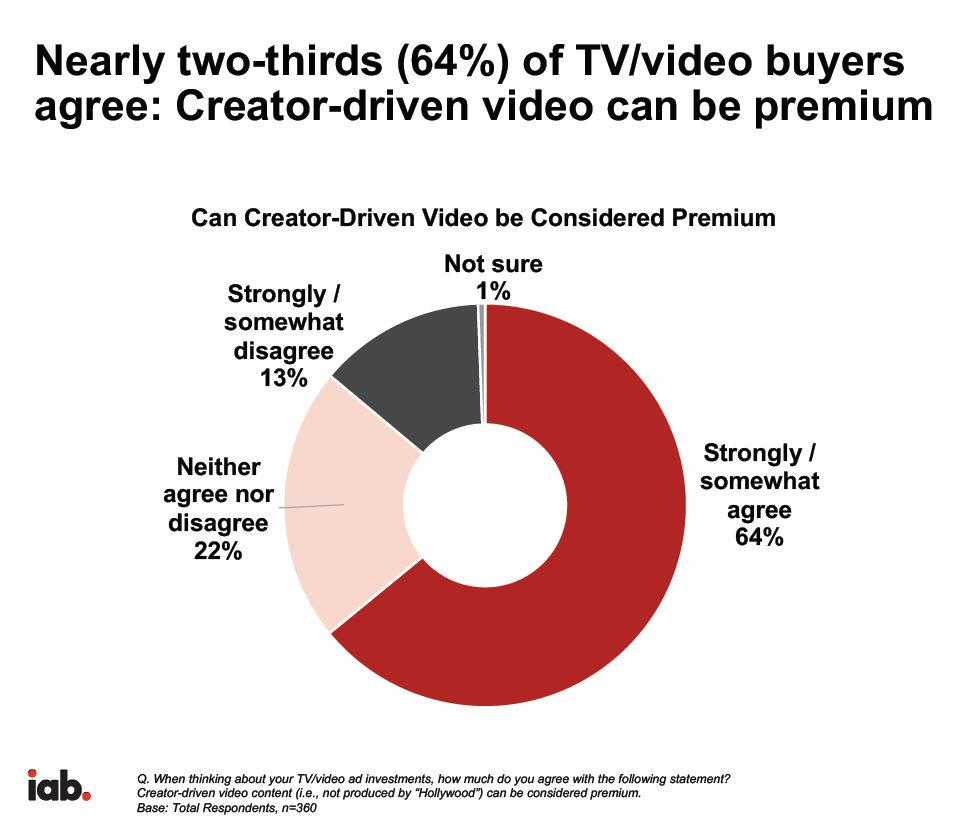

Meanwhile, on the content front, most TV/video buyers think creator-driven video content can be considered premium.

“Buyers want engaged audiences watching video content of all stripes, including premium and creator-driven video,” said Eric John, VP, Media Center, IAB. “They want currencies they can trust. That’s where the industry is going — the question now is how fast we will get there.”

