READ MORE: Americans’ New TV Habit: Subscribe. Watch. Cancel. Repeat. (The New York Times)

Cancelling streaming services is no longer niche or occasional. Churn has gone mainstream and premium SVODs are going to have to employ new tactics to compete for a share of the household wallet.

Finished watching The Bear? Ditch Hulu. Want to watch Fallout? Sign up for Amazon Prime Video. Time for Slow Horses Season 3? Then cancel Amazon (having already binged Fallout) and get Apple for at least a couple of weeks. More and more of us are doing this, partly because price inflation has exhausted the amount people are willing to spend on stacking SVODs, most of whose content they don’t actually watch.

It’s also because the SVOD system of no-contract, one-month viewing — so important in kick-starting the streaming business — makes it so easy to do.

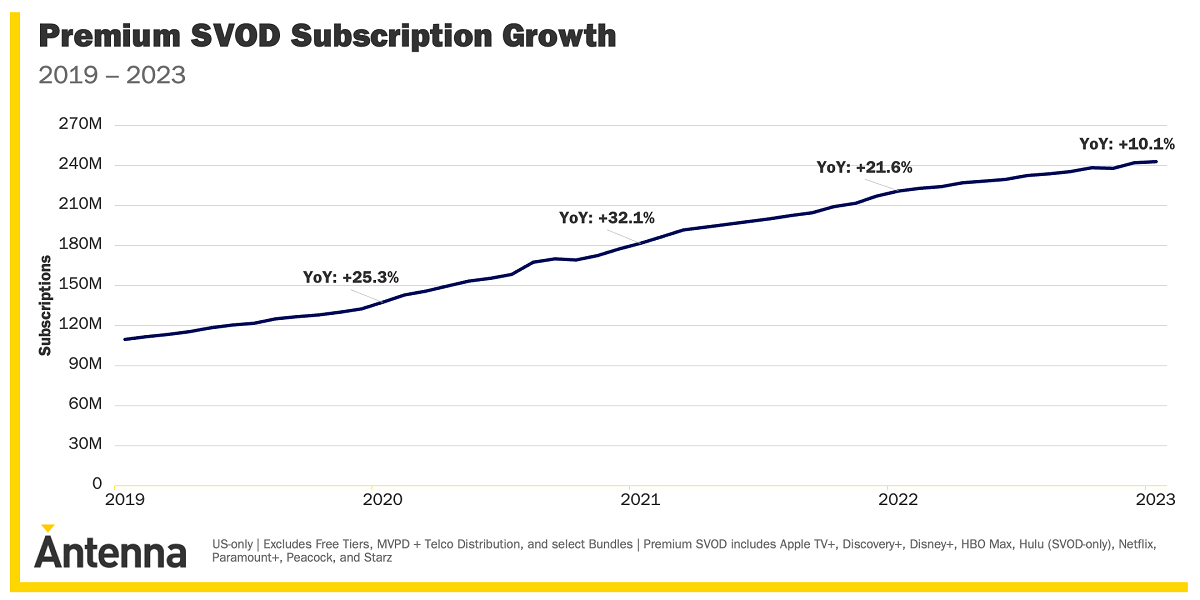

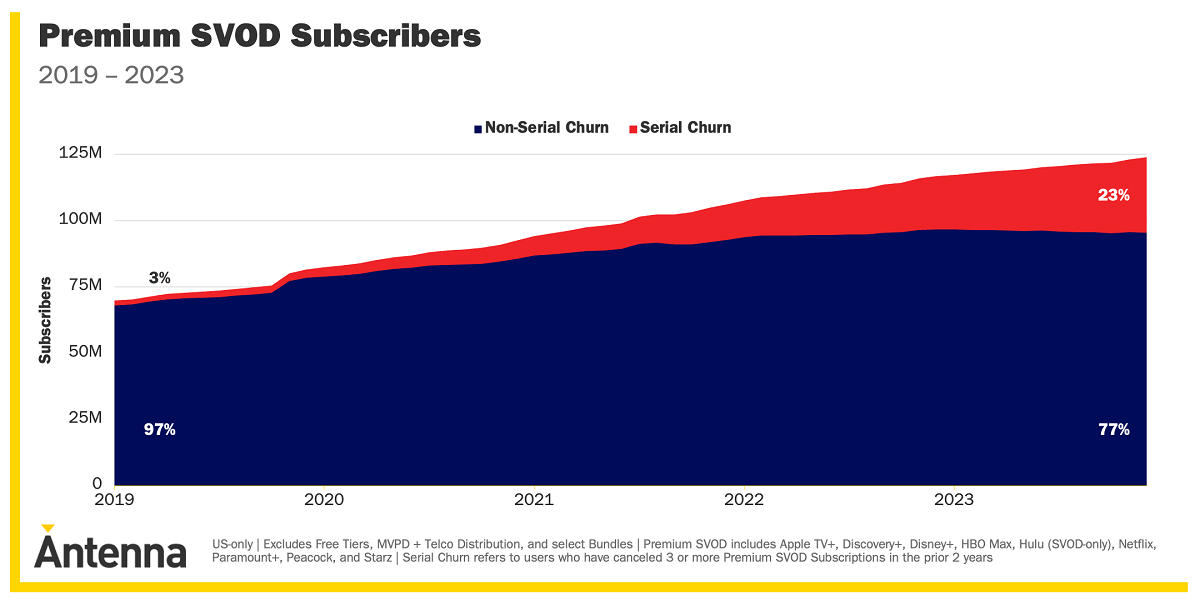

According to data from Antenna, at the end of 2023 nearly one-in-four streaming US consumers qualified as serial churners — individuals who have canceled three or more Premium SVOD services in the past two years. That’s an increase of 42% YoY.

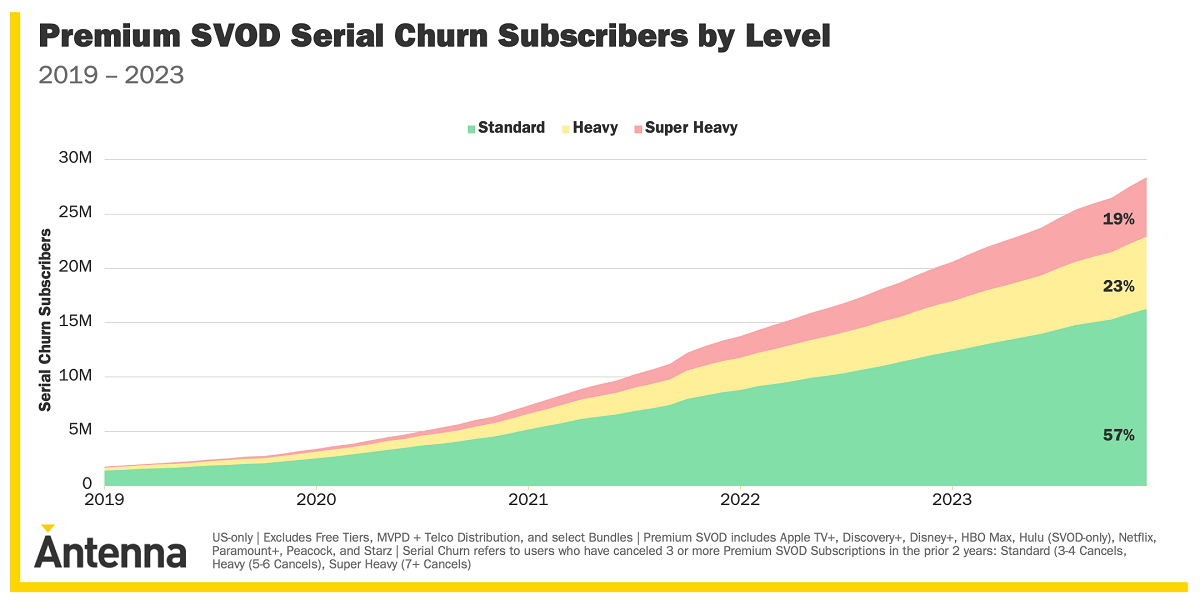

Antenna even identifies a group of “super heavy serial churners,” those who make seven or more cancellations within the past two years, and found that they constituted 19% of subscribers in 2023.

