TL;DR

- There is currently a huge push towards ad-based business models among ad-free subscription-based services. Introducing advertising allows companies to maximize revenue while lowering the cost of entry and thus attracting more users.

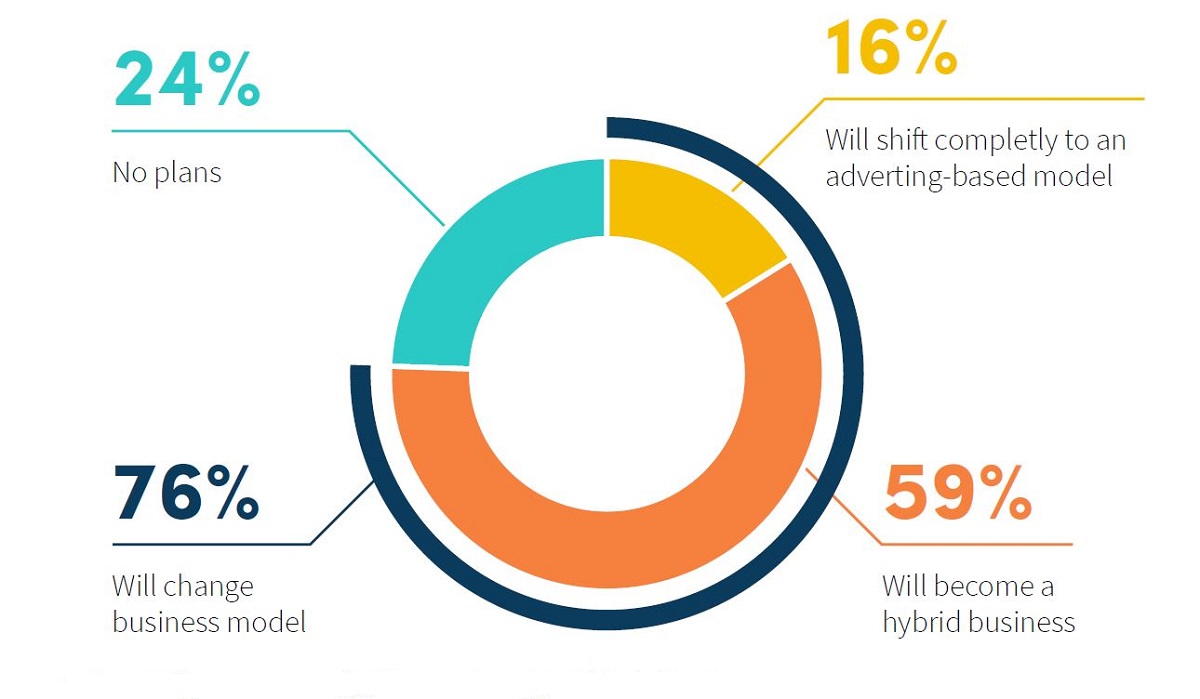

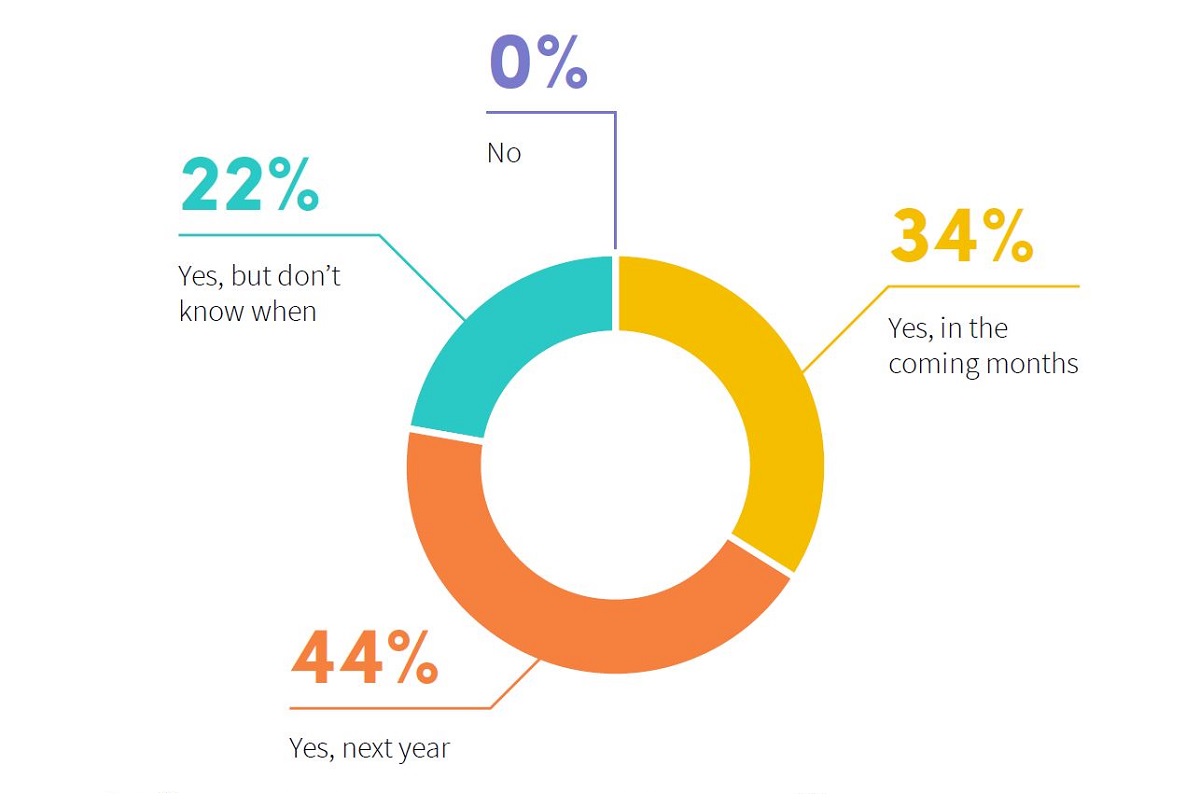

- More than three-quarters of SVOD streamers plan to introduce ads by 2025, with nearly 60% of those planning to implement a hybrid model that combines an ad-supported tier alongside a premium, subscription-based one.

