TL;DR

- A new survey from consulting firm Ernst & Young finds that media executives are bullish on both generative AI and mergers & acquisitions.

- EY surveyed 150 US M&E board members, C-suite executives and their direct reports to gather insights into the current state of the industry and identify trends for the future.

- Eighty-three percent of M&E executives surveyed say their companies have already or are planning to initiate artificial intelligence projects within the next year.

- In today’s business environment, advertising sales, streaming platforms and broadcast and cable networks create the most optimal business portfolio, the consultancy says.

READ MORE: Finding value in the next evolution of media and entertainment (EY)

Media executives have their eye on two things, according to a new survey from consulting firm Ernst & Young: Generative AI and good, old-fashioned mergers & acquisitions.

AI is not only streamlining operations but also sparking creative breakthroughs, says EY, while strategic mergers are reshaping the playing field across Media & Entertainment.

This new, uncharted epoch follows a lengthy period of FUD (fear, uncertainty, doubt), driven by higher interest rates and rising economic uncertainty — which put a squelch on consumer spending — and the Hollywood strikes, which delayed the release of the fresh content that viewers demand, putting a big dent in studio coffers.

“The storyline for the linear television business remains grim while the advertising sector churns through a period of volatility,” EY dourly reminds us. “Meanwhile, the streaming model still is not profitable for most M&E companies.”

EY surveyed 150 US M&E board members, C-suite executives and their direct reports to gather insights into the current state of the industry and identify trends for the future.

Their findings suggest that “M&E companies are zeroing in on optimizing content and media business portfolios and harnessing artificial intelligence and generative AI to help rekindle their growth ambitions and create sustained resiliency,” the report reads. “They are also taking a serious look at how to future-proof profitability by continuing to consolidate, create new partnerships and streamline operations to permanently reduce expenses.”

Generative AI Gets the Green Light

Eighty-three percent of executives surveyed say their companies have already or are planning to initiate artificial intelligence projects within the next year.

“More than two-thirds (69%) of all respondents expect that GenAI will accelerate the process of content creation, from research to ideation to scripting; this belief rises to 87% for film, TV and video game production executives, who no doubt recognize AI’s potential to augment human creativity.”

A full two-thirds of respondents anticipate that generative AI “will improve the customer experience through intelligently automated assistants, voice recognition and elevated customer query handling. More than half believe that GenAI will improve content quality (53%) and drive audience engagement at scale (51%).”

While nearly half (49%) of those surveyed said they have AI pilot projects currently in the works, there is a critical gap when it comes to the ethics of AI. Only 27% of are developing AI ethics and guidance policies, which set the legal, moral and business parameters within which AI can operate.

