TL;DR

- The free ad-supported streaming TV (FAST) space is quickly growing and a new report from analysts at research firm TVREV projects that by 2025 ad spend on FASTs will surpass that of cable, broadcast or SVOD services.

- Growth is rising across Europe too, attributed to: the higher cost of living driving audiences to cheaper or free sources of high-quality content; the ever-improving quality of content available on FAST platforms; and the entry of more prominent content brands into the FAST landscape.

- However, while FASTs are poised to grab a higher proportion of ad spending, the report also lays out many challenges that remain in the still evolving ecosystem, notably lack of standard measurement, and a lack of transparency.

READ MORE: FASTs Are The New Cable, Part 2: Advertising (TVREV)

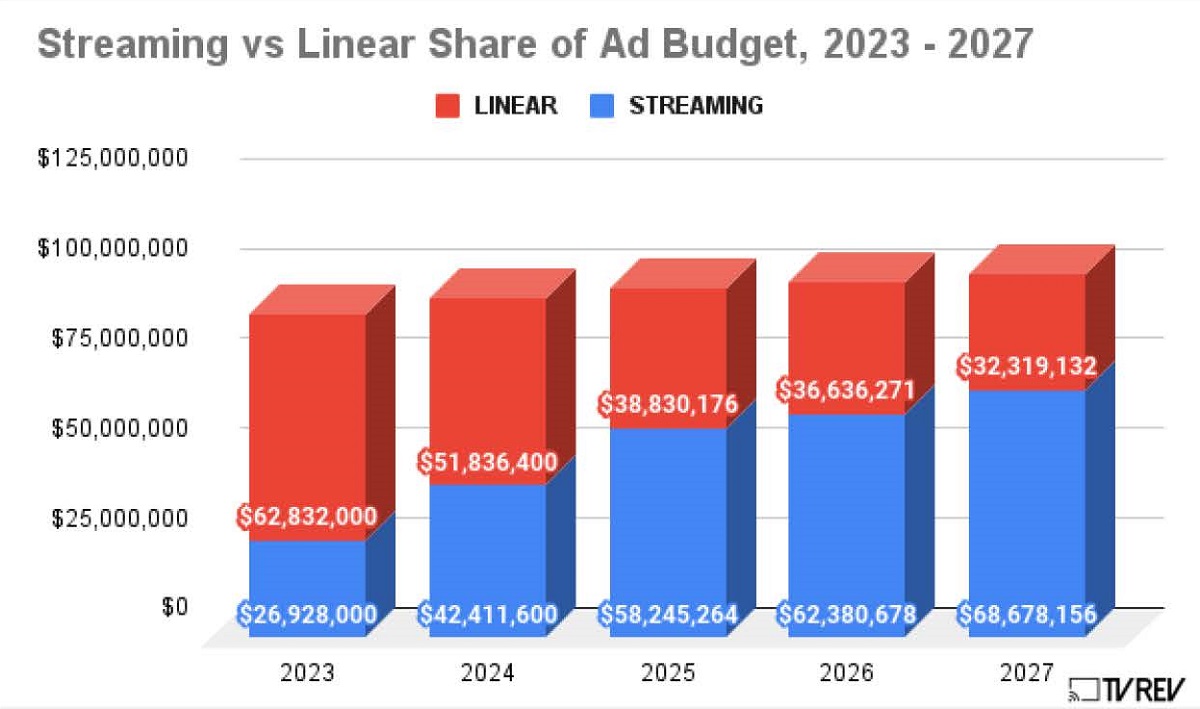

Free Ad-Supported TV (FAST) channels are poised to capture a dominant share of ad spend by 2027, yet at the same time there remains a concern that as TV viewing shifts from linear to streaming, ad dollars may not follow.

These seemingly contradictory findings appear in a new report from research firm TVREV, “FASTs Are the New Cable Part 2: Advertising,” which concludes that the shift of advertising to streaming is “still not guaranteed,” despite huge tailwinds in its favor.

