TL;DR

- The convergence of linear and streaming is redefining advertising planning into a cross-media marketplace.

- The overall message is that TV advertisers should be focusing on digital formats, but they shouldn’t abandon linear completely.

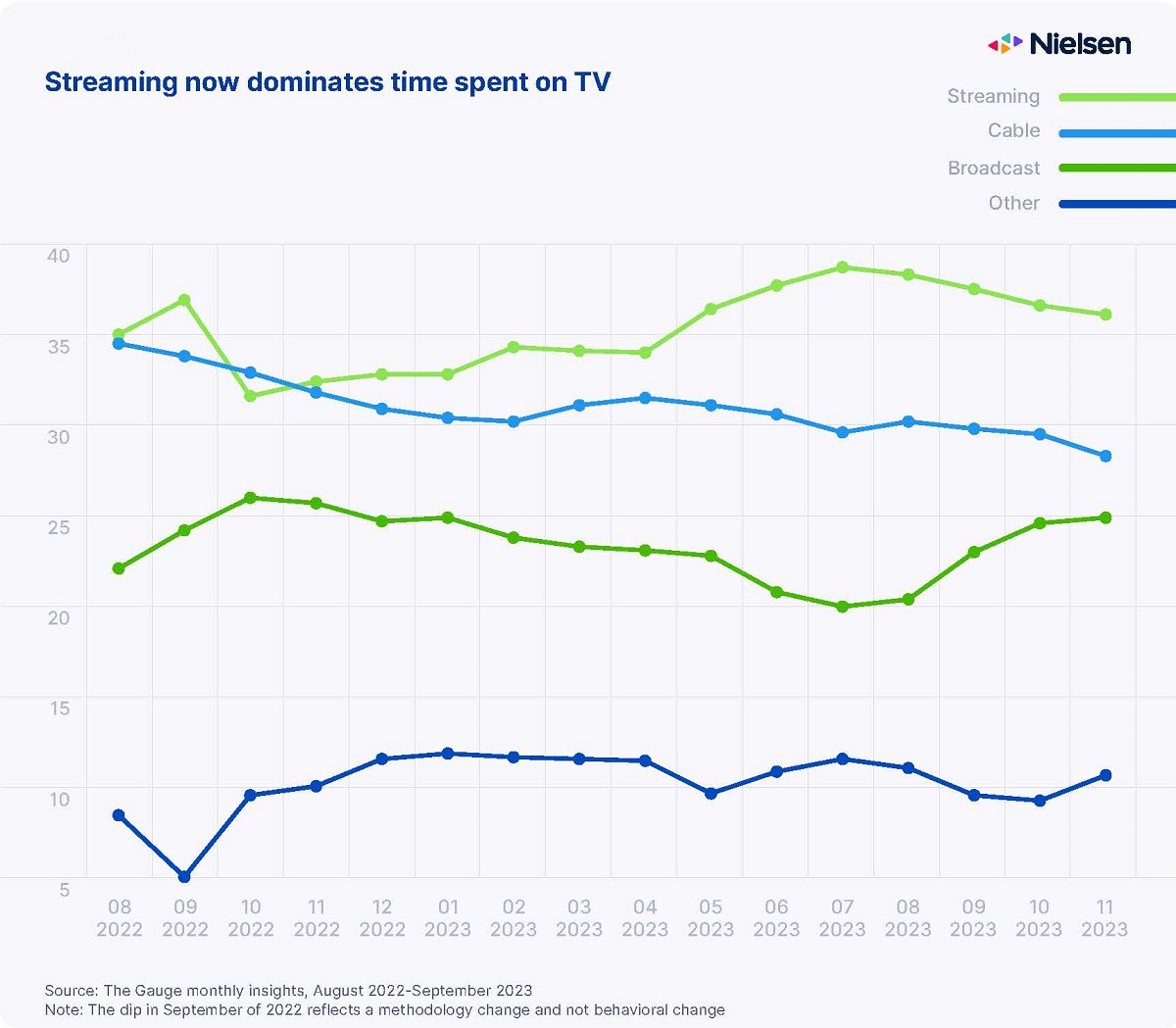

- In a world where linear broadcast and cable represent just half of overall TV viewing, buyers and sellers need to operate with more agility and flexibility.

