TL;DR

- Influenced by the popularity of Japanese anime IPs like “One Piece,” the demand for non-English content in the US is continuing to grow.

- Japanese-language shows within the Anime genre have a solid and relatively consistent level of demand in the US.

- Foreign-language children’s programming like France’s “Miraculous: Tales of Ladybug and Cat Noir” has also been in demand.

- Spanish-language news broadcasts register huge audiences among the United States’ large Hispanic community.

READ MORE: United States demand for Non-English content (Parrot Analytics)

Global hits like Money Heist, Squid Game and Hindi thriller Mirzapur have sent demand for non-English language content to record highs in a trend that looks set to continue.

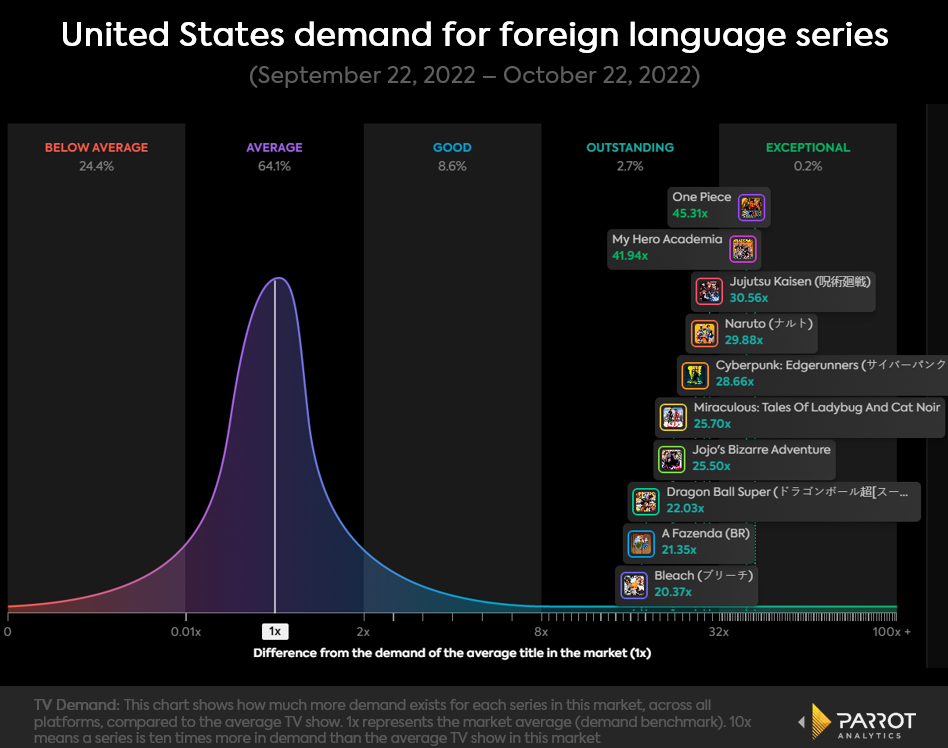

A number of foreign-language shows in the United States have had outstanding levels of demand, with some even reaching a more than 40 times increase than the average show nationally.

Parrot Analytics illustrates the demand by charting the top 10 foreign-language shows in the country.

Leading the pack is Japanese anime One Piece — being remade as a live-action series for Netflix — exhibiting 45.3 times more demand than the average series, and My Hero Academia, with 41.9 times more demand.

“What is overwhelmingly apparent… is that Japanese-language shows within the Anime genre have a solid and relatively consistent level of demand in the US,” Parrot says.

To view a larger version of this graphic, click here.

