American viewers spend more time with AVOD and OTT content aggregators than SVOD, meaning opportunities to reach engaged CTV audiences are expanding.

That’s according to the end-of-year findings from CTV analytics platform TVision.

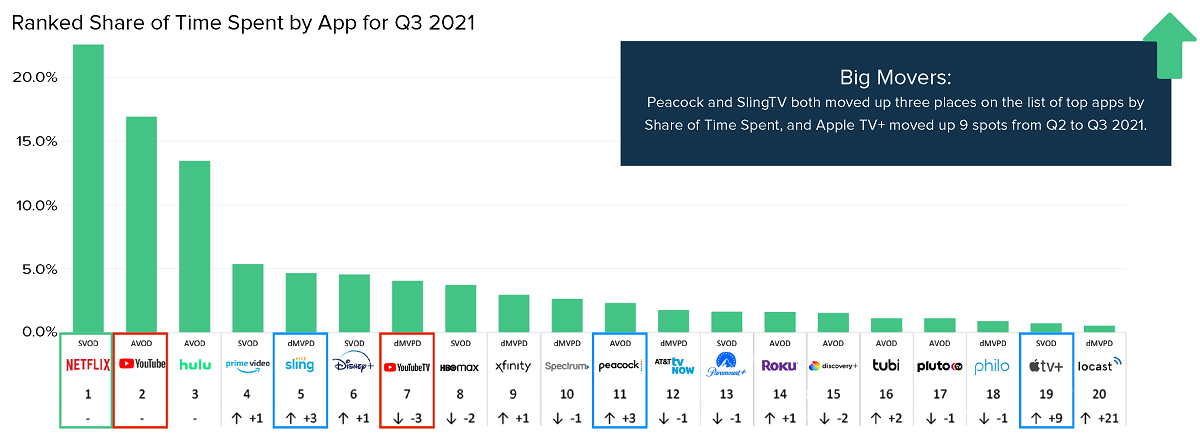

The report also showed that streaming-only viewers are more likely to be younger, but seniors are cutting the cord as well now, too, and that Netflix dominance is at risk of being overtaken by YouTube in an all-important “time-spent” metric.