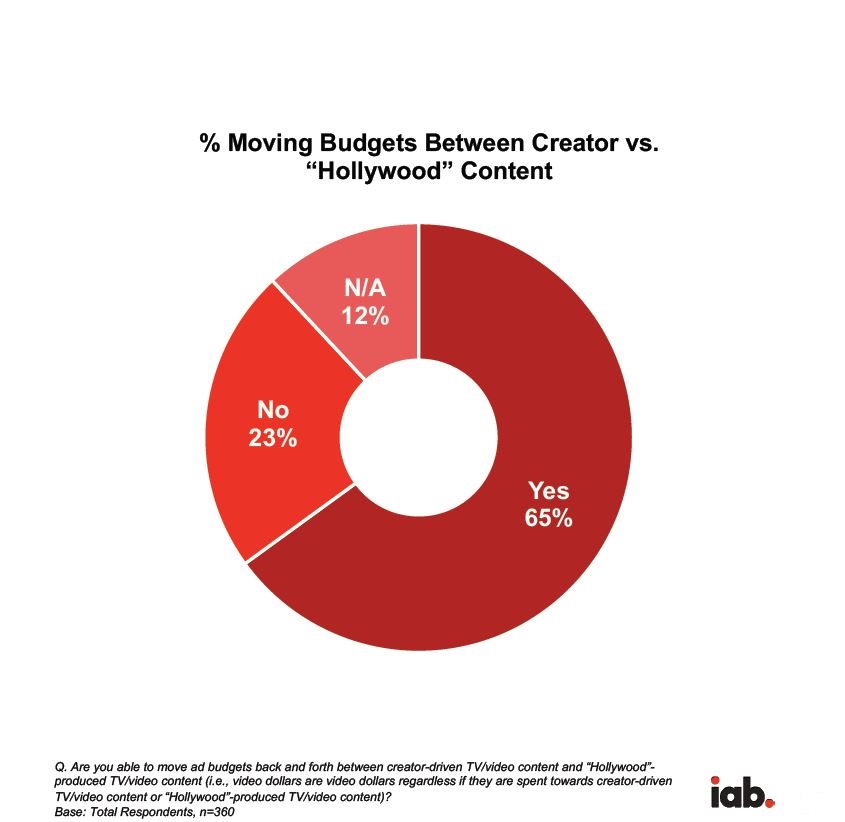

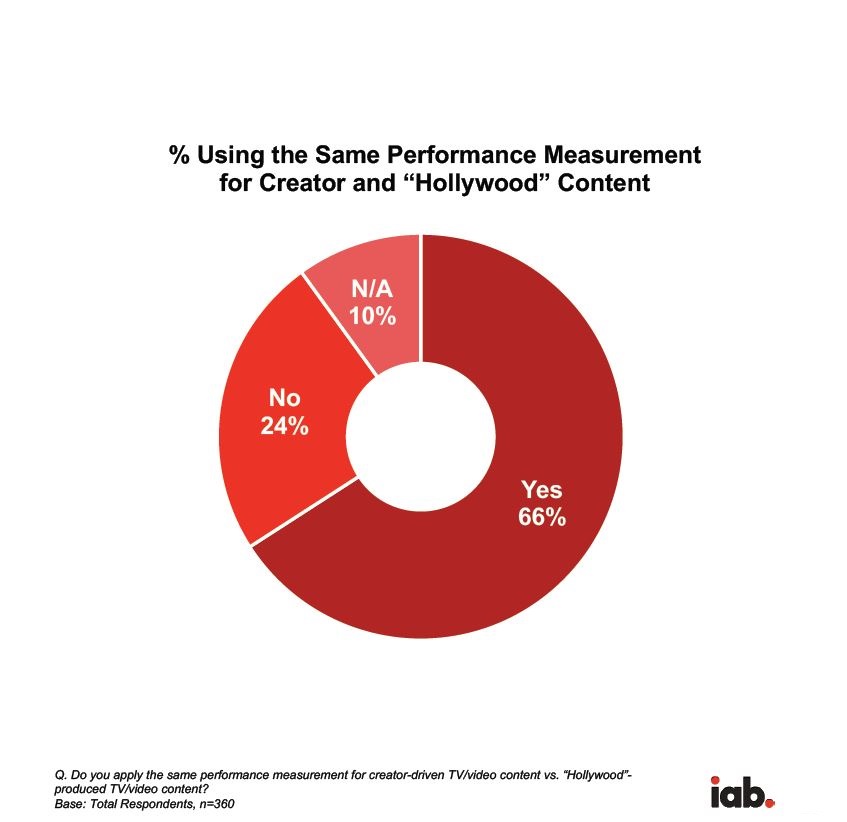

The report found that what constitutes premium video content extends to both “Hollywood”-produced content and the creator economy. In fact, two in three buyers (65%) are moving budgets between creator-driven and Hollywood-produced video content. And two in three buyers (66%) use the same measurement approaches for both types of content.

John added, “Marketers and brands focusing and optimizing their spend not only in the traditional world of premium content, but also in the diverse, multiplatform world of creator content.”

At the same time, an overwhelming majority of TV/video buyers want a multi-currency video market — and estimate that it will be live within two years.

While it is expected that Nielsen will continue to be used as a principal currency in 2023 and beyond, its exclusivity will be challenged. In the IAB’s assessment advertisers need to ensure that measurement partners are standards-based, particularly for core metrics including cross-platform video impressions, and that they have or are pursuing third-party verification.

Slightly more than half (52%) want viewable impressions defined by cumulative view-time, while 48% want continuous view-time. The lack of consensus extends to the number of seconds, with 32% wanting three minimum seconds for viewability, 24% wanting five seconds, and 19% wanting four seconds.

Absent a standard definition for measurement, the IAB advises marketers to adopt a customized approach — recognizing that each content environment has its own engagement model — based on differing consumer habits and mindsets per environment.

