TL;DR

- The ubiquity of connected TV in US households is proving to be the savior for major streaming services as viewers actively embrace ads in return for cheaper content.

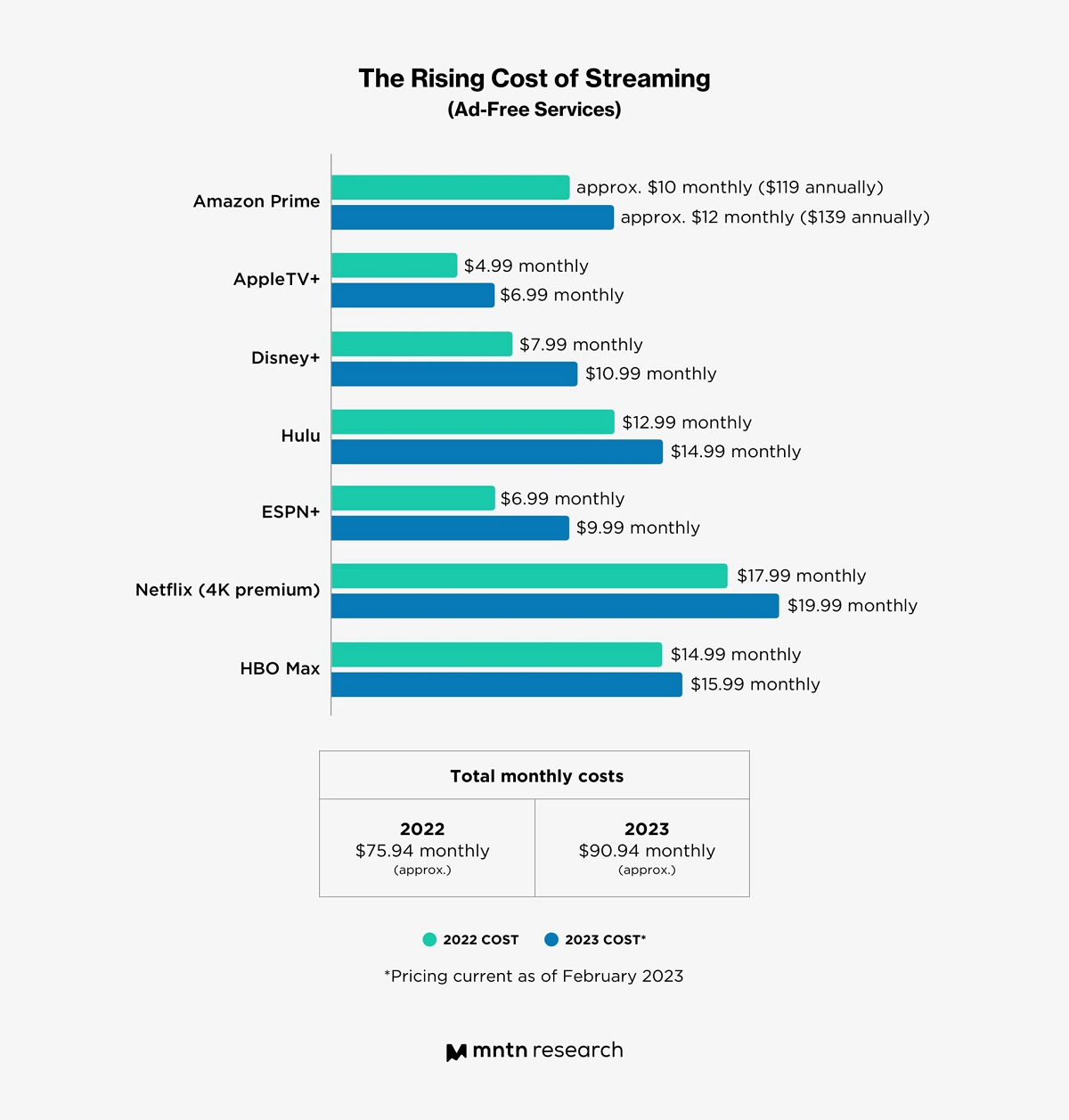

- Ad-supported services are successfully counteracting rises in premium SVOD costs across the board. In one year, the overall monthly fee for all services combined climbed 20%.

- By 2024, nearly half of the US population is expected to use ad-supported streaming.

READ MORE: Why Inflation and the Rising Costs of Streaming Are Driving Viewers to Ads (MNTN Research)

If you subscribe to the seven biggest SVODs in the US this year you’ll be paying upwards of $90 per month — $15 more than you paid in 2022. Of course, few people actually do so and as costs continue to climb three or four premium content services will start to feel more expensive.

