TL;DR

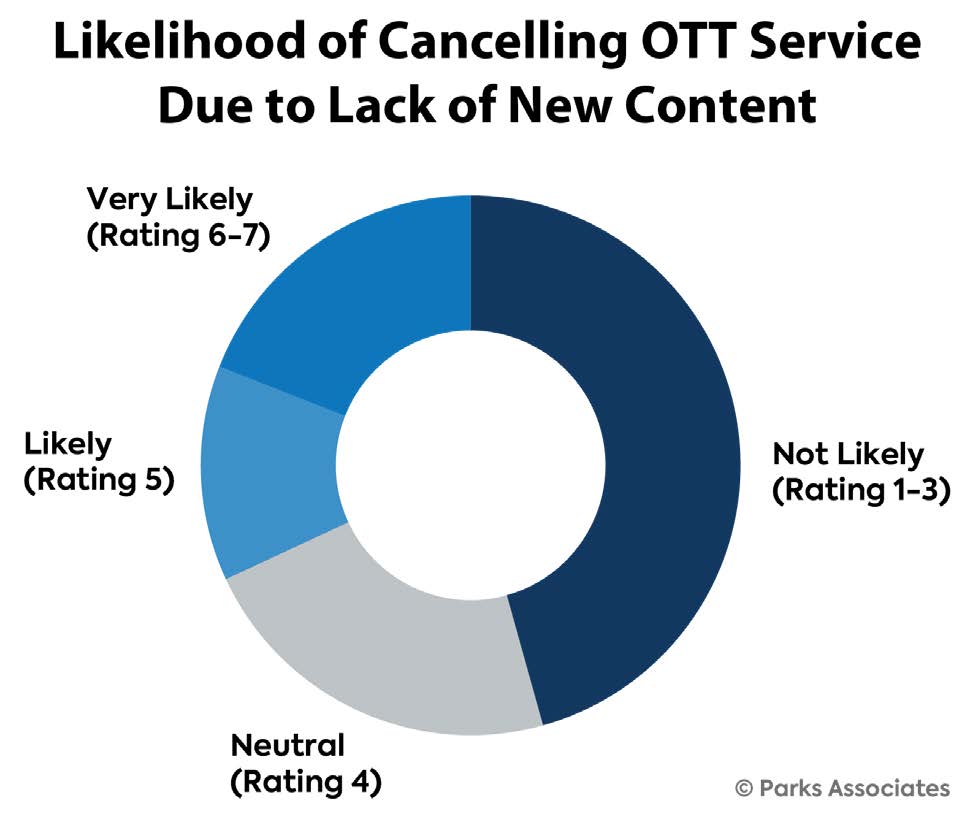

- As consumers experiment with new services, content sellers and streaming services must ensure that relevant, engaging content is frequently presented to subscribers.

- While churn is showing signs of stabilizing, it remains incredibly destructive to long-term success.