“The clock is ticking,” said IAB CEO David Cohen. “To make significant progress, buyers need to come together and align on what they need, and sellers across the diverse video ecosystem need to be part of the conversation.

“We are optimistic about the conversations currently taking place and will continue to advocate for universal standards, transparency, interoperability, and collaboration across the industry.”

Buyers are also increasingly focusing on attention metrics, says the report, with more than nine-in-ten using at least one method to gauge consumer attention. Already, half (51%) of buyers are applying biometric attention metrics to their campaigns.

Eye-tracking is used by one-third (34%) of buyers but other biometric attention metrics, including thermal scanning (e.g., is someone in the room when the ad is playing), and other biometric data such as body temperature, heart rate and blood pressure.

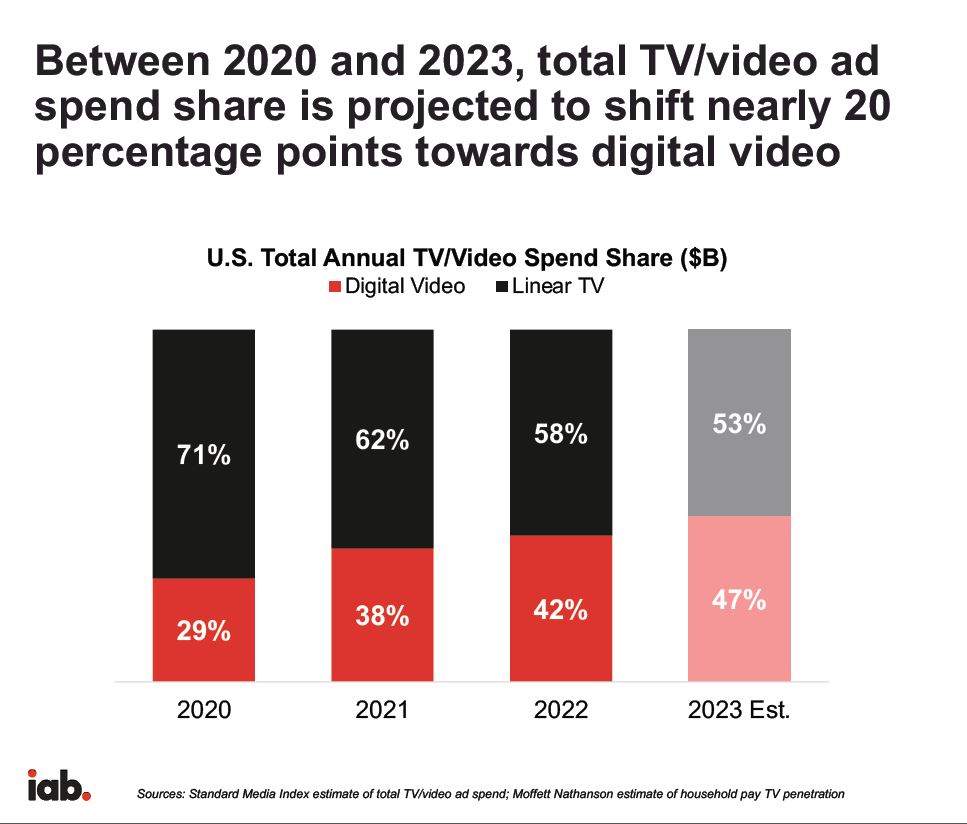

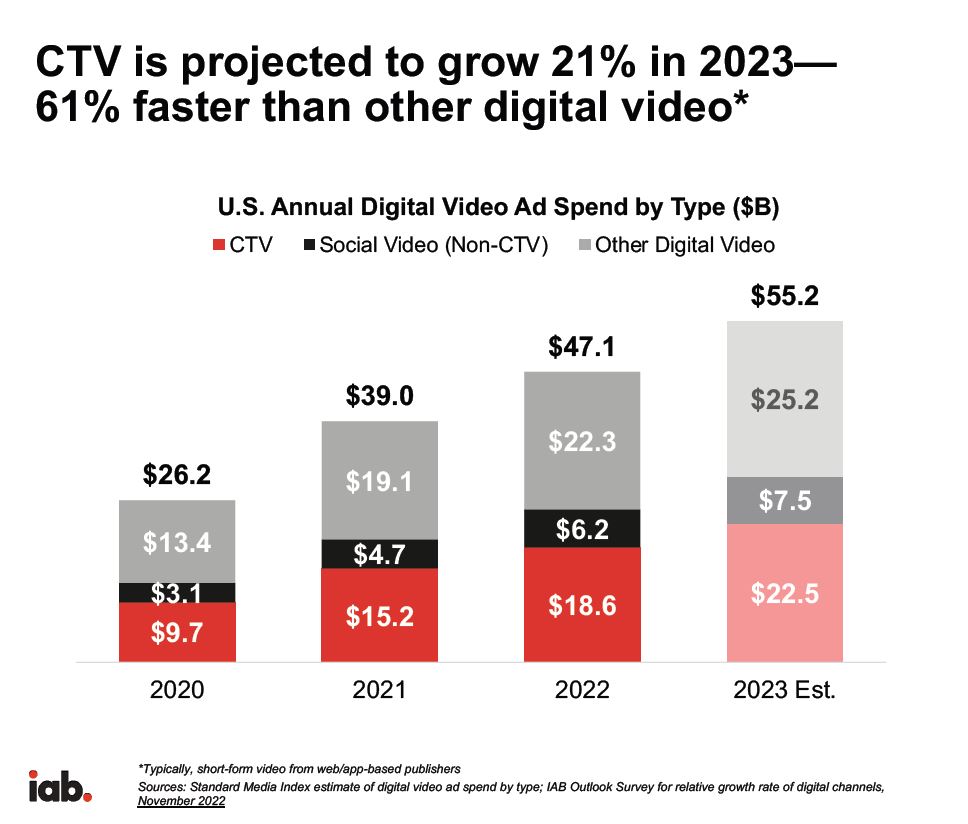

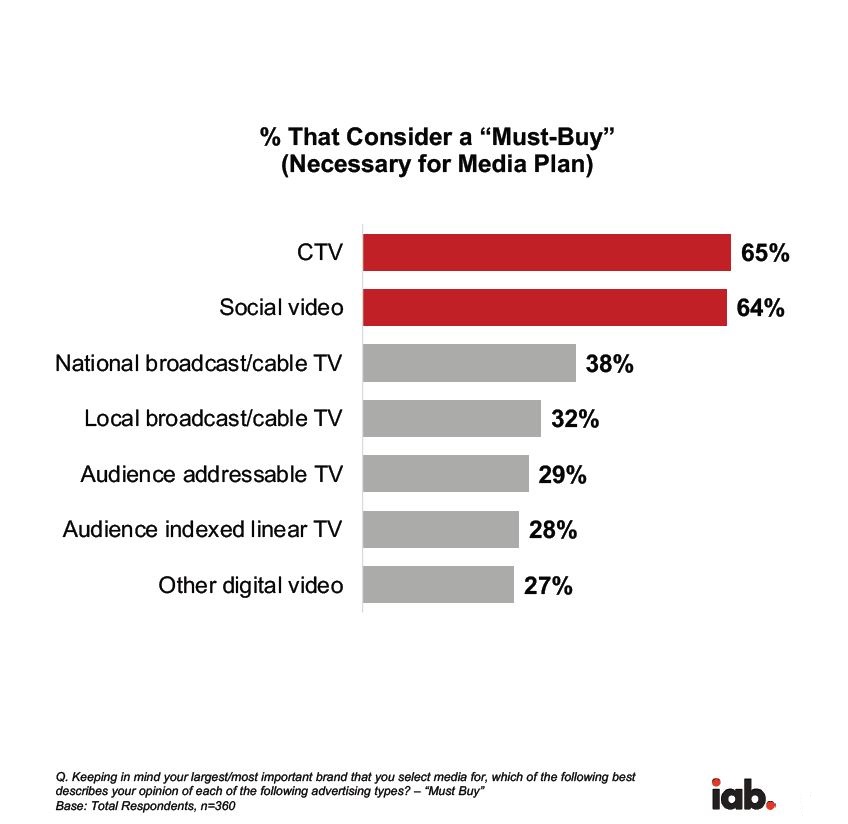

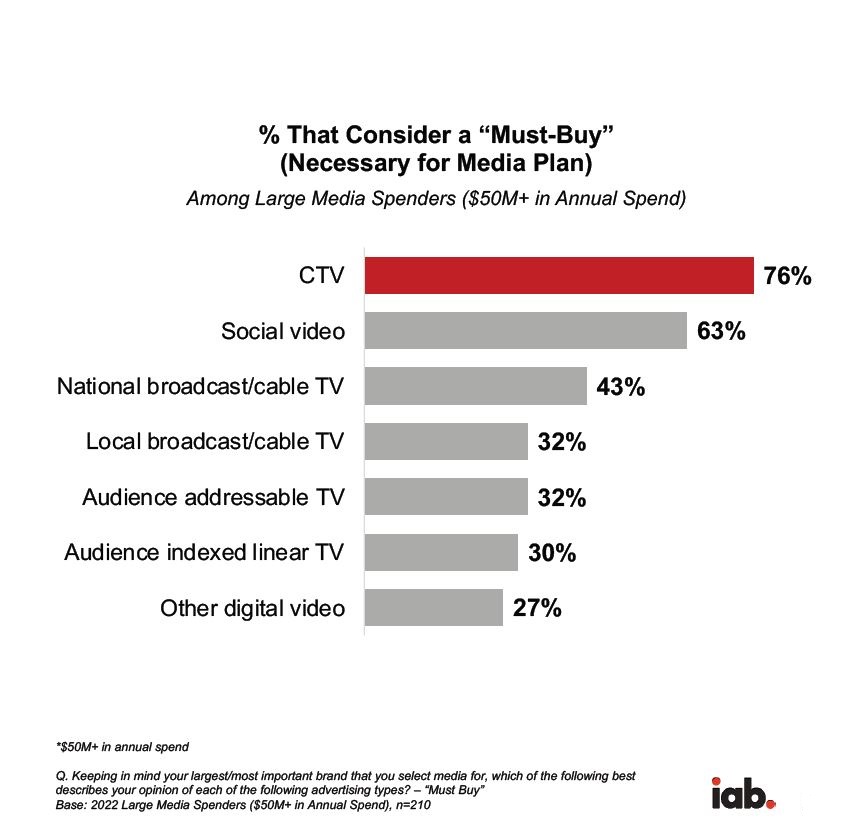