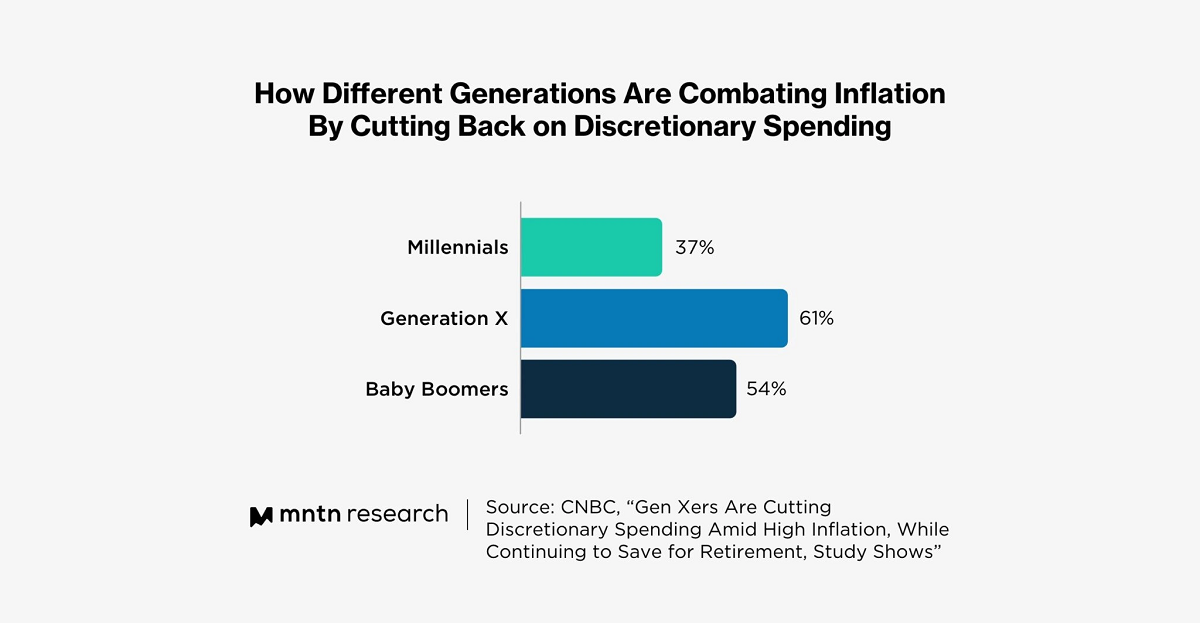

Despite being forced into offering cheaper advertising-supported options, however, the major streamers seem to have struck upon a model that’s a win-win for all. While consumers are cutting back on spending, they’re not unsubscribing — they’re just migrating to ad-supported streaming

“The ability to offer access to the same hit programming for less money is a compromise that benefits all parties,” sums up MNTN Research. “Streaming services help to mitigate any major subscriber loss by lowering the barrier to entry in exchange for advertiser dollars — and viewers are more than happy to agree to this proposition.”

MNTN has crunched the numbers and finds that while streamers continue to raise prices — and expect to take a hit in subscribers — they are making up for this with enticing AVOD packages.

According to MNTN, Netflix’s new ad-supported model has been well-received. Netflix executives are pleased with its adoption rate, and the offering is predicted to hit 7.5 million US subscribers by the end of this year.

READ MORE: Netflix Is ‘Pleased With the Growth’ of Its Ad Tier So Far, Head of Advertising Says (Variety)

Disney has also seen solid adoption of its new ad tier, which is projected to account for 88% of its global subscriptions by 2028.

READ MORE: Disney Plus with ads is live — and it beats Netflix (Tom’s Guide)

Per the research, these sign-ups aren’t being driven exclusively by new subscribers; Disney says that one in every four paid premium subscriptions may switch over to the ad tier. The service now has a goal of signing up 260 million subscribers to its ad-free option by the end of 2024.

READ MORE: 1 in 4 Disney+ Subscribers May Opt for Ad-Supported Tier (Adweek)

Indeed, so popular are free or ad-supported streaming services that eMarketer predicts that by the end of this year households that don’t pay for TV will outnumber the ones that do. As MNTN reports, eMarketer foresees that by 2024 nearly half the US population (158.5 million viewers) will be streaming ad-supported content.