Building an Ideal Media Mix

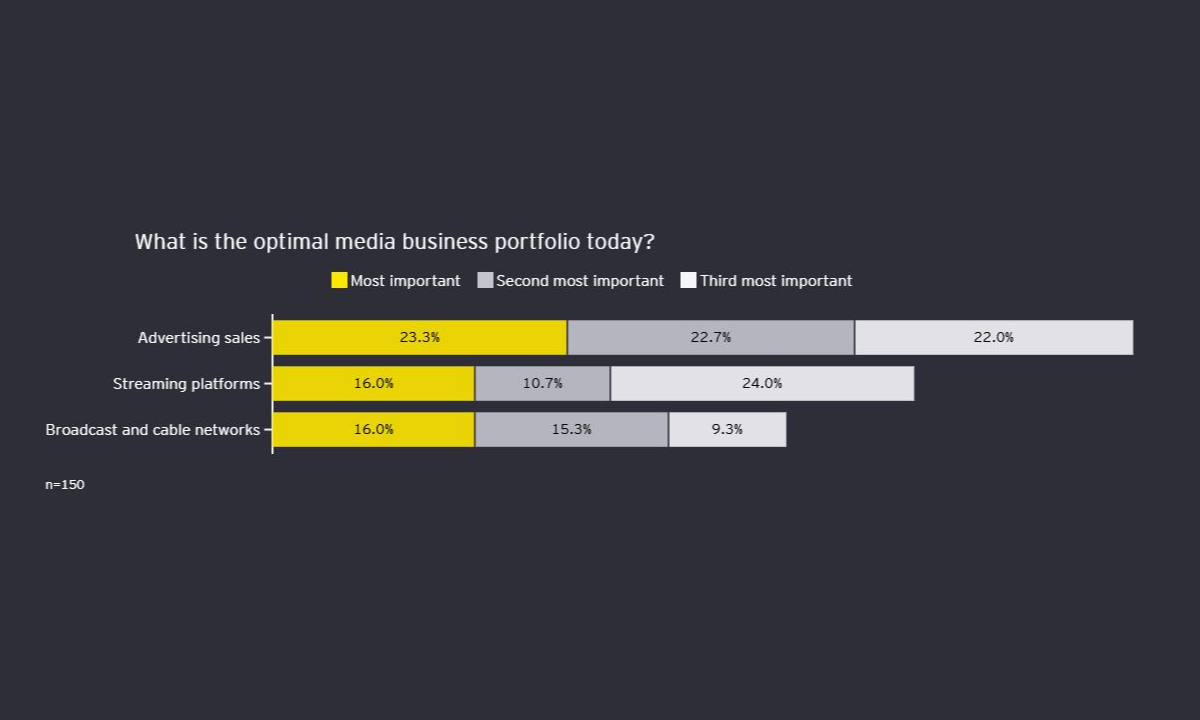

Advertising sales, streaming platforms and broadcast and cable networks create the most optimal business portfolio, says EY.

“According to more than two-thirds (68%) of M&E executives we surveyed, the most important part of an optimal media business portfolio today is advertising sales, followed by streaming platforms (51%), and broadcast and cable networks (41%) — and this is expected to remain the case in three years. Advertising’s high ranking is testament to the fact that, despite its cyclicality and the pressing need for M&E companies to generate alternative new revenue streams, it will continue to play a vital role in driving operational and financial success.”

The traditional linear broadcast and cable network business remains under considerable strain, says the consultancy, with 91% of M&E executives predicting that video will continue to decline while remaining a key part of an optimal media business mix for the foreseeable future.

“More than half (52%) of survey participants say that the decline in this segment will continue at a rate consistent with current trends, while 39% expect the decline to accelerate. One-third (33%) of survey respondents attribute the preference for tailored services over the traditional pay TV bundle as the primary driver for cord cutting by consumers,” the survey reports. “An equal percentage (33%) indicate that with less discretionary spending at their disposal, consumers are taking action to reduce expenses.”

Linear TV Still Generating Solid Profits

But don’t be quick to conclude that this heralds the imminent demise of linear TV.

“Our study finds that M&E executives overwhelmingly say that the broadcast and cable network segment should remain a part of an optimal media business mix. Respondents rank linear video, including TV stations and cable networks, in the top four of all businesses to include in a media portfolio — both today and in three years’ time.”

Despite a marked decline in popularity among consumers, linear video “still generates solid profits and cash flow, far higher than what streaming offers today with its subscriber churn and heavy investment in content, technology and marketing.”

That’s because it’s supported by the favorable economic structure of the pay TV bundle, of which it forms the cornerstone. Hybrid models, says EY, may be the ticket to address persistent losses in streaming.

“M&E executives are moving ahead decisively with the rollout of hybrid models, pushing subscribers toward ad-supported direct-to-consumer (DTC) offerings that re-create the dual revenue streams of linear, while offering lower monthly prices — a critical factor in an à la carte media world where the consumer remains firmly in control.”

Consumer Pain Points

A whopping 93% of respondents, more than nine in 10, said that “consumers appreciate the increased choice DTC services offer, while 85% believe that consumers value the ability to more effectively manage their media and entertainment budget.”

But consumer “pain points” must be addressed to improve the day-to-day streaming experience, says EY. “More than two-thirds (68%) say consumers want to access content through a single platform; 59% note that DTC users would prefer an uncomplicated process to change channels, much the way they can when they watch linear TV.”

This belief that consumers prefer an aggregated viewing experience spans all M&E sectors, but the idea that a single platform improves the viewing experience is by no means new. “For decades, the multichannel video programming distributor (MVPD) bundle served consumers — and the industry — very well. Consumers benefited from having simple access to news, sports and a wide variety of entertainment video programming. With few alternative options for consumers, the video production and distribution players also profited handsomely.”

