TL;DR

- The obituaries for the golden age of streaming TV are pouring in as economic reality comes home to roost.

- Analysts predict that streaming will become more expensive and interrupted by ads more frequently as studios look to balance their budgets.

- Cost-cutting pressure could also cause the volume of shows released to drop substantially, creating less opportunity for ambitious projects that have wowed audiences in recent years to be made.

The streaming wars have drastically changed and so has the television landscape for 2023 as economic reality comes home to roost.

“The grand experiment of creating something at any cost is over,” David Zaslav, president and CEO of Warner Bros. Discovery, told Deadline late last year.

READ MORE: David Zaslav Warns Creating Content At “Any Cost Is Over” But Says “Golden Age” Is Still Alive & Kicking (Deadline)

What’s less certain is what TV will look like once this new reset is complete — and whether the TV experience for consumers will simply look different or become dramatically less satisfying.

Some commentators believe the “golden age of streaming” — in which consumers have enjoyed a nearly endless flow of ad-free content at relatively low cost — is coming to an end.

READ MORE: RIP The Golden Age of Streaming 2013-2023 (NAB Amplify)

That’s despite a record number of shows being released across streaming and broadcast TV last year. In 2022, over 2,000 original shows were released, more than double the 779 shows that aired a decade earlier, according to Variety. In August, the number of viewers of streaming services surpassed those of cable and broadcast TV for the first time ever.

READ MORE: Peak TV Broke Records In 2022. That Won’t Happen Again (Variety)

READ MORE: Streaming outperforms both cable and broadcast TV for the first time ever (NPR)

“While 2022 brought new heights for the surge in both volume and prestige in television that is often called ‘Peak TV,’ it may also be remembered as the year the TV gold rush began to peter out,” suggests Mike Bebernes at Yahoo! News.

READ MORE: Is the streaming TV ‘golden age’ already over? (Yahoo! News)

That peak TV has peaked is a theme taken up by a number of media articles in the past month. “The never-ending supply of new programming that helped define the streaming era — spawning shows at a breakneck pace but also overwhelming viewers with too many choices — appears to finally be slowing,” says John Koblin in The New York Times.

The figures don’t lie. The number of adult scripted series ordered by TV networks and streaming companies aimed for US audiences fell by 24% in the second half of this year, compared with the same period last year, according to Ampere Analysis. Compared with 2019, it is a 40% drop.

New Economics of Streaming TV

Streaming isn’t going away. Ampere also predicts global content spend will hit $243 billion this year — up 2% on 2022 and a long way up from the $128 billion spent in 2013. However, cutbacks are coming. After Netflix’s stock nose-dived last spring when it reported shock subscriber loss, Wall Street got cold feet.

As Stephanie Prange at Media Play News puts it, “Now that Wall Street has realized that streaming will have to generate a profit as legacy distribution flags, financiers are putting pressure on companies to make it pay. When the distribution method was new, Wall Street hailed streamers for gathering subscribers and offering ever more expensive content to entice them. No longer.”

READ MORE: Streaming Golden Age Waning (Media Play News)

In recent months, as recounted by Kolbin, entertainment companies became increasingly anxious about a slowing economy, the cord-cutting movement and a troublesome advertising market. Since the summer, scores of executives have abruptly been dismissed, strict cost-cutting measures have been adopted and layoffs have taken hold throughout the industry.

