TL;DR

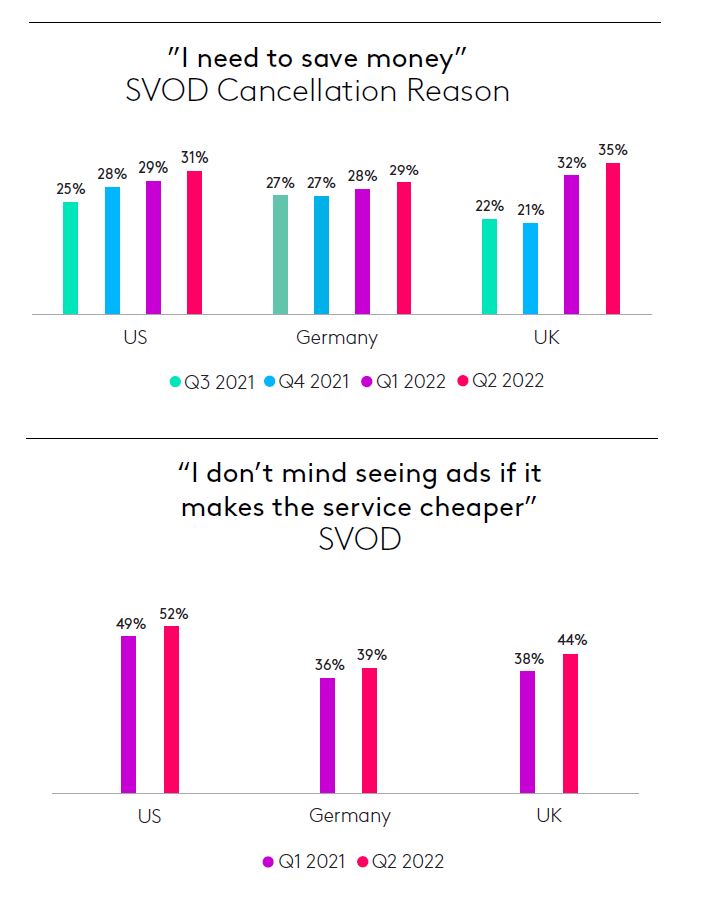

- Kantar’s latest survey on home entertainment trends confirms the economic crisis helping to set the conditions for ad-funded business models. Consumers are increasingly warming to the idea if it saves them money.

- Kantar predicts growing use of “dynamic product placement” and says that smart TVs have reached a tipping point in penetration. In fact, we — and ad agencies — should get used to the term Advanced TV, which embraces addressable, connected TV streaming, and VOD.

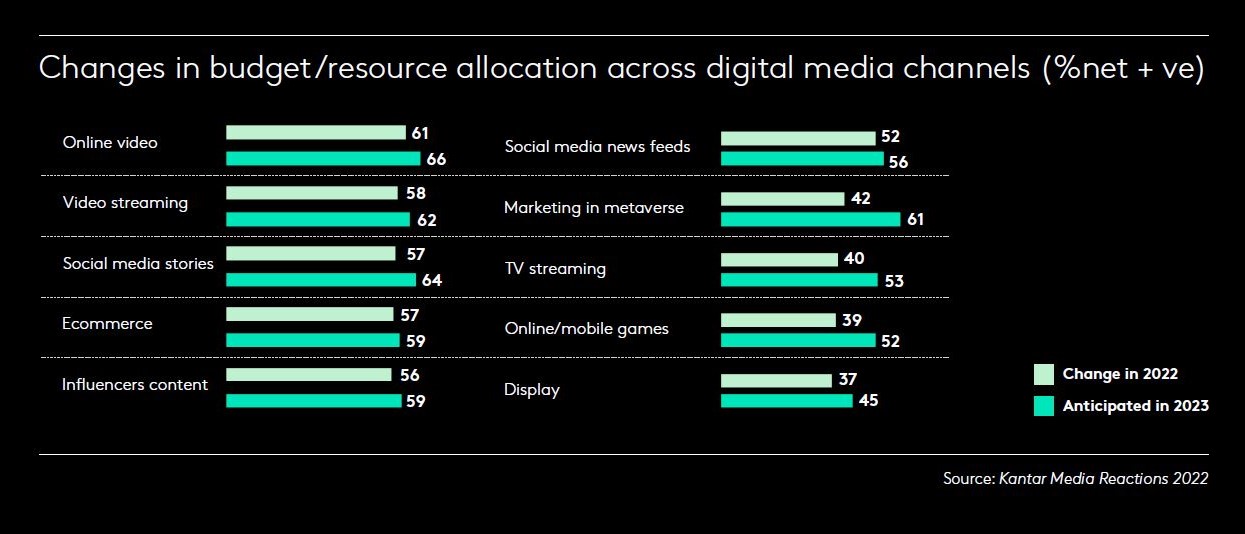

- Video game platforms and the metaverse are emerging media channels likely to see rapid growth in investment in 2023.