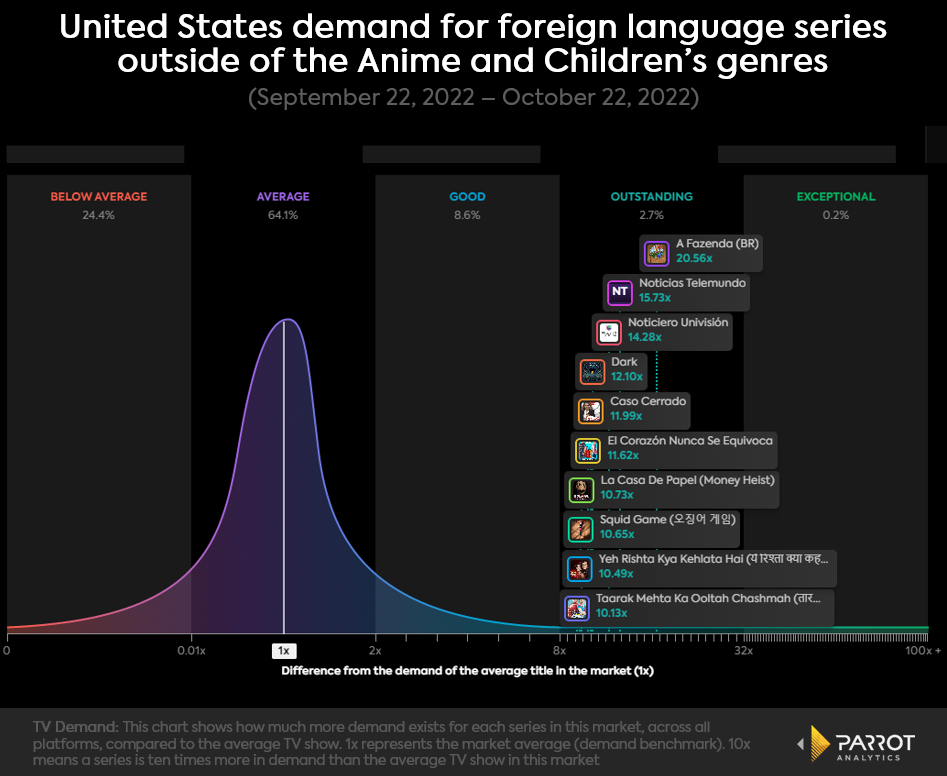

To view a larger version of this graphic, click here.

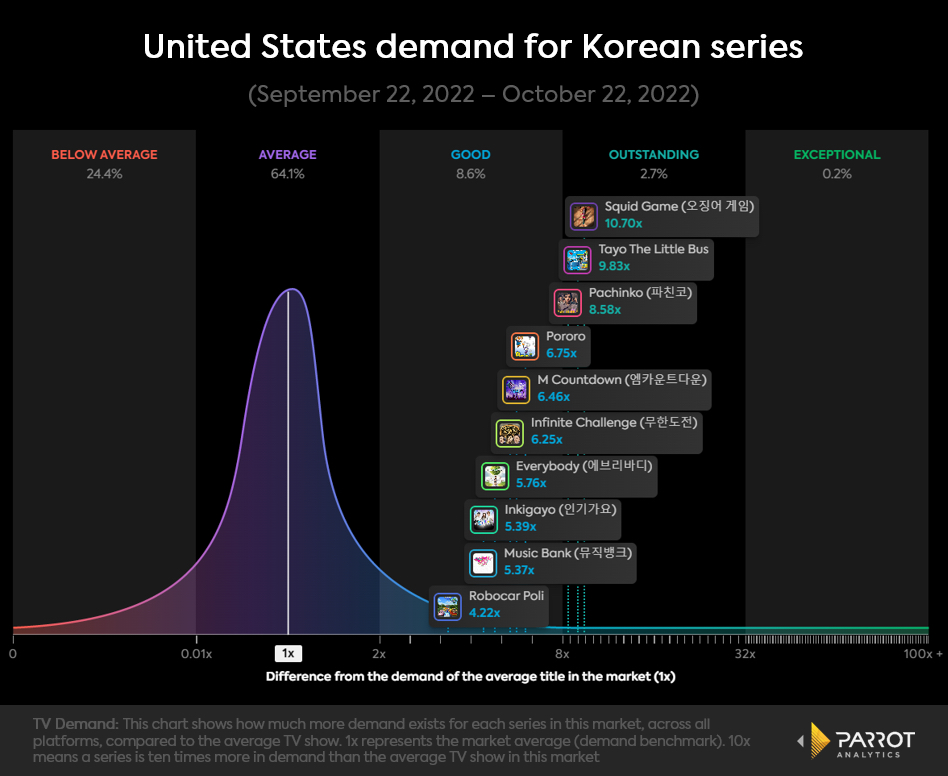

To view a larger version of this graphic, click here.

Children’s non-English language programming is also in demand, albeit to a lesser extent. For example, Miraculous: Tales of Ladybug and Cat Noir, a children’s cartoon that was originally produced in French, has 25.7 times more demand than the average series in the United States.

Away from both the Anime and Children’s genre, Parrot looks at how other genres in non-English language are faring.

Top of this chart is the Brazilian reality TV game show, A Fazenda, with 21.4 times more national demand than the average series. Second on the chart is the Spanish news broadcast Noticias Telemundo with 15.7 times more national demand than the average series.

Perhaps neither are surprising given the country’s large Hispanic community. In addition to this, Veronica Villafañe from Forbes shares that its production network became the most subscribed to broadcasting network on YouTube in 2020 — regardless of language. This could be an indication of viewer’s loyalty to the source of news. Very closely following this show is another news broadcast, Noticiero Univision.

READ MORE: Passing 10 Million Subscribers, Telemundo Becomes Top US Broadcast Network On YouTube, Regardless Of Language (Forbes)

With viewership rising 200% between 2019 and 2021, Korean-language television series, particularly K-Dramas, are clearly becoming mainstream content in the American market.