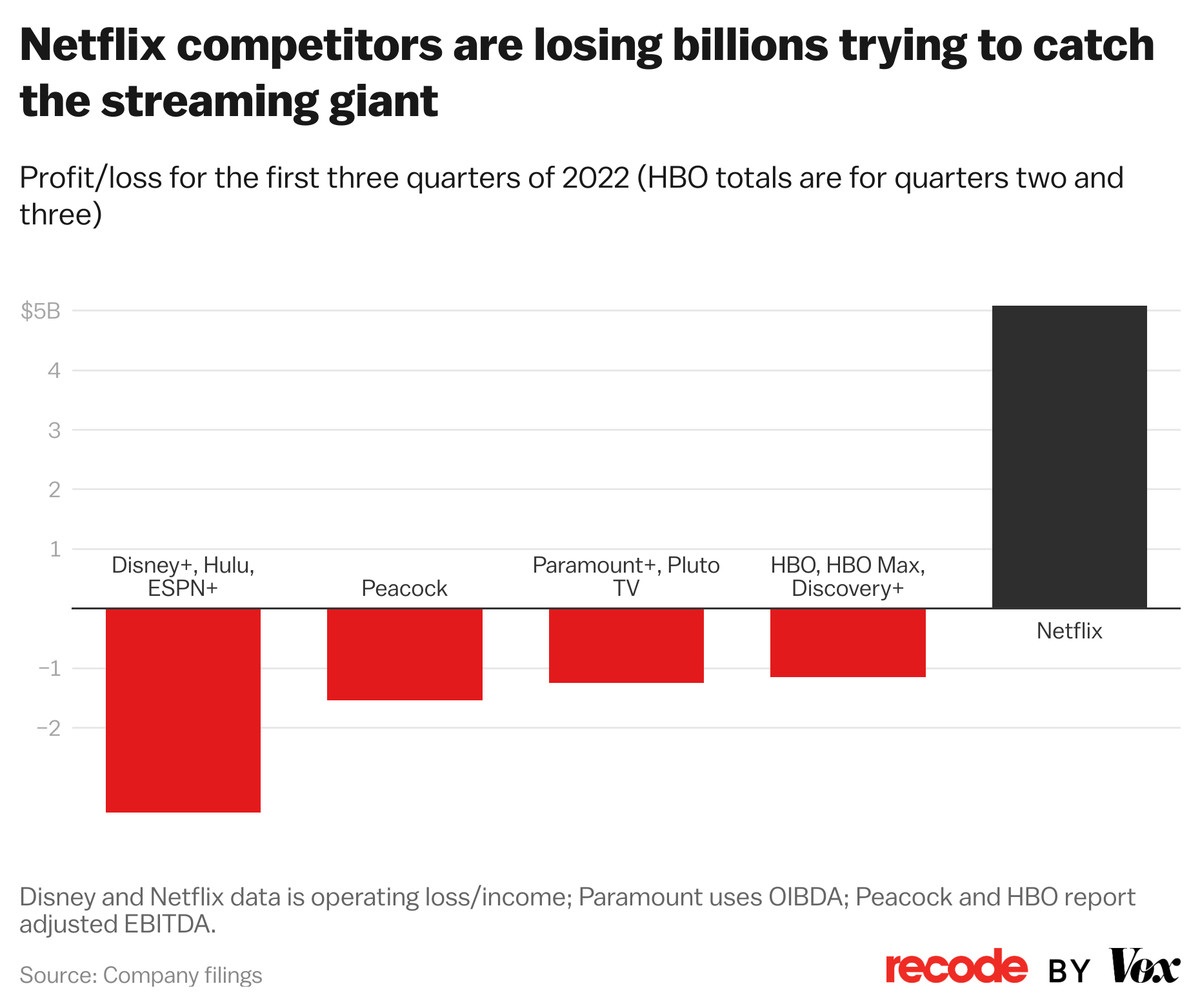

You don’t need to dig through public filings to see the money hemorrhaging; a handy chart published by Vox has done it for you. It shows losses being made by Netflix competitors:

As Peter Kafka writes in Vox, the big picture to note is that there’s a ton of red ink, and there would be much, much more if we they went back further, “because some of these services have been bleeding money for multiple years,” and if they could see the P&Ls of Apple and Amazon, “which are burning big piles of money on streaming but are so big that it doesn’t matter to them or their investors (for now).”

READ MORE: The streaming boom is over (Vox)

Amazon and Apple TV+, which make most of their money from e-commerce or selling hardware, have actually increased the number of adult scripted series ordered this year. According to Ampere Analysis as quoted in the NYT, both companies, are “not as beholden to the same budget limitations as pure entertainment companies — they have deeper pockets and can weather this storm.”

Price Hikes and Consolidation

The others? Well, a period of consolidation seems to be in the cards. Warner Bros. Discovery is a case in point. It faces a debt of roughly $50 billion and is about to merge its main streaming services, HBO Max and Discovery Plus, to a new service reportedly called Max. Other analysts predict more mergers as competing companies buy each other out.

“As a result, streaming may soon come to resemble the cable TV model that it disrupted just a few years ago,” Bebernes notes.

One result of this is a price hike for streaming. Warner Bros. Discovery just raised the monthly cost of HBO Max for the first time since the streaming service was launched in 2020 (by $1 to $15.99 plus taxes a month for US subscribers, equivalent to a 7% increase).

At the same time, we may be getting less for our buck. “2022 was the year reality intruded,” concludes Eric Deggans at NPR. “Consumers learned streaming services will not always offer a bottomless well of content. In the future, they likely will cost more, have a little less library content and cancel more shows more quickly. Welcome to the future.”

READ MORE: Six ways media took a big step backward in 2022 (NPR)

Content cutbacks

An article by Liam Gaughan in Collider points out how mass TV cancellations will reshape streaming in 2023.

Among the cull: 1899, Minx, Love Life, Made For Love, Fate: The Wink Saga, Blockbuster, Night Sky, The Wilds, Shantaram, Rutherford Falls, Why Women Kill, and The First Lady all got the chop, many after just a single season.

READ MORE: How Mass TV Cancellations Will Reshape Streaming in 2023 (Collider)

The new economics of streaming TV means “there’s been a general acknowledgement that the streaming model simply isn’t delivering the same returns as the old model, in which a film or television show had many opportunities for additional rights sales and releases, says Paris Marx in Business Insider.

As a result, Marx says, streamers are retreating from any sort of creative risk in favor of “humdrum, lowest-common-denominator shows.”

READ MORE: The golden age of streaming TV is over (Business Insider)

According to Koblin at the NYT, a cutback was inevitable, particularly when many executives were ignoring profit margins and giving full series orders without so much as seeing a script.