Going Deeper Into the Report

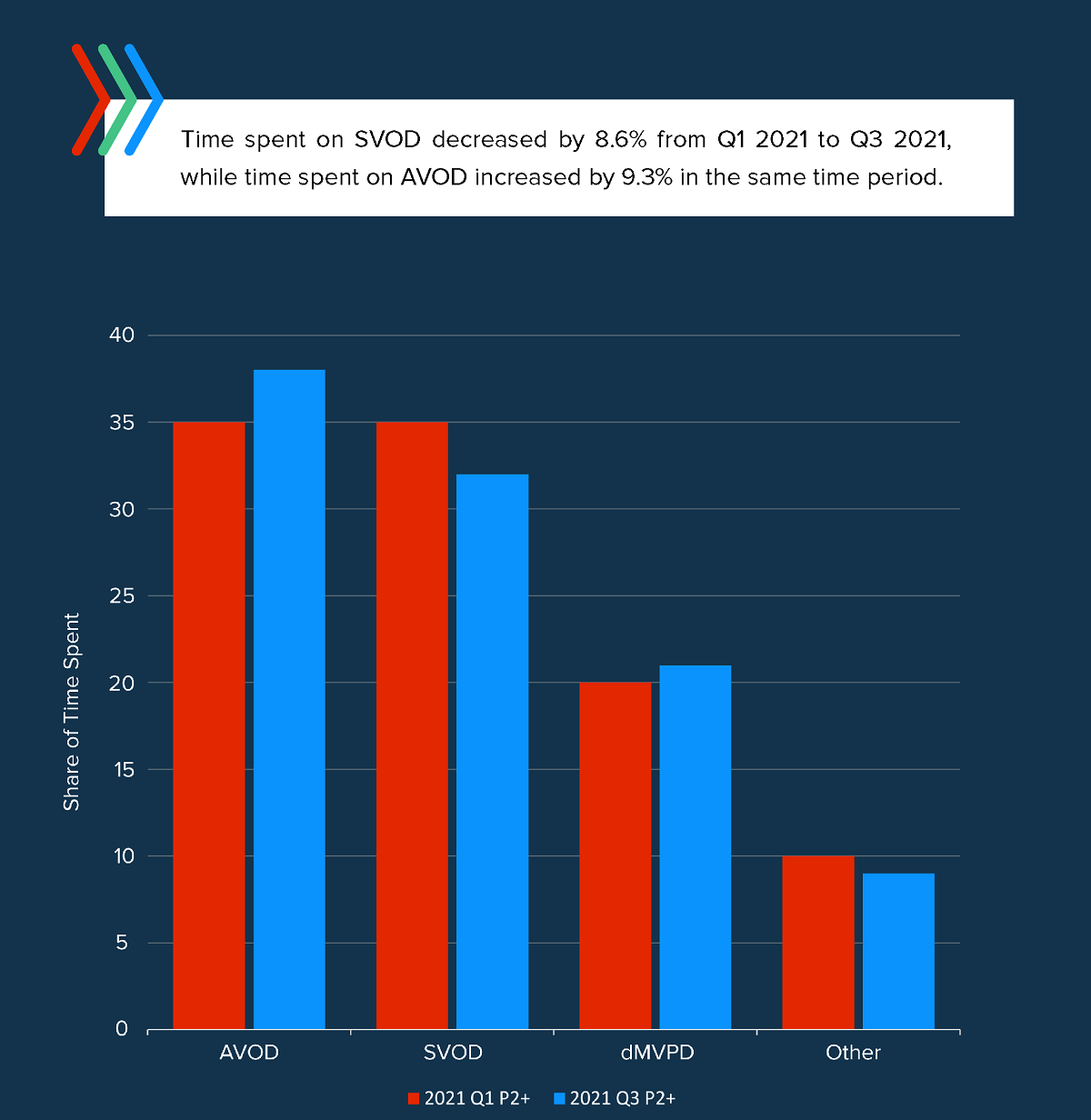

A year ago, the question on everyone’s mind was whether streaming TV audiences, which had become accustomed to commercial-free viewing, would embrace ad-supported video on demand. Fast forward to 2021 and Americans are spending more time watching AVOD than SVOD. Digital/Virtual MVPDs (dMVPDs), another ad-friendly vehicle for streaming TV viewers including Sling, Hulu, DirectNow and Roku, have also increased their share.

The report found that between Q1 and Q3 2021, time spent on SVOD decreased by 8.6% from Q1 2021 to Q3 2021, while time spent on AVOD increased by 9.3% in the same time period.

New streaming services continue to hit the market and TVision now measures hundreds of apps. While households reduced the number of apps they had in early 2021, going from 7.7 in Q4 2020 to 7.2 in Q1 2021, that number has since begun to climb again. In Q3 2021, households had 7.5 apps installed. This Fall, almost 30% of households had 10 or more apps installed on their main television. As AVODs and dMVPDs (Digital/Virtual MVPDs such as Sling, Hulu, DirectNow and Roku) grow their content libraries and consumers become more accustomed to ad-supported CTV, we may see the total number of apps installed continue to increase.

READ MORE: The State of CTV (TVision)

WATCH THIS: TheGrill: Focus on AVOD presented by FilmRise

As inflation rises toward a possible recession and consumers continue to tighten their belts, ad-supported video-on-demand — including FAST channels — are quickly becoming the norm.

WrapPRO recently convened a panel of industry experts to discuss consumer habits amid the rise of AVOD as part of its symposium, “TheGrill: Focus on Streaming presented by FilmRise.”

Moderator Brandon Katz was joined by Daniel Christman, SVP of cross platform group at Screen Engine/ASI; Tejas Shah, SVP of commercial strategy and analytics at FilmRise; Katina Papas Wachter, head of ad revenue strategy at Roku; and Alysha Dino, senior director of publisher development at Publica.