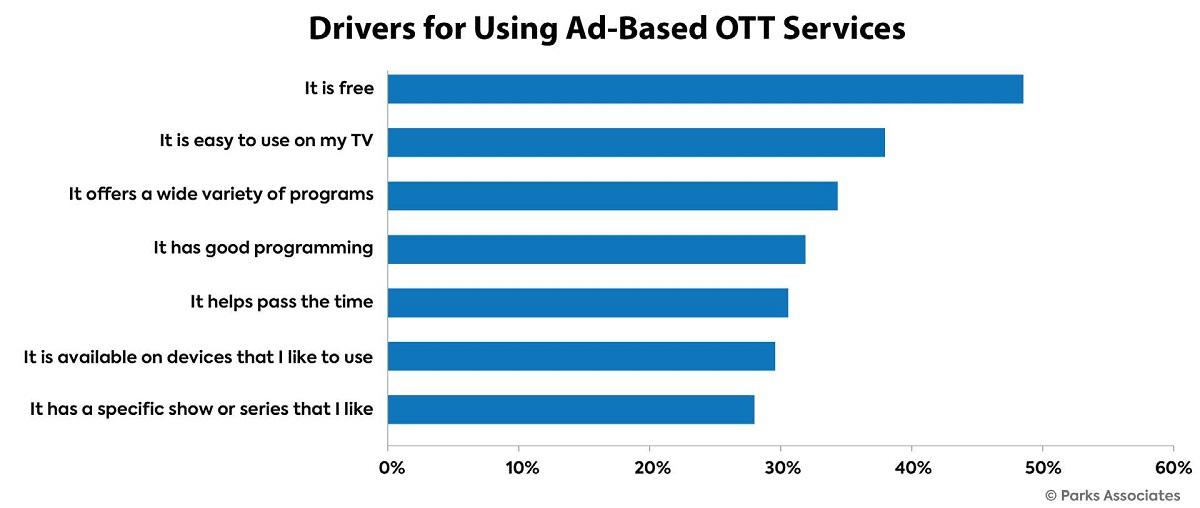

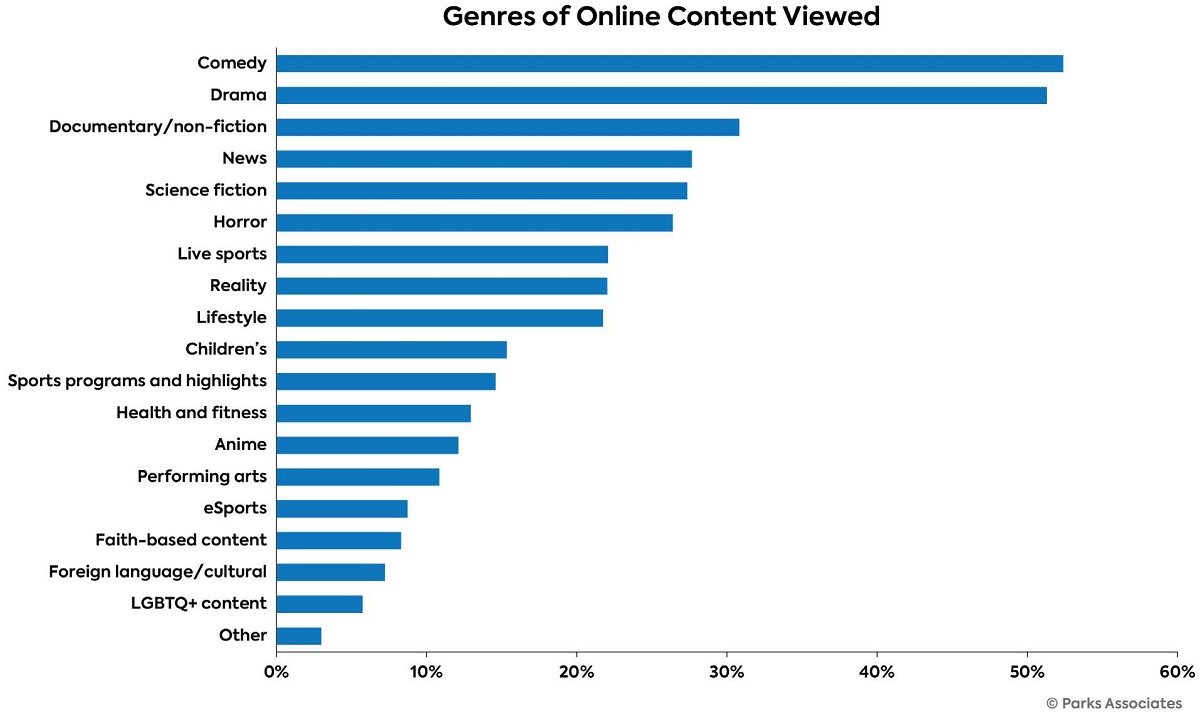

- The lack of new original content in an OTT service’s pipeline has implications for an offering’s bottom line. In addition to being a free service, content variety plays a key role in driving usage of ad-based OTT services.

READ MORE: Optimizing Video: Enhancing Content Performance for OTT Success (Parks Associates)