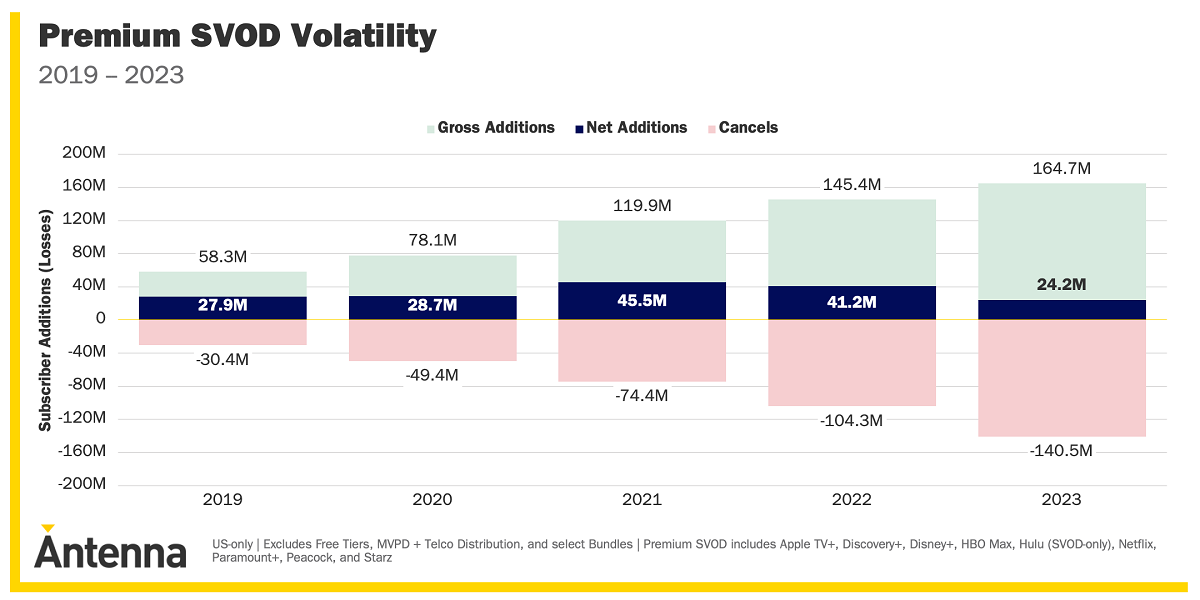

More data: serial churners were responsible for 56.5 million cancellations in 2023, up a whopping +54.6% year-on-year, while cancellations by non-serial churners increased 18.5% to 82.8 million in the same period.

READ MORE: Understanding Serial Churners (Antenna)

As the headline in The New York Times succinctly puts it, “Americans’ New TV Habit: Subscribe. Watch. Cancel. Repeat.”

While consumers value flexibility, the implications could be significant for the major media companies, especially as it seems likely this behavior will become even more common.

One option outlined by John Koblin in The New York Times is to bring back some element of the cable bundle by selling streaming services together.

Executives believe consumers would be less inclined to cancel a package that offered services from multiple companies. Disney, for instance, is bundling Disney+, Hulu and ESPN+ into one package and, later this year, will launch a sports streamer pooled with Fox and Warner Bros. Discovery.

Another tactic is to promote “coming soon” content prominently on the home page. For instance, Apple TV+ is teasing Dark Matter, a science-fiction series that comes out in its app in May.

Peacock promoted a special offer to deter new subscribers from cancelling by offering a deal to sign up for a full year at a discount.

According to Antenna research, cancellation rates for those who did sign up did not drop off a cliff a month later, but instead were close to average.

Netflix appears immune, according to Antenna data. Or rather; it is the service most likely to be part of household bundles with every competitor part of a revolving carousel that consumers pick and mix according to the latest show to land.

Without a predictable revenue stream, it is harder for streamers to invest in new content, causing them to cut production and deliver fewer stand out new releases to market, in a vicious cycle that will gather pace unless nothing changes.

READ MORE: Antenna Q1’24 State of Subscriptions Report: Premium SVOD (Antenna)

Why subscribe to The Angle?

Exclusive Insights: Get editorial roundups of the cutting-edge content that matters most.

Behind-the-Scenes Access: Peek behind the curtain with in-depth Q&As featuring industry experts and thought leaders.

Unparalleled Access: NAB Amplify is your digital hub for technology, trends, and insights unavailable anywhere else.

Join a community of professionals who are as passionate about the future of film, television, and digital storytelling as you are. Subscribe to The Angle today!