The rise of AVOD could create favorable conditions for both producers of advertising and delivery platforms, Christman commented, kicking off the discussion. “There just isn’t an overwhelming urge among consumers to add more paid subscriptions to their monthly budgets, especially as we head into all this recession talk,” he says. “And we know the demand for content is as great now as ever. So this sets up as an extremely favorable story for those involved in ads content creation, and delivery.”

Watch the full conversation in the video below:

READ MORE: ‘The Great Shift to AVOD’: Why Viewers Are Flocking to Ad-Supported Streaming (WrapPro)

“As we close out 2021, it is clear that this was a year of transformation across the streaming ecosystem. On the advertising side, questions of whether consumers would embrace ad-supported streaming television largely dissipated as viewers now spend more time with AVOD than SVOD, and dMVPD providers also represent a growing share of streaming viewing time.”

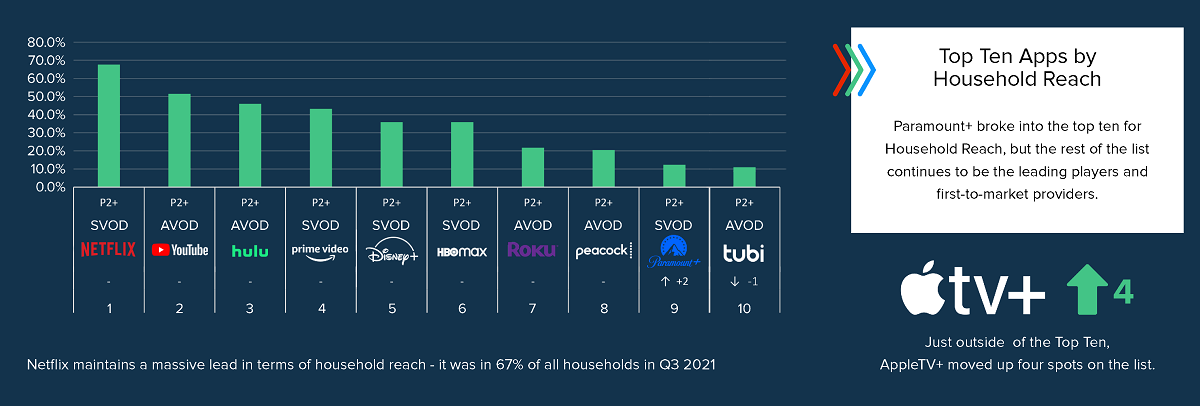

Netflix, long the standard-bearer in streaming television, maintains a substantial share of viewer time spent. However, their share has decreased from 27% in the first half of 2020 to 22% in the first half of 2021. While Netflix maintains a massive lead in terms of household reach — it was in 67% of all households in Q3 2021, AVOD and dMVPD entries are cutting into Netflix’s share of time spent. YouTube’s share of time spent consistently increases, and in fact, when YouTube and YouTube TV are combined, we find that Google’s Ad supported properties capture greater share of time spent than Netflix.