On the surface, TV viewing hasn’t changed. Familiar network hits like NCIS, Grey’s Anatomy, and Criminal Minds are at the top of the charts of most watched shows by Americans. This of course hides the fact that how people are watching on has changed radically.

While linear and cable TV represent roughly half of viewing time the other half is solidly streaming.

The age of Connected TV is here shaking up the planning and ad buying process.

“Media planners should be paying attention to both digital and linear TV, but attention is obviously moving toward the former,” states Insider Intelligence, which provides analysis of viewing trends.

Daily time spent with linear TV will be down 3.7% this year from 2023, totaling two hours and 55 minutes, while time Americans spend with digital video in particular will be up 5.7% this year to total three hours and 50 minutes.

“That means TV advertisers should be focusing on digital formats, but they shouldn’t abandon linear completely,” it suggests.

Subscription OTT video is becoming a bigger part of people’s media diet. High use on platforms like Netflix and Hulu are contributing to the one hour and 49 minutes that people will spend watching subscription OTT this year, per Insider Intelligence forecast. Both of those platforms now have ads, as do other large players like Amazon Prime, Disney+ and Max.

“These platforms are intensifying the efforts to attract more users into their platform with their original content or exclusive content,” said the firm’s forecasting analyst, Jasmin Ellis.

Amid streaming’s success, linear TV is still relevant. Time spent is in decline, and that trend won’t change. But the drop-off is happening slower than our forecasts initially anticipated due to viewing habits of people 35 and older, many of whom haven’t yet cut cords, Ellis said.

READ MORE: What media planners need to know about where people are watching TV (Insider Intelligence)