There are many reasons for that, but on a very macro level, they can be boiled down to this: a lack of standardization that impacts just about every aspect of the streaming ecosystem, from planning to measurement to transparency to privacy.

“This is partly because the whole ecosystem is so new, and partly because the different parties (buyers, sellers and middlemen) rarely attempt to work together, each believing that they alone have the key to everything,” say analysts Alan Wolk and Mike Shields in their summary to the report.

Ad Revenue Predictions

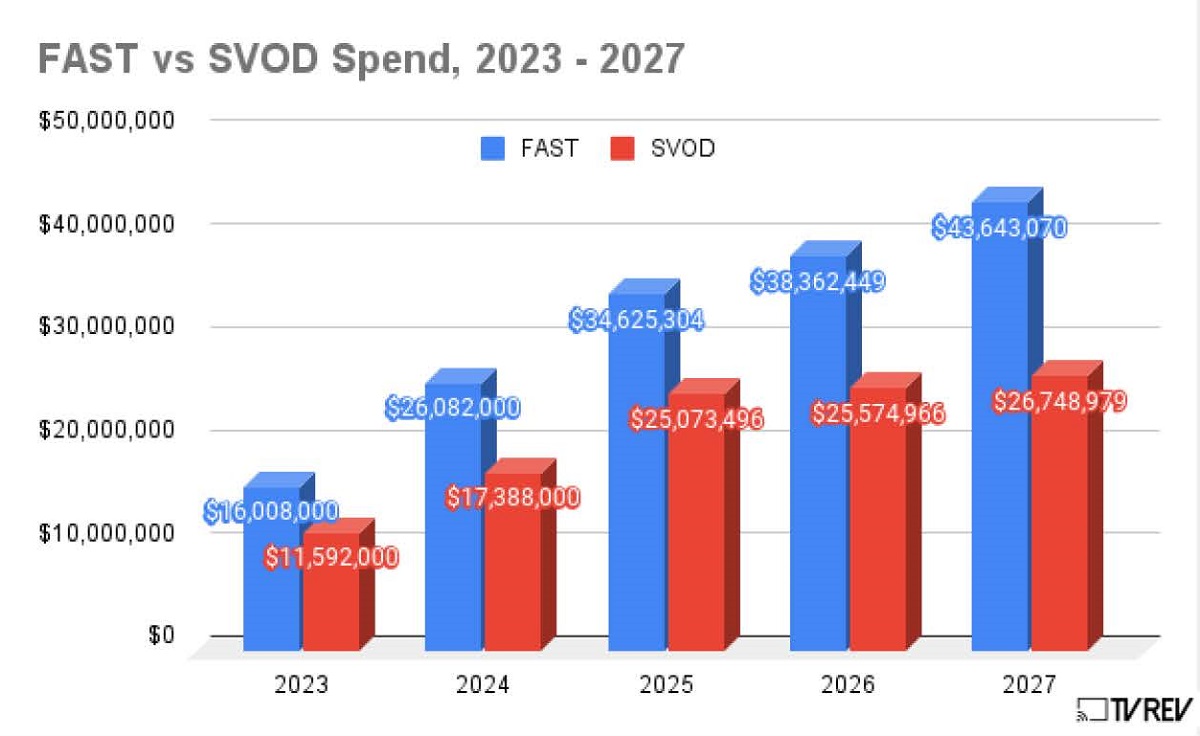

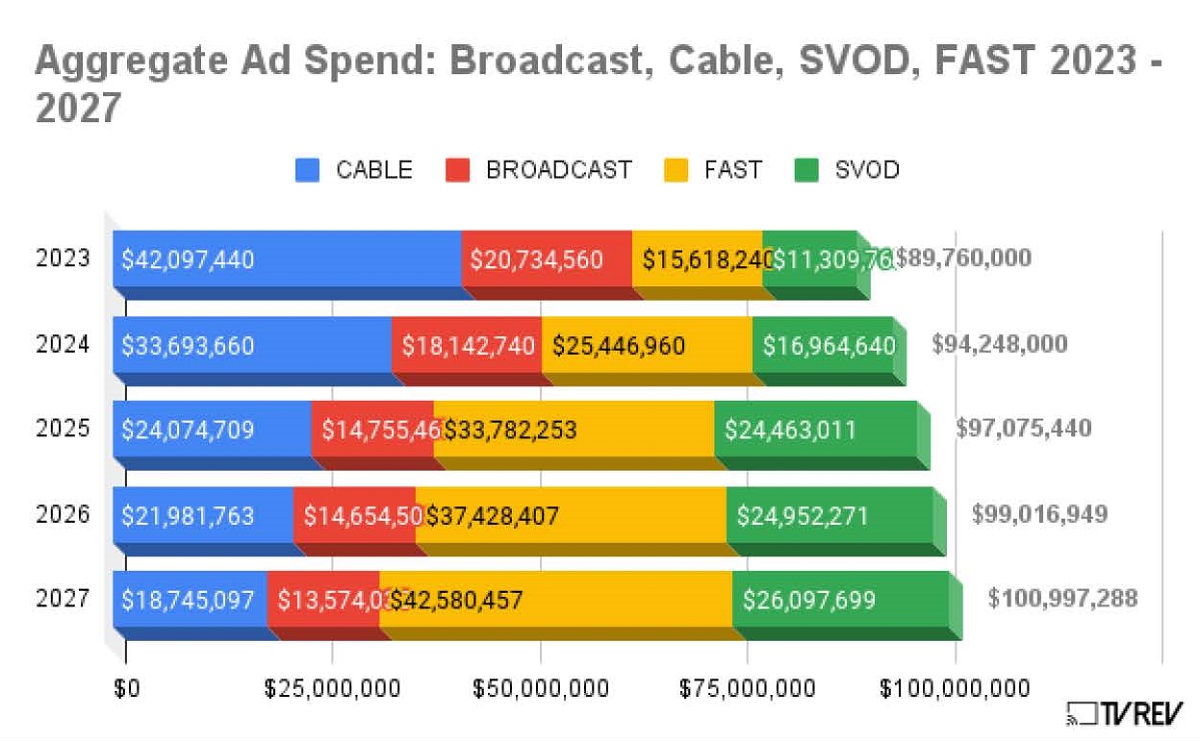

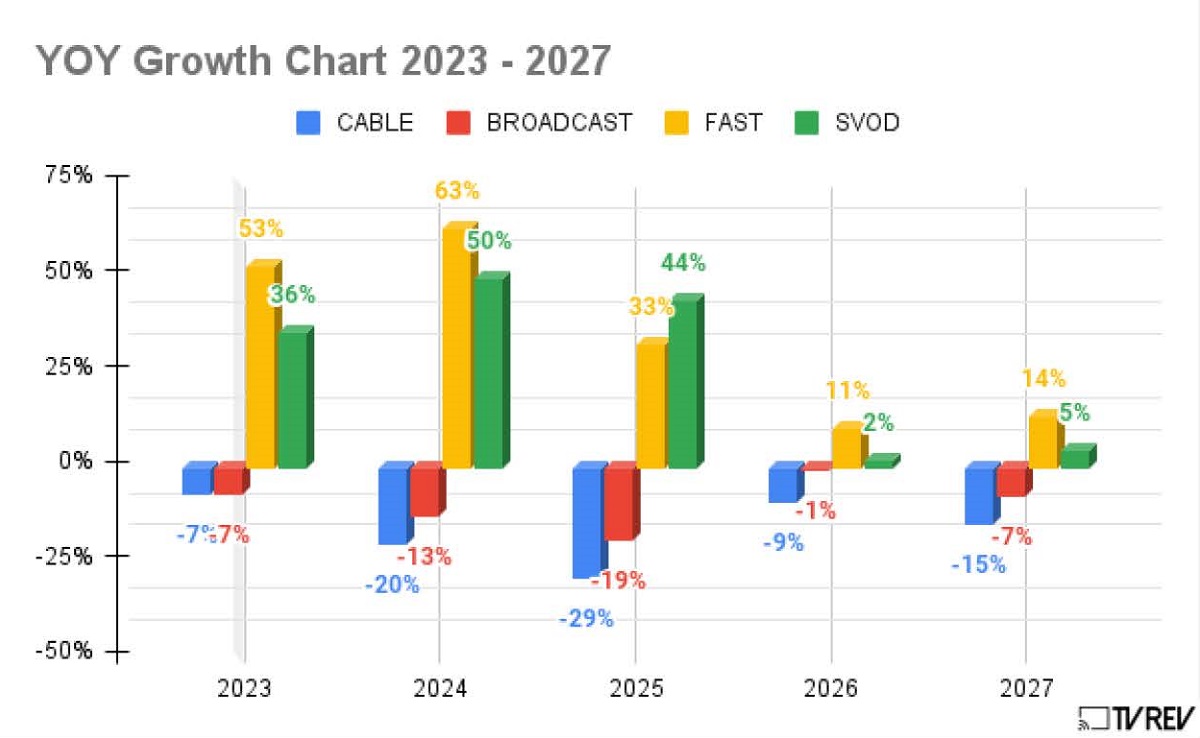

First up, predictions for where ad spend will go over the next few years. Per TVREV’s report, US ad revenue generated by FAST services is expected to rise from an estimated $10.4 billion in 2022, to $15.6 billion and 17% of total TV ad spend this year, to $33.8 billion and a 35% share by 2025, then to $42.6 billion and a 42% share by 2027.

SVODs with ad-tiers like Netflix are projected to see advertising grow from $11.3 billion and a 13% share of total TV ad revenue in 2023 to $24.5 billion and a 25% share in 2025, and to $26 billion and a 26% share by 2027.