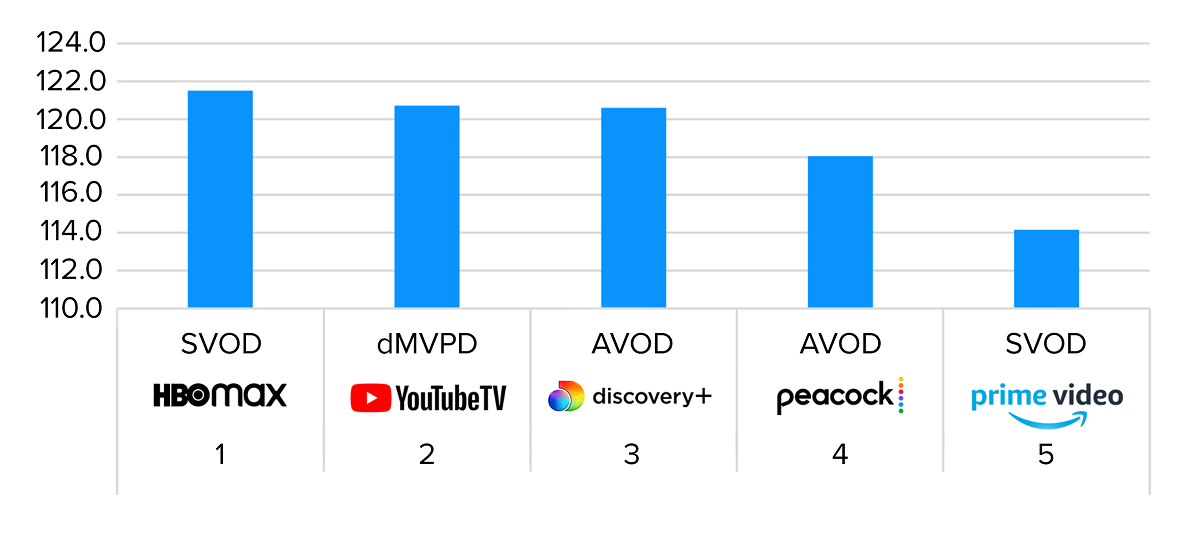

How well viewers pay attention to content is an important metric for marketers seeking to understand the different opportunities available on streaming — whether for in-content product placement or advertising. When TVision looked at the top applications for Share of Time Spent, it found that HBO Max leads the group for Attention, an important insight as the application began showing ads in Q3 2021.

CONNECTING WITH CONNECTED TV:

Currently one of the fastest-growing channels in advertising, Connected TV apps such as Roku, Amazon Fire Stick and Apple TV offer a highly effective way for brands to reach their target audience. Learn the basics and stay on top of the biggest trends in CTV with fresh insights hand-picked from the NAB Amplify archives:

- How Social Media and TV Advertising Boost Content Discovery

- TV is Not Dead. It’s Just Becoming Something Else.

- Converged TV Requires a Converged Ad Response

- Connected TV and the Consumer

- Connected TV Opens Up a Million Ad Possibilities

Another important metric is co-viewing — handy to understand the real reach of applications, and one that provides an important distinction between household and person-level viewing. Disney+ and other family viewing applications typically top the co-viewing lists, and this held true in Q3 2021.

While the majority of television viewers continue to consume both linear and streaming television, TVision also tracked “cord nevers” — viewers with no history of watching linear TV. These viewers make up 2% of all time spent watching television, skew younger than the average TV viewer, and watch fewer apps overall.

Forty-eight percent of cord nevers are under age 34, with the vast majority under 18, meaning that a good portion of this younger generation does not engage with linear TV. But 49% of Cord Cutters are over age 55, which means that senior viewers are also moving away from linear as streaming options continue to expand.

Premium content can be very effective in driving engagement — the report highlights the impact of Emmy-winning comedy Ted Lasso for Apple TV+.

Taking all of this on board, TVision suggest that in 2021 CTV advertising became a real component of both advertisers’ media strategies and media sellers’ inventory offerings. Overall, CTV ad attention rates are however lower than linear TV advertising norms. Advertisers can find more engaged viewers by optimizing for frequency, ad length, content alignment and more, the analyst believes.

The Impact of Disney+’s Premium Movie Strategy

As the public has returned to in-theater experiences, questions remain about the role streaming can play in commercially successful movie premieres. TVision examined three different release strategies from this summer: Cruella, which was released at a premium price on Disney+ first, before general availability on the app; In The Heights, which was released simultaneously in theaters and on HBO Max; and The Tomorrow War, which was released exclusively on Amazon Prime.

While attention to Cruella was 5.7% higher when viewers paid extra for the opportunity to view the movie, Disney+ was able to leverage demand for the movie to capitalize on two chances to encourage viewers to subscribe or continue to subscribe to see Cruella. While the first bump in viewership was smaller, a second, larger bump occurred in August, when the movie was generally available. Overall viewing of Cruella tapered off more slowly than In The Heights and The Tomorrow War, which saw dramatic peaks and drops at first availability and no subsequent bumps.