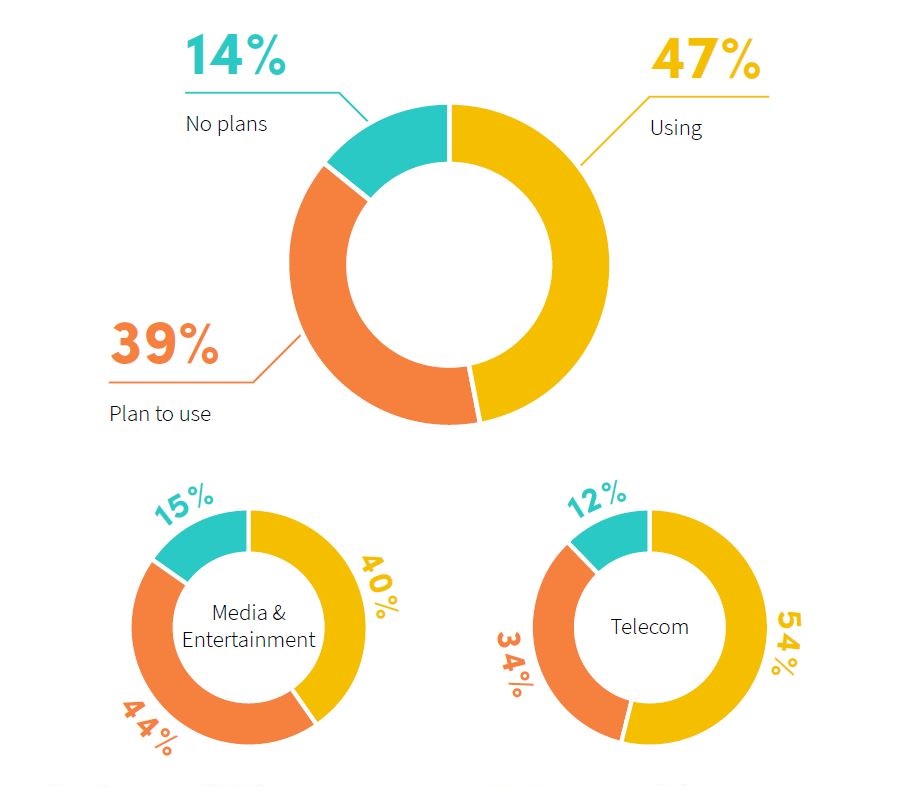

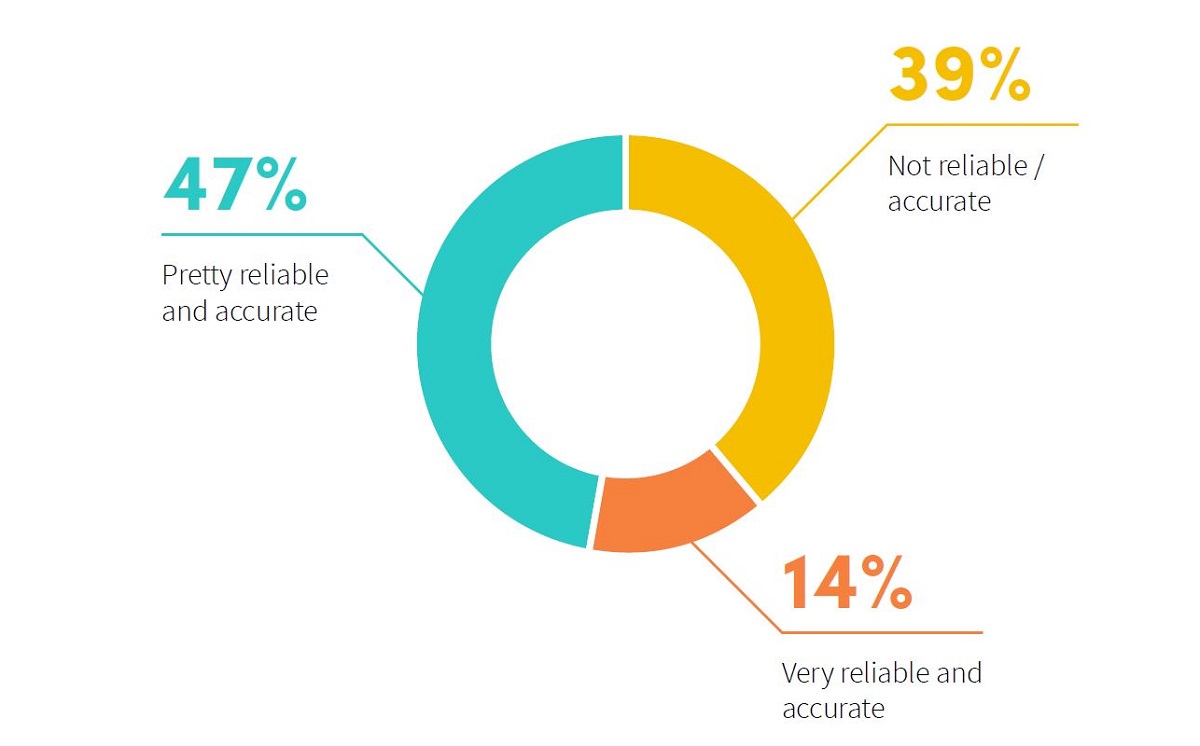

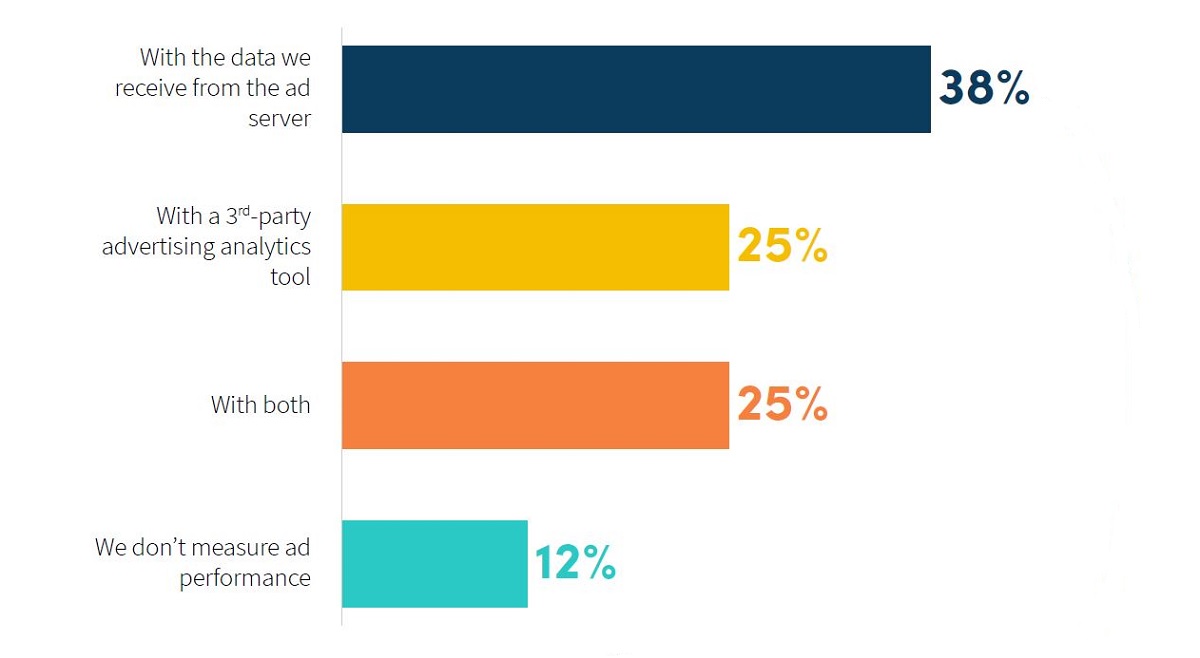

- Adoption of third-party video analytics is well underway. 39% of ad-based services don’t fully trust their ad server data, yet only 25% use third-party ad analytics.

READ MORE: NPAW Survey: 76% of SVoD Services To Introduce Ads in the Next Two Years (NPAW)

More than three-quarters of SVOD streamers plan to introduce ads by 2025, according to a new global B2B industry survey by video intelligence company NPAW. And nearly 60% of those will implement a hybrid model that combines an ad-supported tier alongside a premium, subscription-based one.