Streaming gave consumers an unprecedented choice of — and control over — their viewing experience and budgets. Media companies responded by emulating the tech companies disrupting their business model, spending billions of dollars in the process of building up their own streaming platforms. But we all know how this ended up: “Streaming adoption has badly frayed the traditional MVPD bundle,” says EY, “The results are clear, with the number of traditional MVPD subscribers falling rapidly in recent years. There is no sign of this trend slowing.”

Mergers & Acquisitions on the Rise

In the face of growing dissatisfaction among consumers, and a media landscape that increasingly continues to resemble the “walled-off gardens” of the early internet, media companies are turning to mergers & acquisitions to save the day.

The carriage agreement between “two industry heavyweights” brokered in September 2023 (we’re guessing EY is referring to Charter and Disney) shows the way forward.

“Ending a standoff, the deal enabled the cable giant’s subscribers to receive ad-supported DTC services in a bundle with certain linear TV packages. The media company retained linear distribution at attractive rates, which protected a crucial source of cash flow generation. We expect to see more of these types of deals as media companies try to preserve as much of their legacy business as possible while they transition to streaming.”

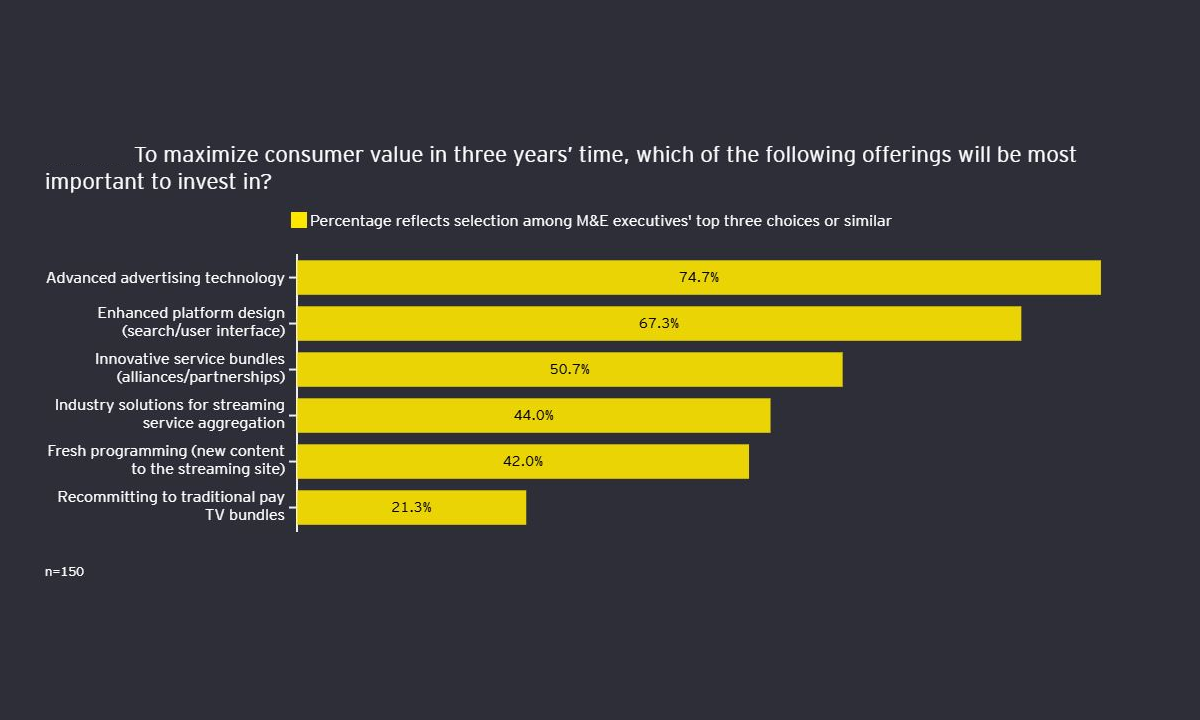

To maximize the value they can deliver to consumers, M&E companies are investing in four key areas, according to EY: 75% are prioritizing advanced advertising technology to drive marketing relevance; 67% are investing in platform design to enhance the user interface and overall experience; 51% are spending on cross-platform service bundles (e.g., ecommerce, wireless) to boost the overall offering for consumers, and potentially reduce churn; and 44% are dedicated to building an industry solution for streaming service aggregation.

This will help “revive the easy-to-use pay TV experience of having all content in one place, an integrated program guide for programming discovery, and the ability to change channels with a single click of the remote.”