READ MORE: Consumers and Ad-Supported Streaming: Looking Forward to 2023 (MNTN Research)

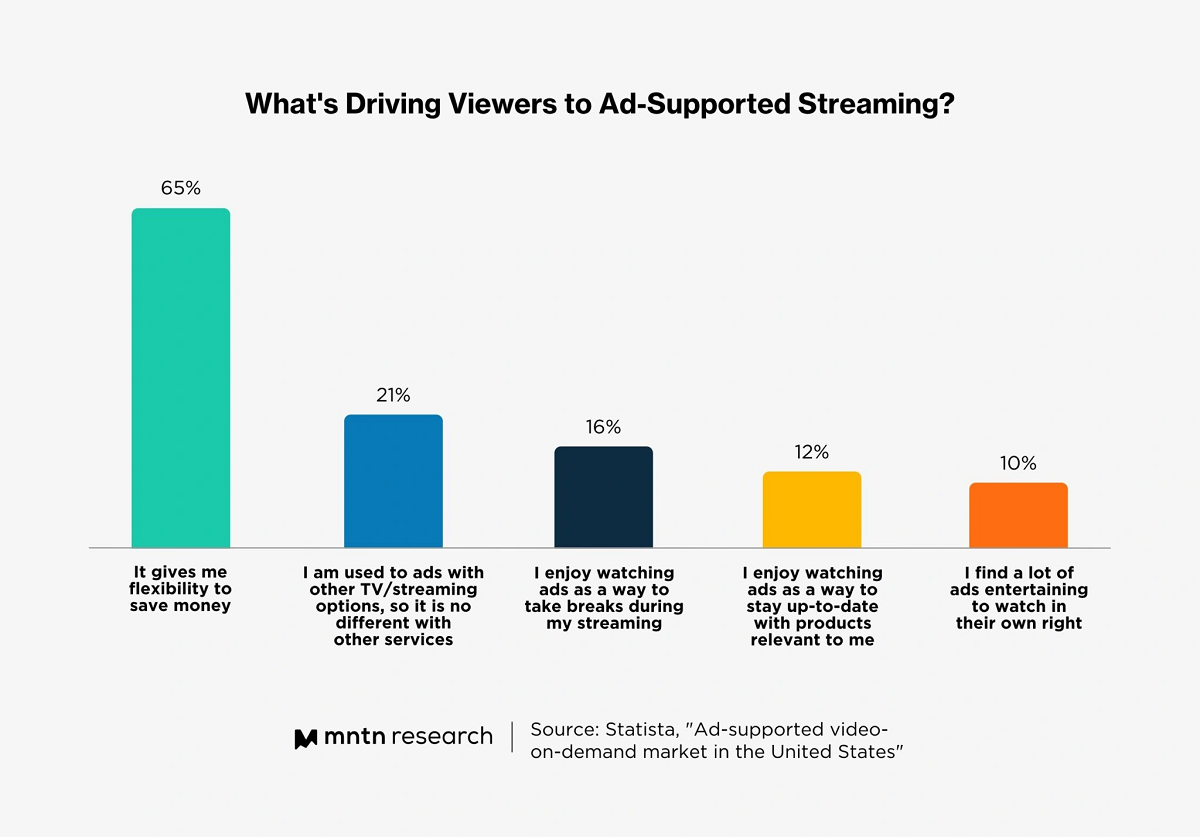

What is happening is not just the offer of decent quality content for less money in exchange for watching ads.

What is happening is that viewers are actively embracing ads as something they are familiar with, and that the market will grow if those ads become more relevant and targeted.

That can happen since most viewing of streaming services happens on connected devices — mostly the living room TV.

Studies show that consumers aren’t just tolerating CTV ads in exchange for keeping up with their shows; they’re embracing them more than other ad channels. 73% of consumers say they prefer “ad-supported CTV viewing” over a “no ads” model, with 60% saying they prefer ads that are customized to them — something that CTV’s targeting allows.

READ MORE: How Connected TV Advertising Works (MNTN Research)

READ MORE: Unruly Data Uncovers Consumer Attitudes Toward Connected TV (CTV) During COVID-19, Including Consumption Behaviors and Ad Preferences (Unruly)

READ MORE: 60% of Streamers Give High Enjoyment Ratings to Shows with Customized Ads (MNTN Research)

“These consumers overwhelmingly watch their streaming services, and ads, on their television,” Notes MNTN. “This gives them a big-screen experience that helps to capture their attention — but also easily enables them to take action as 95% of consumers stream TV with a smartphone on hand.”

In sum, while consumers are cutting back on discretionary spending, the industry-wide embracing of ad-supported content has helped to stem subscriber loss — and even boost subscription numbers.

“While streaming TV once prided itself on not featuring ads like its linear TV forebearer, CTV’s ability to target ads on a granular level has made TV advertising less obtrusive — and more enjoyable — for viewers.

READ MORE: What Is Linear TV Advertising and How Does It Work? (MNTN Research)

READ MORE: TV Advertising Campaigns: How Television Marketing Works (MNTN Research)

“This ability to save money, watch on-demand exclusive content, and get contextually relevant ads has changed how consumers, streamers, and brands think about advertising.”