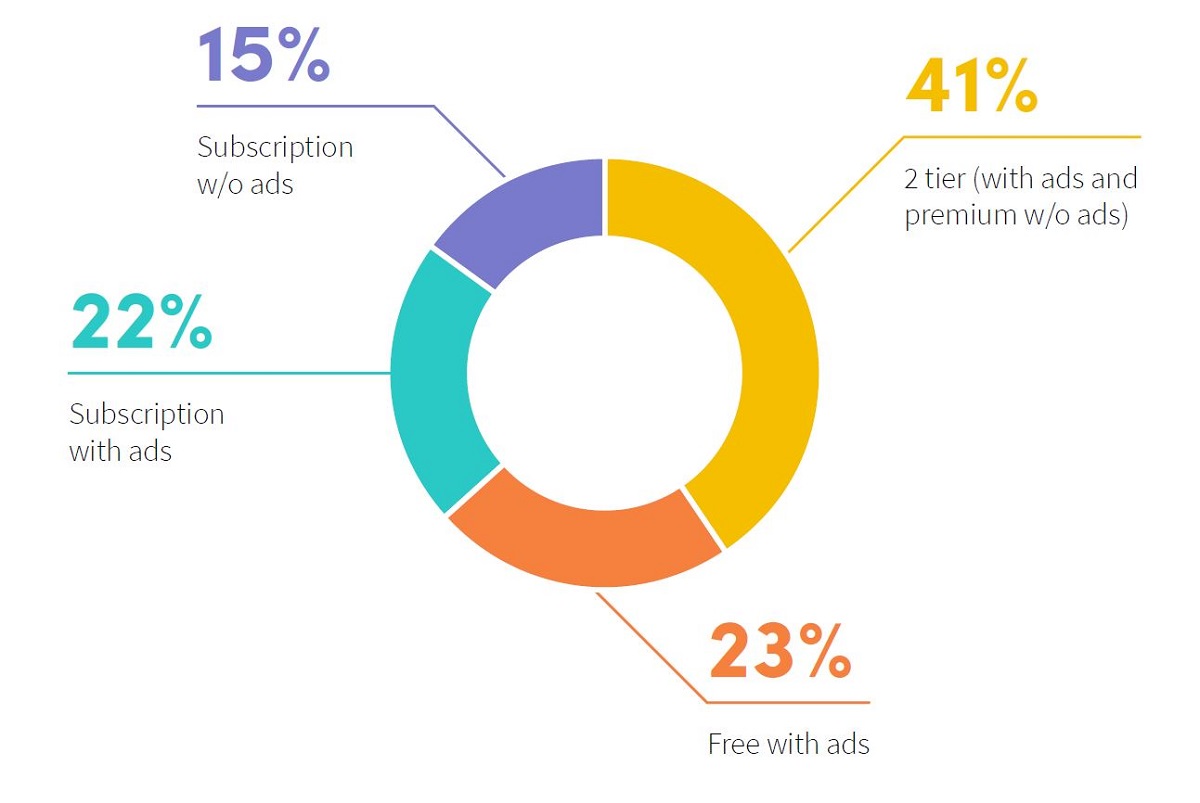

All of the survey respondents agree that the main driver for this shift is to lower the price of subscriptions for their viewers. Of the sample of streaming platforms surveyed for this study, 41% currently have a two-tier business model.

In second place comes free services with ads (23%), also known as the FAST model, and subscription-based with ads (22%). The