Sports for the Win

Despite the lack of profitability streaming has provided to date, it won’t be leaving anytime soon, EY predicts.

“Until recently, streaming executives justified the spend, saying it was necessary to offer a deep well of content to attract and retain subscribers.”

Expenditures on content will likely increase over the next three years, the survey finds, rising from 77% across all M&E companies to 90% among broadcast TV, cable and streaming networks, and film, TV and video game production.

“The competitive content race remains vigorous,” says EY. “Companies continually add programming to feed their streaming services to lure in new subscribers and keep existing users, fearing that a reduction in investment will lead to a loss of market share to their peers.”

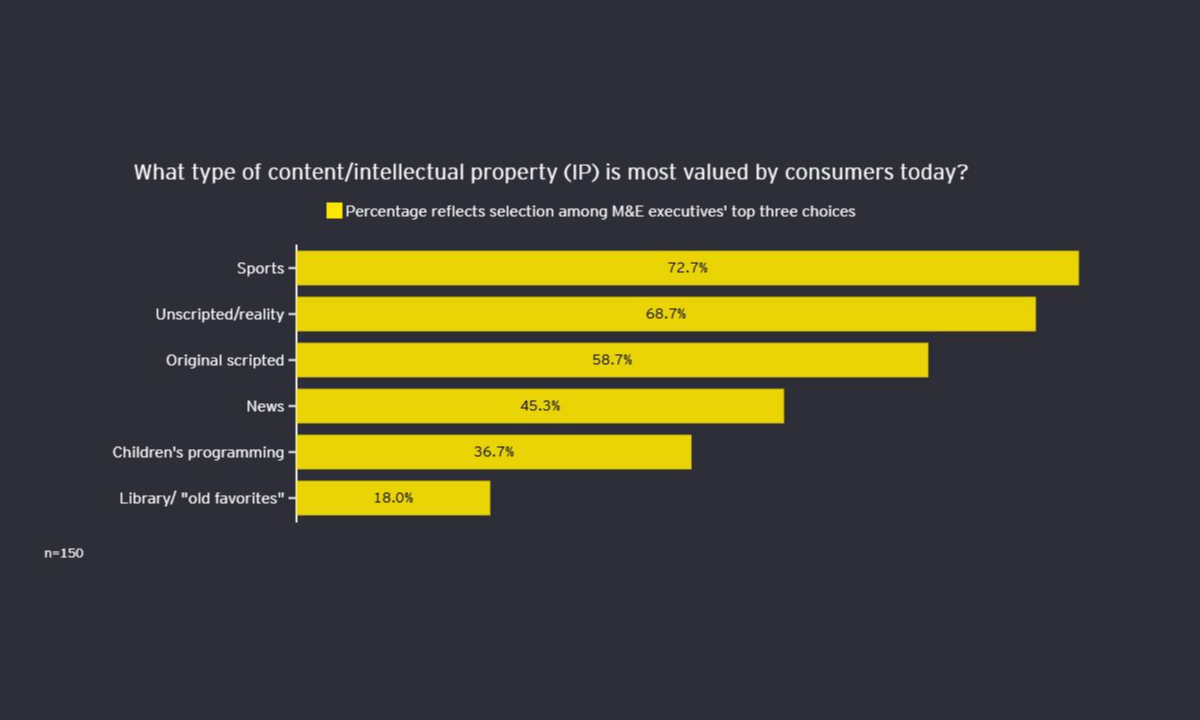

Sports remains a big draw among consumers, and more than three-fourths (77%) of M&E execs identify sports as the most important content to a media company’s success, followed by user-generated or short-form content (56%), video games (55%) and unscripted news or reality programming (41%).

“Sports remains one of the few types of content that can still aggregate large live audiences,” EY observes, which reinforces that “sports rights will continue to be highly sought-after, driving further price inflation and intense competition between M&E operators and the digital-native behemoths.”

Why subscribe to The Angle?

Exclusive Insights: Get editorial roundups of the cutting-edge content that matters most.

Behind-the-Scenes Access: Peek behind the curtain with in-depth Q&As featuring industry experts and thought leaders.

Unparalleled Access: NAB Amplify is your digital hub for technology, trends, and insights unavailable anywhere else.

Join a community of professionals who are as passionate about the future of film, television, and digital storytelling as you are. Subscribe to The Angle today!