“It’s part cost-cutting and stock price chaos, and part correction for the buying frenzy over the past five years where series were literally ordered over the phone without any proof of concept,” said Robert Greenblatt, a producer and former chairman of NBC Entertainment and WarnerMedia.

Sure, you could watch the ad-supported tier of services like Netflix, but a recent study by Reelgood noted that Netflix’s ad-supported service features significantly less content — hundreds of fewer movies and TV shows. Some of the most popular movies on Netflix, including Sony’s Bullet Train, and TV shows like The Walking Dead and Brooklyn Nine-Nine are not available on the ad-supported service.

Cost-cutting pressure could also create fewer opportunities for the type of ambitious projects that have wowed audiences in recent years to be made.

According to the NYT, some writers have found the market conditions so difficult that they are giving up on the idea of turning a project into a TV series — and looking to movies instead.

“In a stark reverse of what happened for 20-plus years, writers are now taking TV projects and converting them to features because they’ll be easier to get done,” Jay Carson, the creator of the Apple TV+ The Morning Show tells the paper. “The truth is, a lot of projects for the last 20 years that should have been features were stretched to be TV because that’s just what you did.”

In that regard, fewer projects tailored to appropriate length rather than padded out could benefit the discerning TV viewer.

“These companies pulling back — thinking longer and harder about each project — is actually good for the business,” Greenblatt, the former television executive, tells the NYT. “It will hopefully lead to less waste and more shows worth watching.”

READ MORE: Streaming’s Golden Age Is Suddenly Dimming (The New York Times)

Is TV Itself Bust?

There may be a more profound shifting of the sands underway.

Market research firm The Hub portrays the endemic challenges facing the industry as being more generational in nature. Where older viewers (those over 35) watch lots of premium video on a big screen, their younger peers have a very different consumption pattern.

They’re much more likely to use other screens for entertainment, and to use those screens to play video games or watch “non-premium” video content like that on YouTube, Twitch, or TikTok.

READ MORE: 2022 Video Redefined (HUB Research)

“The ‘streaming wars’ monopolize the spotlight when it comes to predicting the fortunes of media companies in the future,” Hub principal Jon Giegengack told TVREV’s David Bloom. “But this obscures an even more important shift: the next generation of TV consumers are just less engaged with traditional TV itself. Gaming and social video are the focus of their entertainment lifestyles. There’s no reason to assume they’ll grow out of these habits as they age. Media organizations need to adapt to these changes in order to meet tomorrow’s viewers on the devices and platforms where they will spend most of their time.”

READ MORE: Are We In The Streaming Revolution’s Third Inning, Or Its Seventh? (TVREV)

Entertainment companies can and are attempting to diversify to engage younger audiences Amazon, Apple, and Netflix have substantial videogame ventures, but nobody has an alternative to TikTok.

“In the streaming future, we’ll all be paying more for less,” says Bebernes. “So I’ll be streaming as much as I can before the shine comes off this Golden Age.”

Measurement Up for Grabs

The way TV is measured must also shake up to accommodate the move of eyeballs to streaming services. Problem is, no one can agree on how to compare ratings when streamers have been, and still remain, black boxes to the rest of media.

“Outside of the most popular handful of titles, precious little information about streaming series ever makes it beyond need-to-know circles within media companies,” says Rick Porter at The Hollywood Reporter. “Media conglomerates and ad buyers began to get more aggressive about finding alternative data streams to serve their needs.”

Porter cites the mushrooming of TV analytics in the past two years, among them iSpot, Comscore, VideoAmp, Parrot Analytics and Samba TV, all rushing to provide more and different data to media buyers and sellers.

“Very little of that makes it out for public consumption, but business is being and will be transacted using several different data currencies in the future, said the research and ad-sales execs who spoke to THR.

Where once there might have been total viewer breakdowns and a couple of demographic subsets — all supplied by Nielsen — to measure the health of a series, now there could be specialized sets of numbers for every aspect of the business.

Still, there are certain figures that research executives go to first. “I look at reach” — the number of people who check out at least a minute or two of a show “because that shows interest,” says Radha Subramanyam, CBS’ chief research and analytics officer. “And I look at time spent because ultimately, that’s engagement. And that determines whether a show is going to have a life.”

Someone focused on ad sales might still be looking at key demographic groups, whether adults 18-49 or 25-54. “We also want to know what’s happening on the many other screens that people have within reach,” Will Somers, EVP and head of research at Fox Entertainment, tells THR. “So [in addition to Nielsen ratings] we look at streaming metrics, which we also get on an overnight basis… and try to provide a holistic measure of total audience in real time for our stakeholders.”

The fact that nearly every big streaming service has or is about to have an ad-supported tier will likely increase transparency at least on the transactional side of the business. But Nielsen is, for now, still the primary provider of public ratings data — however incomplete it may be.

“Will that change?” poses Porter. “It likely will at some point. Everyone with a stake in the game, from ad buyers and network executives to members of the media and interested viewers, would like to have the best numbers at hand.”

Subramanyam added: “TV is under-measured and misunderstood. Our programs are among the most viewed in the world and form the backbone of linear and streaming platforms. We hope this becomes clearer as the measurement ecosystem evolves.”