READ MORE: K-Dramas Expand Further Into Mainstream US Culture With Panel At SXSW (Forbes)

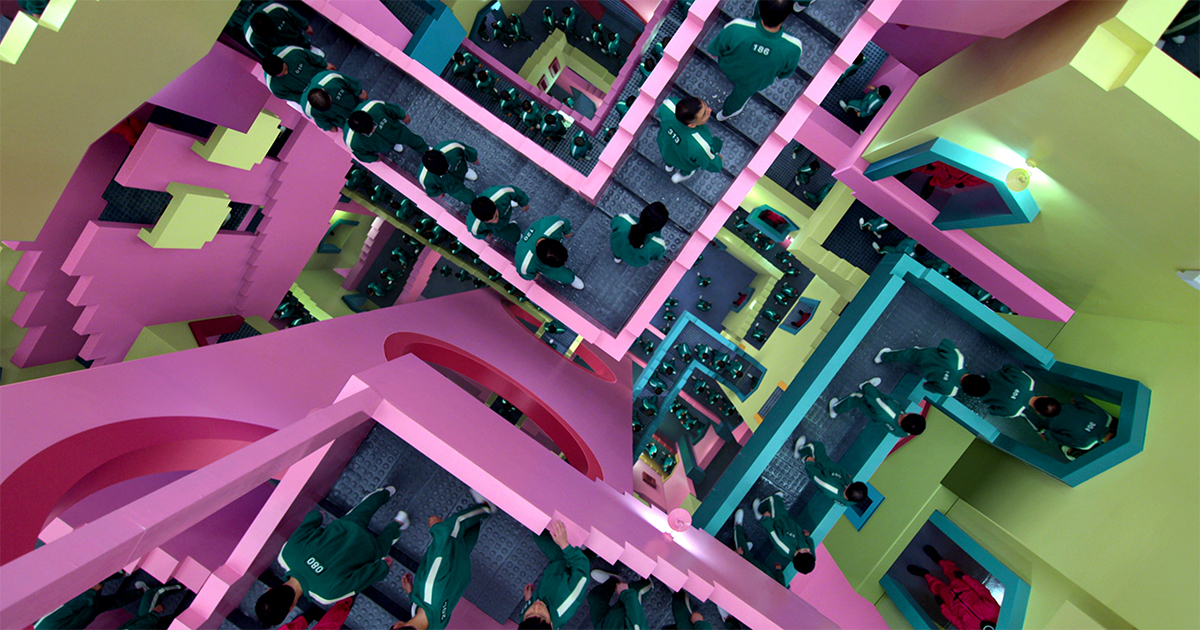

Globally, the survival-themed horror-drama Squid Game became the most in-demand series debut of 2021. Alongside it a number of other Korean shows and films are in-demand, such as the series All of Us Are Dead, which reached the top 10 non-English series on Netflix after just one season, and the 2019 film Parasite, which earned more than $50 million in the US and won six Academy Awards.

READ MORE: Anime and Asian series dominate 4th Annual Global TV Demand Awards, highlighting industry and consumer trends towards international content (Yahoo Finance)

READ MORE: ‘All of Us Are Dead’ Becomes Second Korean Program to Hit #1 at Netflix, Following ‘Squid Game’s Success (Collider)

READ MORE: Box Office: ‘Parasite’ Heads for Huge $50M-Plus in U.S. After Historic Oscar Win (The Hollywood Reporter)

Parrot brings this up to date, looking at how Korean series performed in the US over the last month. At the top of this list remains Squid Game, with 10.7 times more demand in the US demand than the average series worldwide — but all other series ranked by the analyst have less than 10 times more demand than the average series nationally.

Park Chan-wook’s feature Decision to Leave has been critically acclaimed in the run-up to awards season, and Squid Game 2 is in the works at Netflix.

Read It on Amplify: “Decision To Leave:” Park Chan-wook’s Love Story/Detective Story

Read It on Amplify: The (Unavoidable) Universal Appeal of “Squid Game” Is By Design

Perhaps the simple truth is that a well-told story will find an audience anywhere and that language is no barrier to being an international hit — especially now that non-English language programming is widely accessible over streaming services.

A more interesting question outside the scope of this report is to what extent this impacts the sense of cultural hegemony for the US and how exposure to stories from other parts of the world may influence its own behavior on the global stage.

CHARTING THE GLOBAL MARKETPLACE:

Big content spends, tapping emerging markets, and automated versioning: these are just a few of the strategies OTT companies are turning to in the fight for dominance in the global marketplace. Stay on top of the business trends and learn about the challenges streamers face with these hand-curated articles from the NAB Amplify archives:

- “RRR:” Changing the Game for the Global Marketplace

- “1899:” Making a Mystery in Multiple Languages

- “Squid Game” and Calculating the “Value” of Global Content

- Global SVOD Market to Hit $171 Billion in Five Years

- Think Globally: SVOD Success Means More Content, Foreign Content and Automated Versioning