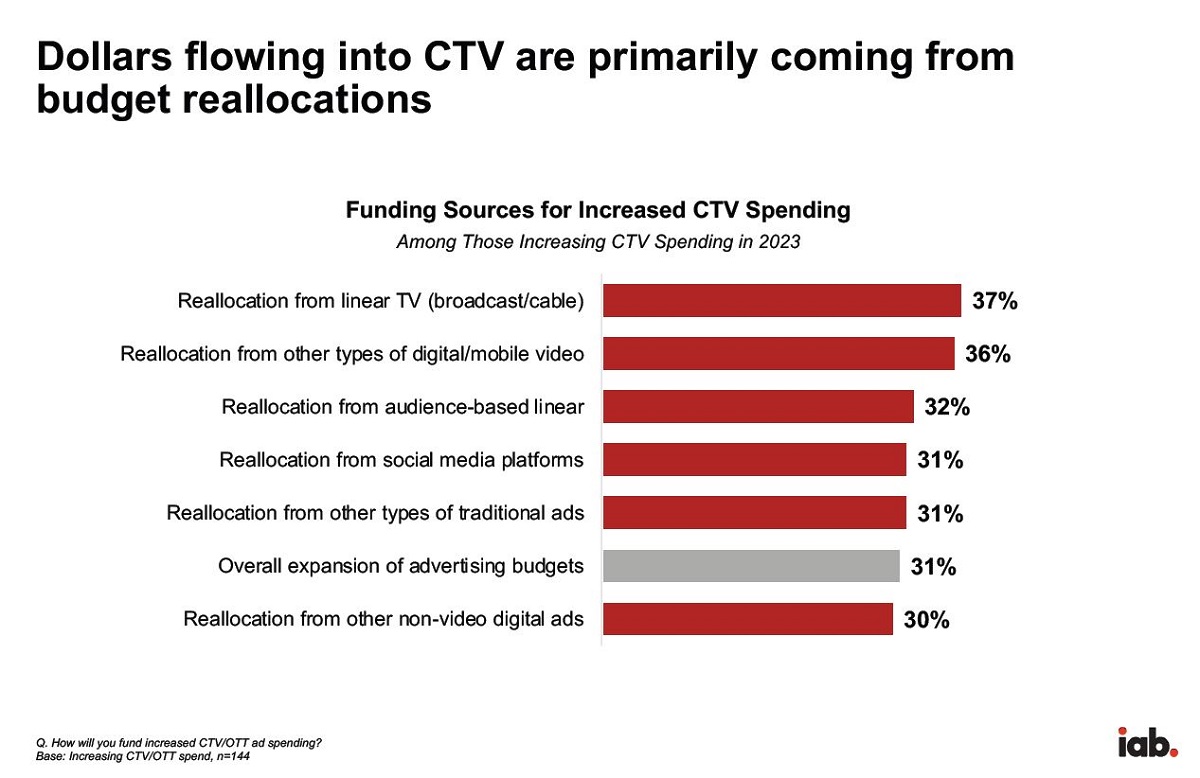

And with buyers prioritizing media channels where audiences are addressable, connected TV (CTV) continues to be one of the fastest growing channels in terms of digital video ad spend — up 22% in 2022, and 37% faster than short-form video from web and app-based publishers. 65% of buyers say CTV is a must-buy, as is social video for 64%.

“With CTV and social video leading the TV/video space by far in terms of being a ‘must buy,’ it is evident that buyers are prioritizing media channels where audiences are addressable,” says the IAB.