traditional SVOD model, subscription-based pricing without ads, was the business model with the smallest sample representation (15%).

Overall, 85% of the companies NPAW spoke to are using ads as part of their monetization model.

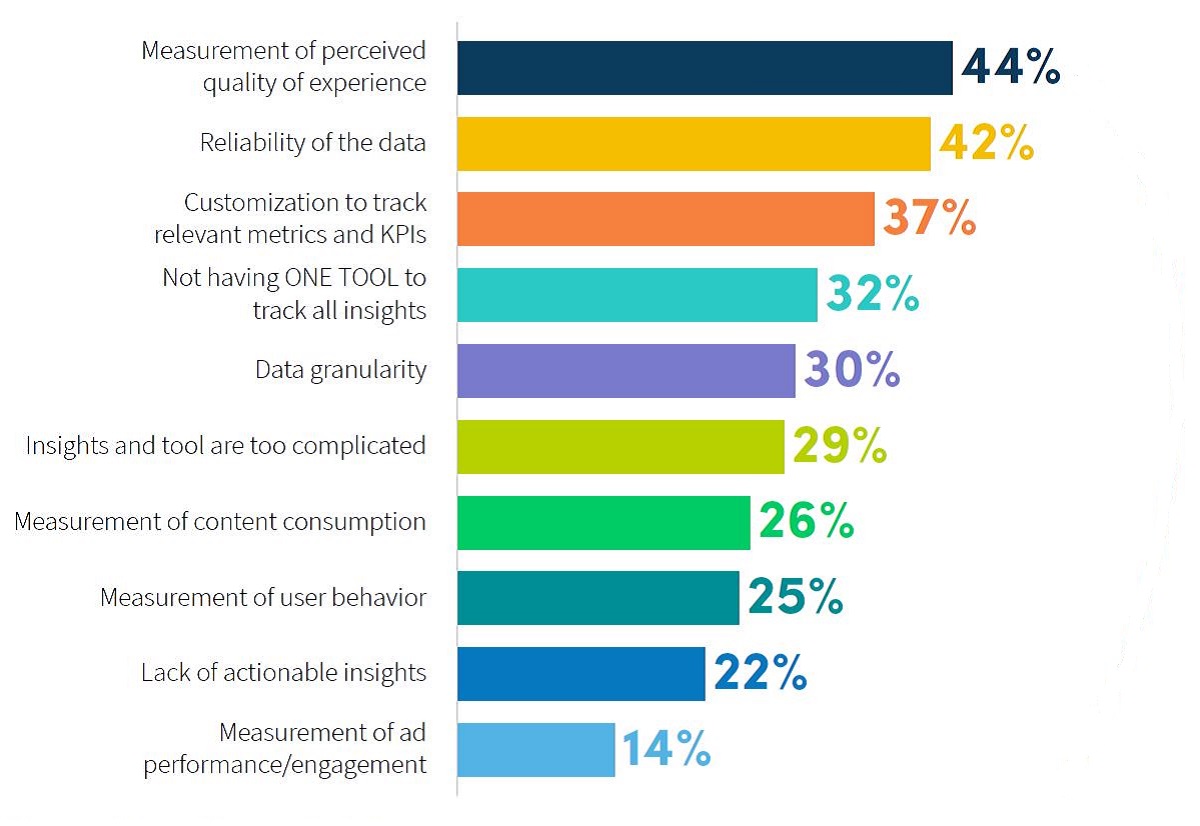

Since NPAW is a provider of video analytics and business intelligence, it spends most of its survey assessing the use case for analytics.