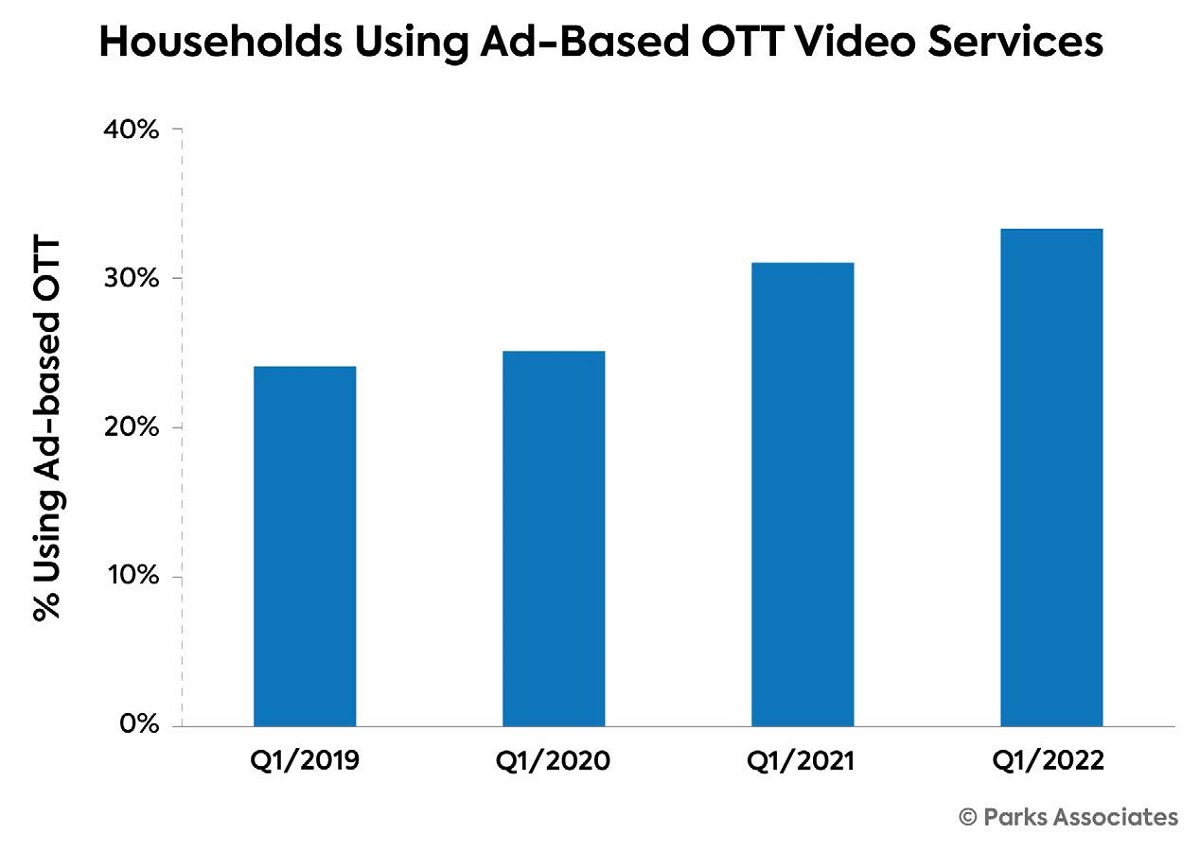

Ad-supported streaming services are the future of video consumption, finds the latest report by Parks Associates, as OTT and traditional linear TV merge with the rise of FAST services.

The white paper, “Optimizing Video: Enhancing Content Performance for OTT Success,” also says that streaming is giving niche content providers a platform to reach millions of consumers.