By comparison, broadcast TV’s share of ad spend will fall from 23% in 2023 to 15% in 2025 and 13% in 2027, and cable’s share will drop from 47% in 2023 to 25% in 2025 and 19% in 2027.

Brands will see FASTs as a replacement for cable and SVOD as a replacement for broadcast networks, “and so the FAST/SVOD split will continue along the same lines… more or less,” Wolk and Shields said in a statement. They also expect FASTs to capture a significant share of local broadcast dollars, noting local advertisers will want to take advantage of lower CPMs and precise targeting that goes beyond geotargeting.

“FAST services today are where cable was 40 years ago,” said Wolk. “There’s not only more inventory available on the FASTs than on subscription services, but they’re also a great reach vehicle. The most-desirable and hardest-to-reach consumers are spending most of their time on streaming, and the FASTs will be how brands can best reach them.”

FAST Growth in Europe

This isn’t the only report charting the huge leap in FAST popularity. Amagi, which provides streaming services infrastructure, has surveyed the European market and confirms that FAST continues to outpace industry predictions. It latest Quarterly Global FAST Report reveals that growth between Jul-Sep 2022 in Europe saw an increase of 99.97% in ad impressions and over 51% in hours of viewing.

It highlights the penetration of internet Connected TV (CTV) a key marker of FAST channels adoption and that in this respect the UK is the most advanced country in Europe with rates as high as ~85%, making it possible to reach almost 94% of internet users via connected devices. Other major European markets including France, Italy and Spain also showed stella growth in FAST adoption – in Italy in the same period growth was 502% year-on-year.

Srinivasan KA, Co-founder & Chief Revenue Officer, Amagi is quoted: “We see FAST continuing to accelerate in a challenging macro environment, and we anticipate the trend to continue, making it an attractive time for content owners to get into this market.”

READ MORE: Amagi’s latest Global FAST Report confirms significant growth for Free Ad-Supported Streaming TV (FAST) in Europe (Amagi)

Sports: The Missing Piece

The great unknown, as TVREV puts it, is sports rights and how quickly they go to streaming, which services they go to, and whether — like Apple’s deal with the MLB — they are available to non-subscribers for free or for a reduced price. Some of that was answered by NFL’s Sunday Night ticket, which was landed by YouTube in a $14 billion seven-year deal meaning that “even more money will go to streaming,” TVREV says.