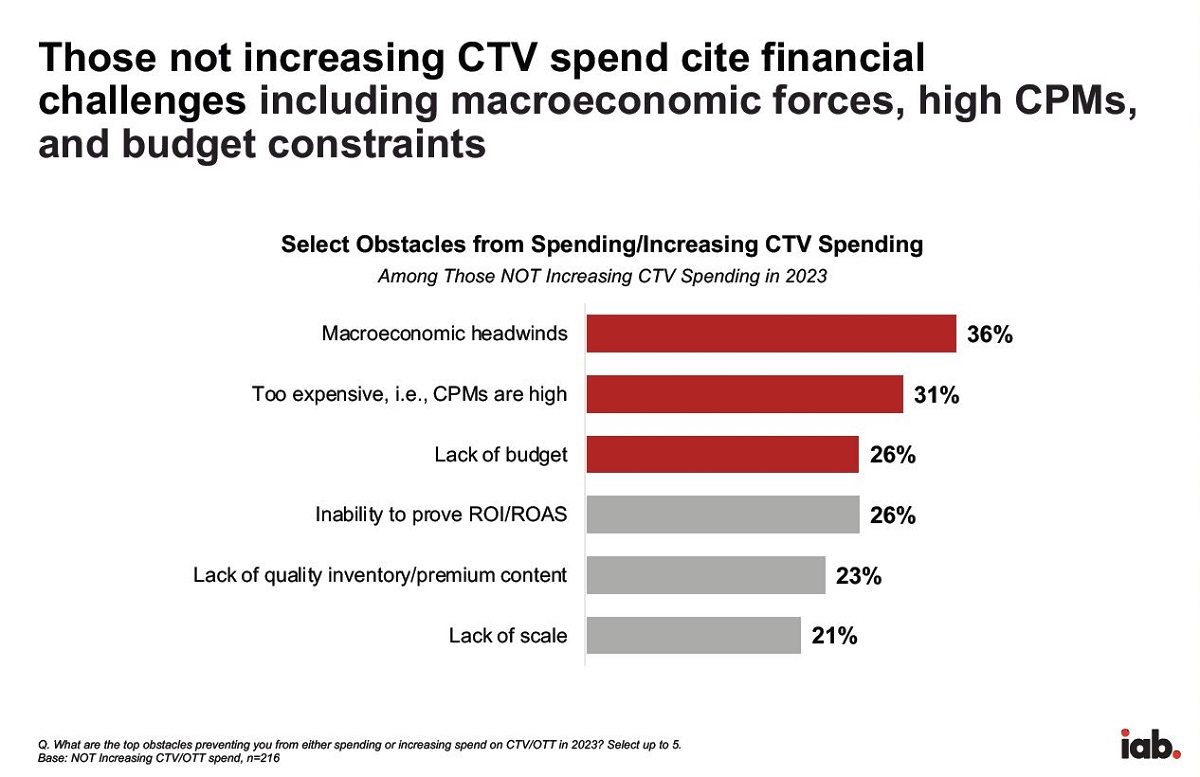

“As CTV ad spend continues to grow, the channel, along with digital video overall, is poised to ultimately gain a majority share in TV/video ad spend. However, as the US economy continues to face macroeconomic headwinds that are limiting ad spend, the growth of this channel will be challenged due to its higher cost structure.”

The IAB produced the report in partnership with Standard Media Index (SMI) and Advertiser Perceptions.