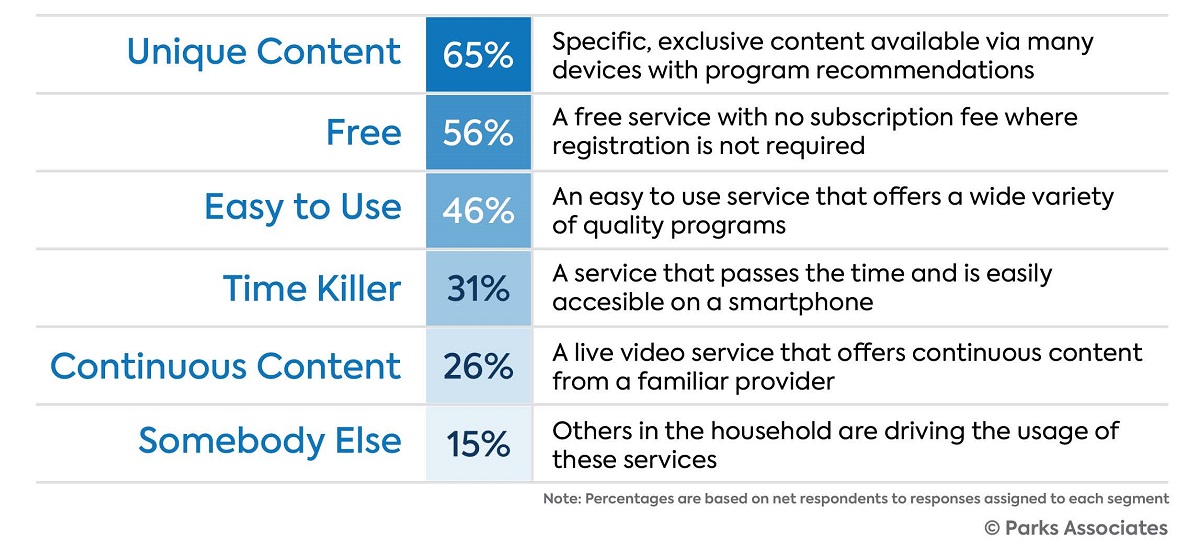

“As consumers continue to move away from traditional pay TV services, they will first seek out options to watch the content they want in ways they are accustomed to—a relaxed, lean back experience,” says report author and Sr. Contributing Analyst, Parks Associates, Thomas Schaeffer. “While most would say that they would prefer not to see ads, many are willing to accept them in exchange for free or lower-priced options.”

Some 87% of US internet households now subscribe to one or more streaming video services, and 20% subscribe to eight or more OTT services, the report finds.

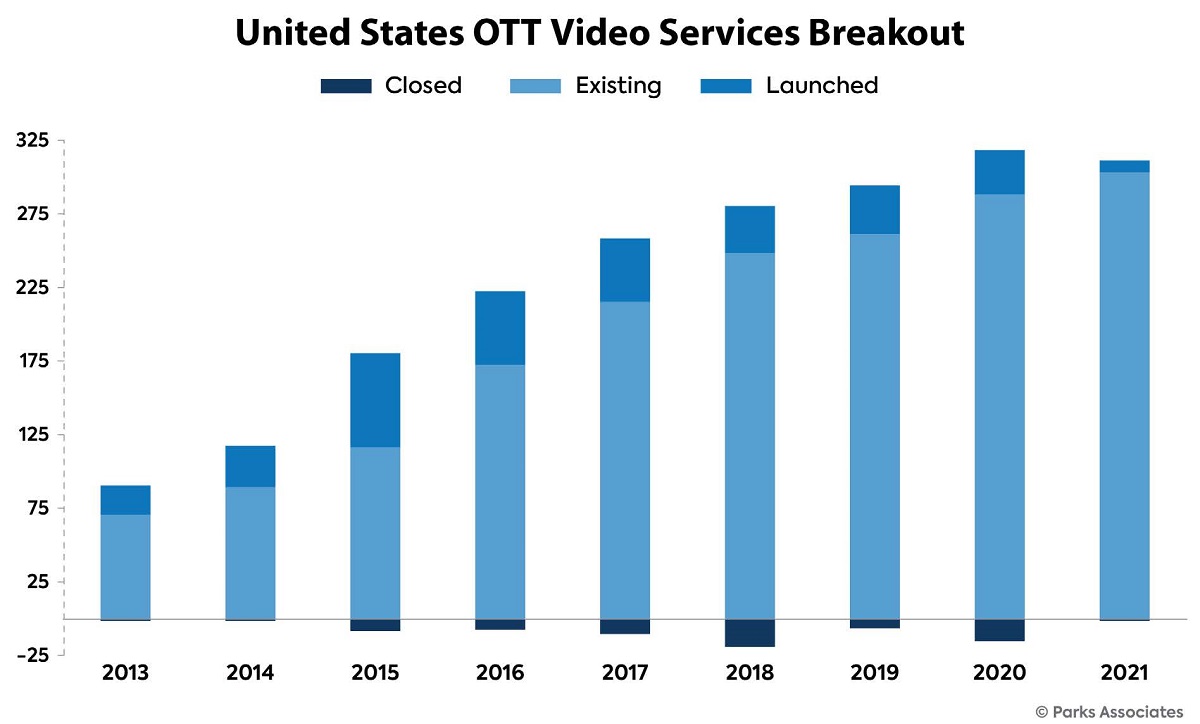

This represents substantial growth compared to five years ago. However, competition is fierce. There are over 300 OTT video services in the US alone, in addition to thousands of FAST channels.

Content sellers and video services are experimenting with new ways to attract and retain subscribers, as well as introducing hybrid business models and partnerships.