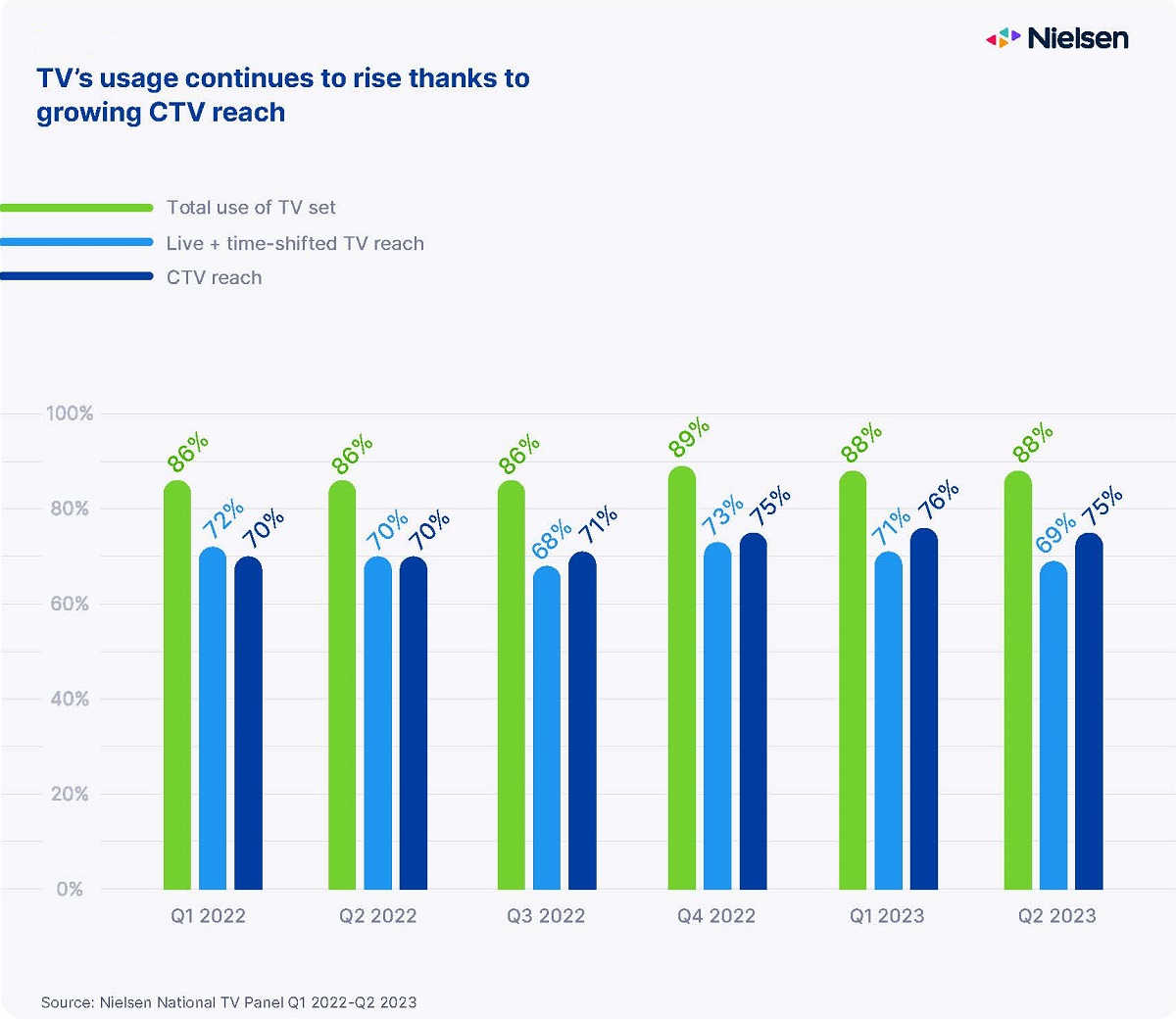

Calling the merger of linear and streaming “Convergent TV,” Nielsen says that media planners need to strike the right balance “of contextual, advanced targeting, and one-to-one advertising.”

In its latest report, the media measurement body says Americans spend between four-and-a-half to five hours a day with TV (live, time-shifted and streaming), but they now spend just as much time with other media.

“We are entering the world of Convergent TV, where the line of what is and isn’t considered ‘television’ blurs,” the report reads.

It is the combination of linear and streaming into a “seamless viewing experience” that is transforming the TV landscape.

“Both the way that people consume content and in the way that media companies produce and release new programming to meet that demand.”

For example, streamers are releasing new titles (both acquired and original) throughout the calendar year, as well as dropping whole seasons at once, which raises the public’s expectations for new, bingeable TV programming outside of the traditional TV season.

Nielsen says streaming usage (whether from digital-first or legacy TV companies) passed cable for the first time at the end of 2022 and is now the dominant form of TV viewing in the US, accounting for nearly 40% of total TV usage.

“For advertisers and media agencies, this is a clear reminder that TV remains a central piece of the marketing mix,” says Nielsen.

“It’s a different medium than 20 years ago when American Idol routinely had 30 million viewers tuning in, but it’s just as relevant today as it ever was. In fact, it’s a more complete full-funnel channel now because it’s increasingly more scalable and addressable, and not just for the largest advertisers.”

Nielsen points out that 60% of medium-sized brands expect to spend more on streaming on CTV, but 35% anticipate they’ll spend more on linear as well.

“As such, measurement silos and incompatibilities should be a thing of the past. Advertisers want to understand how their TV buys are performing not as stand-alone investments but in the context of their cross-media campaigns.”

Cue Nielsen’s own pitch for a measurement standard. “For measurement, data and analytics companies, a top objective now is to develop an adtech ecosystem for TV that combines the best of linear and digital and gives its stakeholders the tools they need to buy and sell with confidence.

“At the heart of that system, the industry needs common, cross- media metrics: a way to measure ad delivery and performance consistently across platforms. We have a few ideas.”

READ MORE: The Next Frontier: Your Guide to the 2024-25 Upfronts/NewFronts Planning Season (Nielsen)

Media planning is not just about TV or CTV, though.