READ MORE: Kantar predicts new viewing behaviours, audience targeting strategies and ‘dynamic product placement’ (Kantar)

Although home entertainment is generally robust during economic uncertainty as people cut back on going out, inflation is impacting the video market. According to analyst Kantar in its year-end “Media Trends and Predictions” report, advertisers are advised to adapt spend accordingly.

Kantar data shows that market penetration for AVOD grew from 20% in Q2 2021 to 23% by Q2 of this year. Its latest study witnesses a clear trend for consumers cancelling some SVOD services to save money and a greater acceptance of advertising. The timing is right, says the analyst, to introduce ad-funded tiers to limit price-sensitive churn.

According to Kantar the winners in the platform wars will be those deploying “windowing strategies” that strike a balance between VOD and linear.

Broadcasters are adopting the aspects of VOD strategy that best fit their positioning while preserving their points of difference. Meanwhile, VOD platforms are adopting traditional concepts like appointment TV and curated content discovery via linear channels.

The market will shift away from all-at-once release strategies and box-set binging for new content in order to maximize revenues.

But there’s a caveat. “Ad-models risk creating two types of viewers: those with less disposable income who become over-targeted by ads, and those with more disposable income, yet are harder to reach.”

Although linear TV has been hit hardest by media inflation — WARC’s Global Ad Trends report finding costs jumping 31% — it is not alone.

The World Federation of Advertisers forecasts average inflation of 10% for advanced TV in the US in 2022 — a concept that includes addressable, connected TV streaming and VOD — compared to just 3% in 2020.

Read It on Amplify: Diagramming the Differences: AVOD, SVOD and TVOD

The WFA also reports high inflation for social videos. Paid social CPMs have also risen steeply since the start of the pandemic, up 33% between Q4 2019 and 2021, the report notes, with expectations that it will remain high over the medium term.

There’s even evidence of media agencies restructuring their teams to remove TV and digital silos to operate in a more holistic manner, in tune with the reality of a complex and growing AV ecosystem.

“As advertisers seek better value for their marketing investments against inflated costs, and as audiences splinter across devices and platforms, media agencies will need to adapt,” Kantar advises.

This is likely to mean further investment in digital skills with an emphasis on tech, data, analytical and mathematical experience, and potentially restructuring teams to take the necessary holistic approach to video planning that merges linear broadcast with online video.

“It will also require discarding rivalries between digital and AV teams and an end to siloed channel planning.”

Dynamic Product Placement Edges Closer

Dynamic product placement — enabling a product, billboard or screen featured within content to be substituted or overlaid with a different brand or advert — is growing. Like addressable advertising, with the right data different viewers could be shown tailored ads.

“However, technological possibilities will need to be balanced against what’s acceptable to audiences,” Kantar warns. “A negative impact may be inadvertently achieved if a placement is clearly anachronistic, jarring or out of place. Tailored content should be closely monitored.”

Growth in Smart TV Use

Kantar reckons we’ve now reached the tipping point in smart TV saturation and usage, with consumers increasingly using their TV to stream content directly, connecting via apps and inbuilt IP services.

“Indeed, data from the researcher’s ComTech tracking study shows that across France, Germany, Great Britain, Italy, and Spain 64% of households own a smart TV.”

Smart TVs are not only being used, but they’re increasingly becoming a preferred screen for viewing streamed content. In December 2021, 88% of video streamers used their TV to access content across the US, Germany and UK.

Kantar notes that, “As video delivery moves towards an all-IP future, smart TVs will have a critical role to play as the main entertainment gateway into the home.”

The Metaverse is a Media Channel

Despite the hype, the metaverse has not yet made huge inroads. However, Kantar’s study suggests it will be a high riser for marketing activity in 2023, with more thought being given to creating immersive brand experiences, virtual product testing, and branded NFTs to use within metaverse environments.

Starting from a much lower base in budgeting, the metaverse sources the fourth highest increase in budget changes for marketers.

Ahead of the metaverse in this respect — though clearly linked through platforms like Fortnite and Minecraft — is gaming. With almost 3.2 billion people playing video games in 2022, spending a combined total of $196.8 billion, Kantar highlights a growing opportunity for brands in this space.

Creative agencies are leaning into the biggest and most visually striking games to reach new audiences and add gaming. Kantar advises broadcasters to consider adding platforms like Twitch to the media plan.