Rise of Niche

Niche services, such as Shudder, PokerGO and Curiosity Stream, are seeing a “significant opportunity” to compete as consumers become less loyal to media brands when adding and removing services to accommodate their viewing habits.

Recently, mainstream media organizations have launched niche offerings. TelevisaUnivision’s ViX Spanish-language service, for example, is currently distributed through a variety of partners such as Prime Video, Roku, LG, DISH TV and SLING TV.

“Ad-supported streaming, particularly FAST linear channels, can be used to distribute content that has relatively limited audience appeal, and could never justify its own channel on traditional broadcast or pay TV,” says Schaeffer.

Examples include Dogs 24/7 and Cats 24/7 on Pluto TV and NHRA (National Hot Rod Association) TV on Tubi and The Roku Channel.

- FAST TV and SVOD Are “Channeling” the Cable Business Model

- SVOD vs. AVOD Today, All Connected TV Tomorrow

- Ways Pay TV Operators Can Win the SVOD Game

Per Parks: Advertising rates for these niche channels are likely lower due to smaller audience size, but they can allow content owners to generate some revenue rather than no revenue for content that might otherwise languish in a vault somewhere.

Content continues to be a key driver for subscriptions, with 48% of consumers referencing content availability as the primary reason for subscribing to an additional service.

Further, it is content variety and relevancy which Parks finds are the primary triggers for signing up for and cancelling services — but price is now a much more significant factor.

“Except for Netflix and Prime Video, consumers are likely to churn if the content library isn’t engaging or relevant and prefer services that offer content across a wide range of genres,” writes Schaeffer.

Elsewhere the report says that outside of Netflix, which carries an average subscription length of 48 months, nearly half of OTT subscribers are hopping from one service to the next multiple times over a 12-month period.

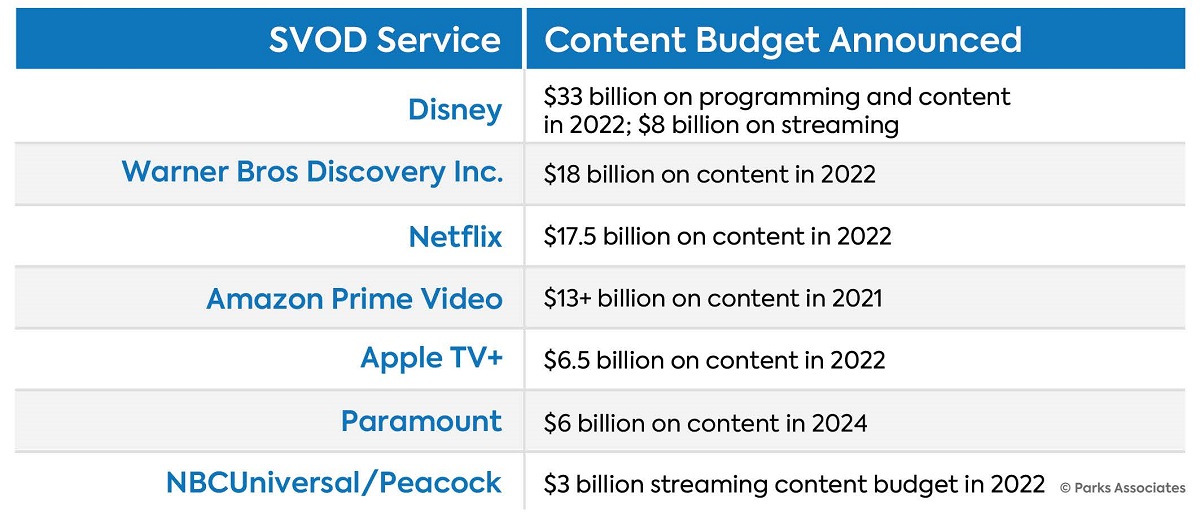

With OTT video advertising expected to reach $119 billion in 2023 much is at stake, with most of it riding on a service’s ability to understand and predict viewer behavior and content engagement.

Parks highlights the need for subscriber engagement data as an increasingly valuable asset for media organizations to assess, demonstrate, and predict the value of a service’s catalog.

“The ability to validate content performance enables content sellers and streaming services to buy and sell a greater variety of licensed content, optimize pricing, and satisfy audience demand.”

The report also forecasts that subscription revenue for OTT services in the US will increase from $34 billion in 2021 to over $46 billion in 2026.