“One of the key advantages of having full visibility into user behavior and experience is that services can identify users at risk of churn early on and address their perceived shortcomings before it’s too late,” the company explained. “This can be done by monitoring drops in usage and Quality-of-Experience issues such as buffering or latency.”

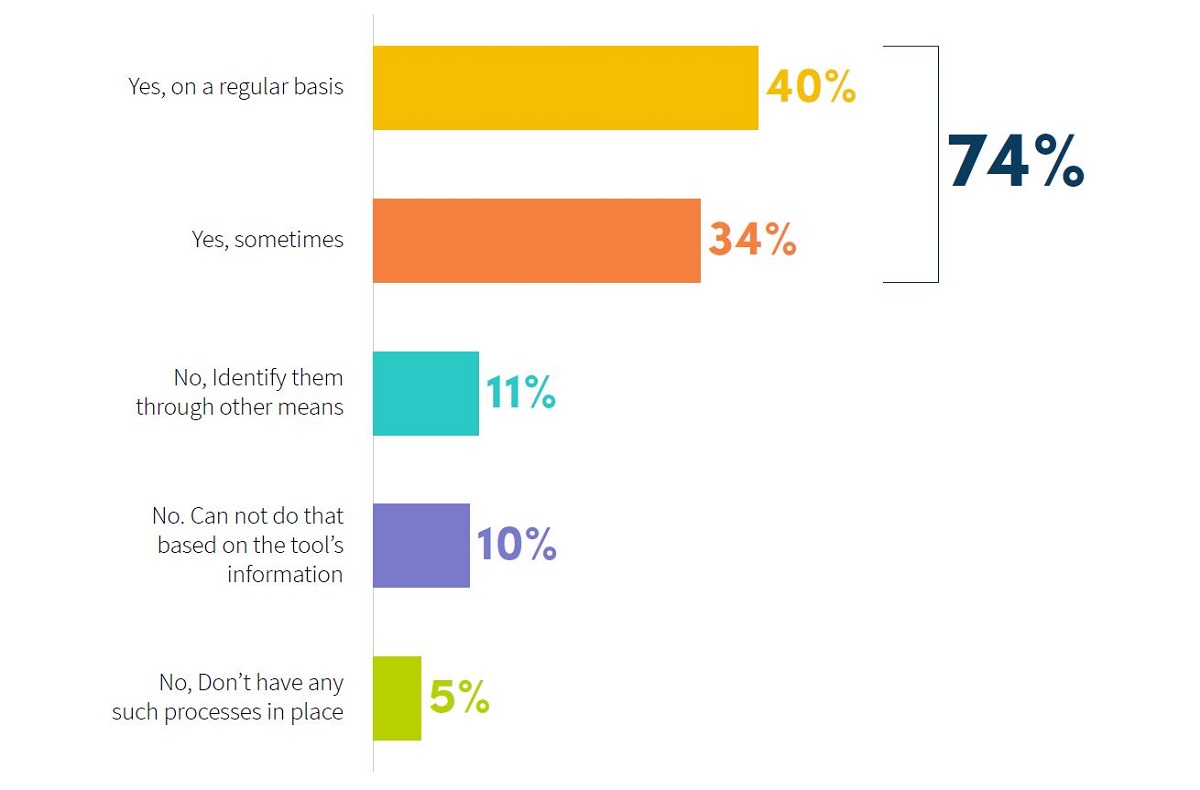

With that in mind, the survey asked respondents using third-party analytics if they used it to pinpoint at-risk users. Seventy-four percent of companies use their third-party analytics tool to identify customers at risk of churn. Eleven percent identify such users through other means, while 10% cannot do so with their tool’s information.

The most popular measurement method is with the data received from the ad server (38%) — despite 39% of companies believing that their ad server numbers are not fully reliable and accurate.

Third-party analytics tools were the most popular among a quarter or respondents, and another quarter favor a combination of these methods.

“It’s encouraging to see that more and more companies are taking a data-driven approach to running their video business, especially as the industry’s shift to ads brings a unique set of measurement challenges,” said NPAW CMO Till Sudworth. “To truly make the most of their advertising-based streaming business, video providers will need an advanced, third-party ad analytics tool — one that can help them track ad performance from an end-user perspective and correlate that information with insights about user behavior and content preferences.”