If other major sports properties were to go behind a subscription paywall, at Amazon Prime or Apple TV, for example, “that could send CPMs through the roof, resulting in SVODs taking a much greater than currently projected share of ad revenue.”

But back to the main caveat of the TVREV report, which canvassed ad executives who all seemed to say how difficult it was to buy advertising on streaming, or more accurately, to buy advertising on streaming across multiple platforms.

“Brands have gotten spoiled by how simple it is to buy linear TV and the various players in the streaming ecosystem have not made it easy by setting up walled gardens and generally refusing to coordinate their efforts,” say Wolk and Shields. “This is counterproductive and the resulting confusion has kept ad dollars from flowing to streaming at the same rate as eyeballs.”

Measurement remains a sticking point. Every service seems to have its own flavor of measurement making it tough to do any sort of apples-to-apples measurement. The lack of transparency around streaming on CTV is another huge issue.

As TVREV outlines, programmatic buying makes it difficult for advertisers to know where their ads ran. Given the importance of context, this is a huge sticking point between agencies and certain FAST services, especially given how completely transparent linear TV has always been.

Overfrequency remains a problem, in which the same households see the same ads over and over; while segueing from third party cookies to a cookieless world prioritizing privacy, ID Resolution and first party consent data is early days.

“Where streaming sits within all of the new digital privacy regulations is still unclear,” Wolk and Shields write. “How to take advantage of first party data when viewing is done on a household level is still unclear.”

Addressing the Issues

It’s not like the industry is standing still. There are technologies and initiatives in train to deal with these issues and an acknowledgement that work needs to be done.

For example, measurement companies are getting smarter about how they refine the data they get from Smart TVs. “Major media companies are starting to use alternative currency providers, meaning we are likely looking at a small group of accepted measurement providers for streaming TV.”

TVREV suggests that programmers are aware that transparency is an issue and many are working to actively make it less of one by giving advertisers insight into the genres and channels their ads run on.

The growing acceptance of universal content IDs is also helping to increase the level of transparency on streaming by, among other things, giving programmers a way to identify a show that does not rely on device ID.

Overfrequency is being nipped in the bud. FASTs associated with major media companies have put protocols in place to ensure the same ads don’t appear over and over.

Privacy issues are being ironed out. This is the area where a lot of work still needs to be done, state the analysts, especially around understanding the privacy concerns of a household versus the privacy concerns of an individual.

“The good news is that the industry realizes this challenge and is working to create solutions, it’s just that there are still numerous opinions as to what that should look like.

Contextual targeting may solve a lot of these problems. It helps with both transparency and privacy, as advertisers will target viewers of certain genres, not the viewers themselves.

“Contextual can even help with measurement, since ACR (automatic content recognition) data measures what is being viewed ‘on the glass’ and contextual targeting just asks that someone in the household is watching that content, with less concern as to ‘who.’ ”

While there is still much about advertising on FAST channels that needs to be sorted out, the general outlook is quite positive. Rather than dismiss or ignore advertiser’s complaints, programmers and ad tech companies are actively working on solutions, so that as the ecosystem evolves and grows, the dollars will continue to flow.

“FASTs will become the cable to SVOD’s broadcast, a place to reach audiences they’d otherwise be missing and to target viewers on programming they can’t find anywhere else.”

HOW FAST CHANNELS ARE TURBO-CHARGING INDUSTRY GROWTH:

As the golden age of streaming winds down, FAST channels — free ad-supported TV — have become the hottest ticket in the Connected TV universe. Learn what FAST is and where it’s going, along with proven approaches for establishing FAST channels including content licensing agreements, monetization strategies, user acquisition and retention, platform partnerships and data analytics, with these handpicked insights from NAB Amplify:

- Why Streamers Are Pressing “FAST” Forward

- FAST Channels: Finding the Right Playout Solution/Strategy

- What’s Up With the (Very Fast) Growth of FAST?

- FAST TV and SVOD Are “Channeling” the Cable Business Model

- More Consumers Are Headed Into the FAST Lane