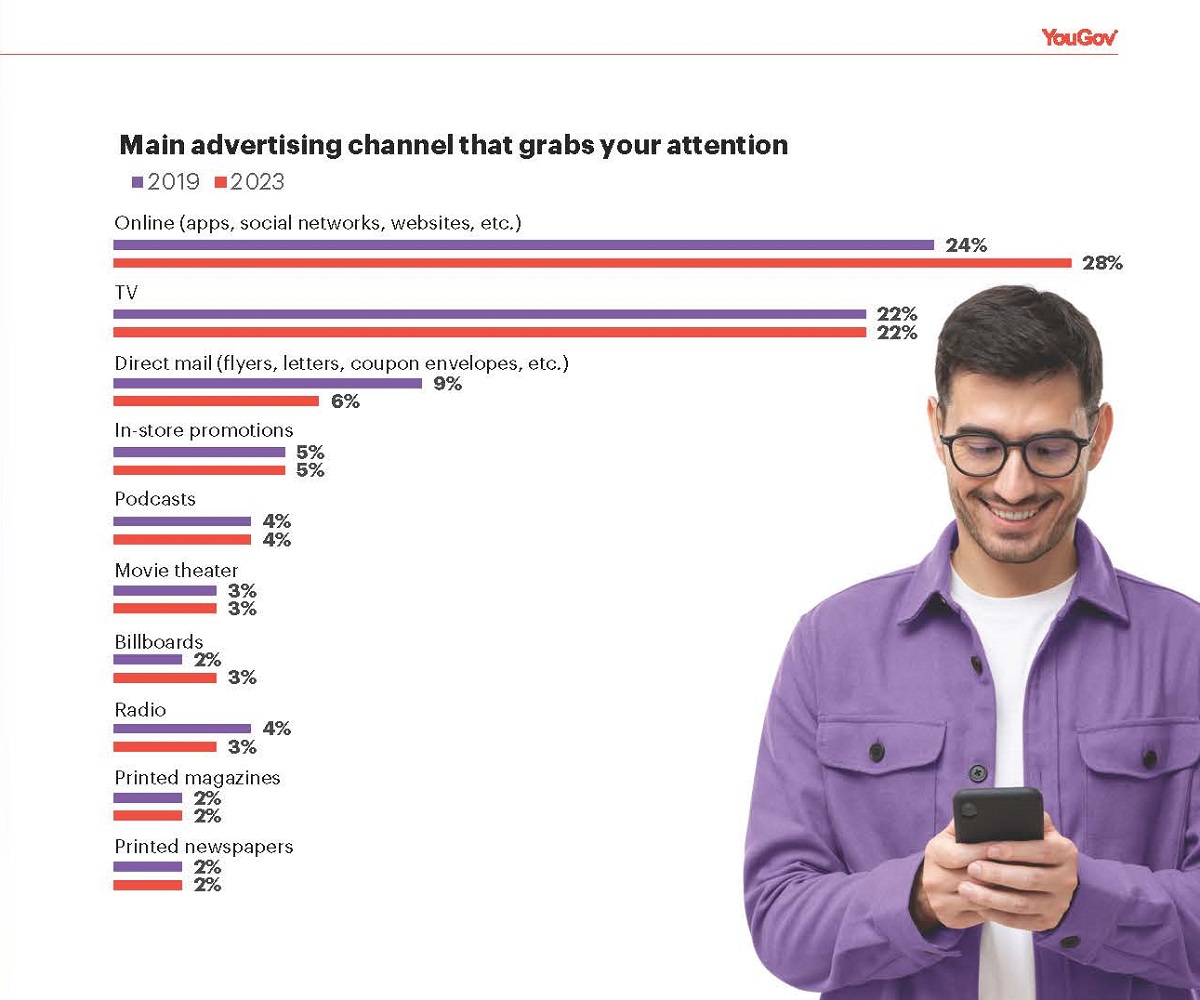

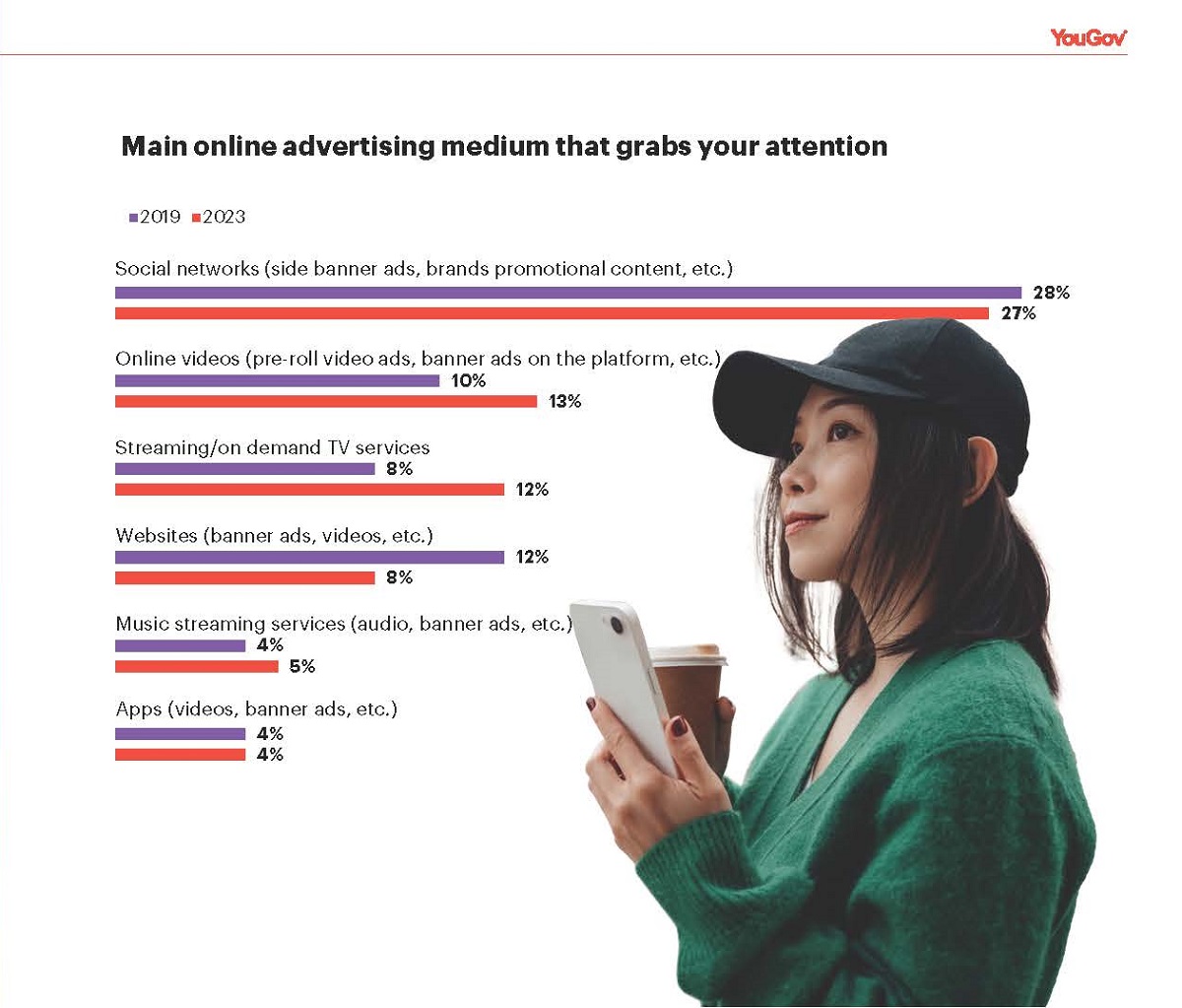

YouGov has charted American media use over the last five years and comes up with the unsurprising conclusion that online is now the primary advertising channel, dominating the attention of consumers.

Social media remains the top channel, YouGov states, but online video and streaming/on-demand TV are registering highest growth. Even among 45+ Americans, social media is now close to eclipsing TV as the top media channel for news and entertainment as much as networking.