TL;DR

- There’s a wave of pragmatism and caution underlying investment in technology across the industry as buyers reign in their equipment spend.

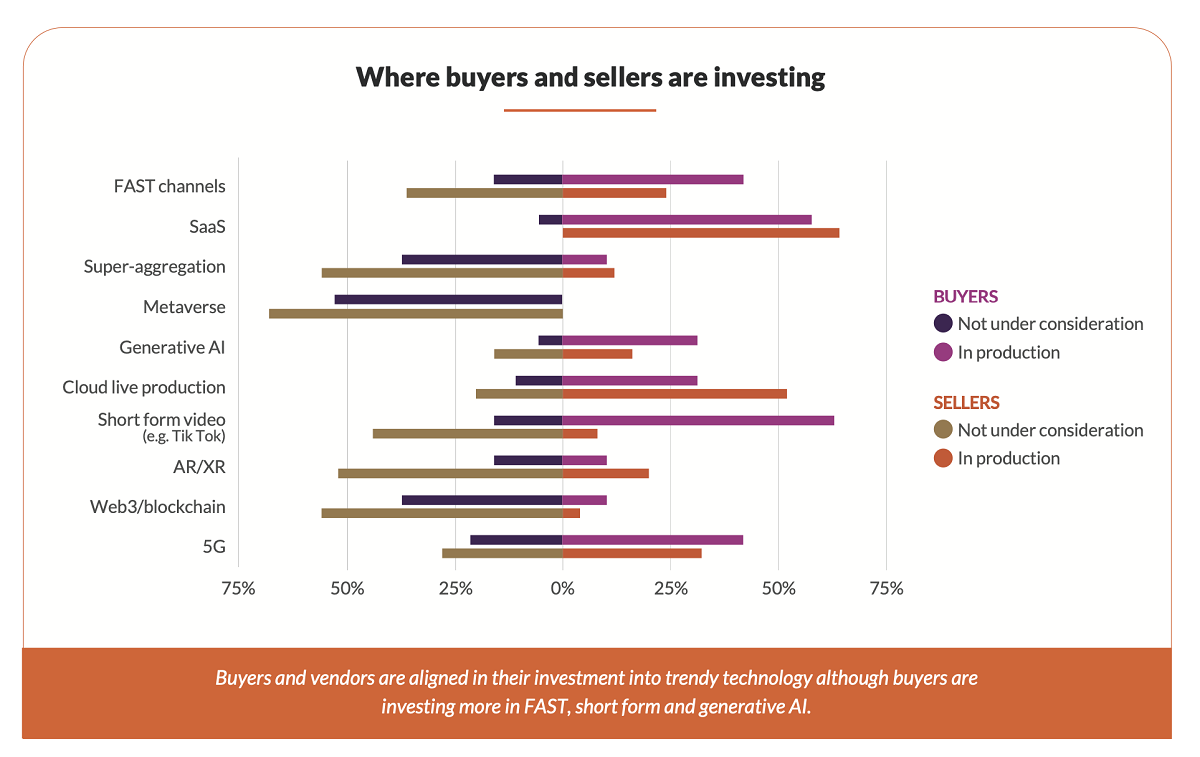

- A report compiled by Caretta Research finds buyers increasingly selective about new developments, focusing instead on creating efficiencies within their technology stack.

- Generative AI is identified as the most transformative technology by buyers, but most are still not yet clear on how they will use it.

- Disappointingly, sustainability is not yet having a significant impact on buying decisions, the report finds, although it is becoming a consideration for certain parts of the supply chain.

- Buyers still maintain the strategic importance of large global trade shows such as NAB Show and IBC for meeting with vendors.

READ MORE: Buying media technology in the age of efficiency (Caretta Research/Bubble Agency)

There’s a wave of pragmatism and caution underlying investment in technology across the industry as buyers reign in their equipment spend.

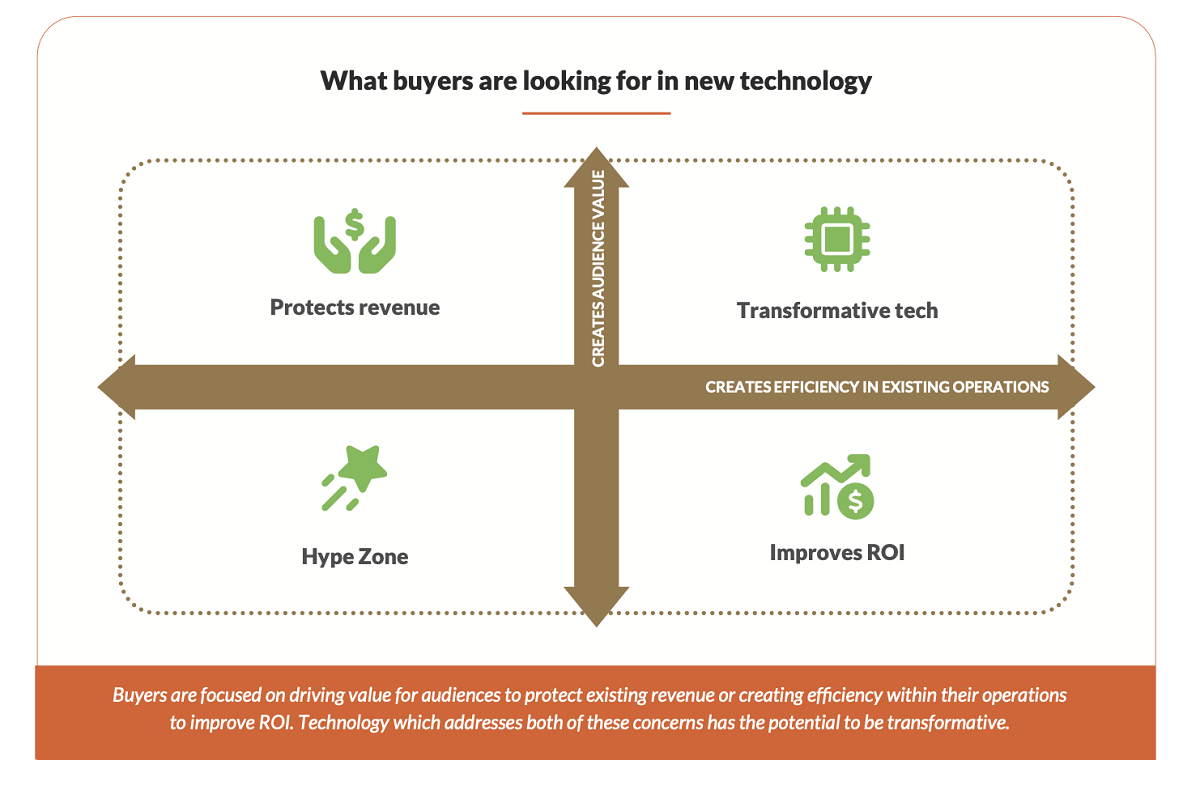

A report examining Media Technology Buying Decisions, compiled by Caretta Research, finds buyers increasingly selective about new developments and more focused on creating efficiencies within their technology stack.

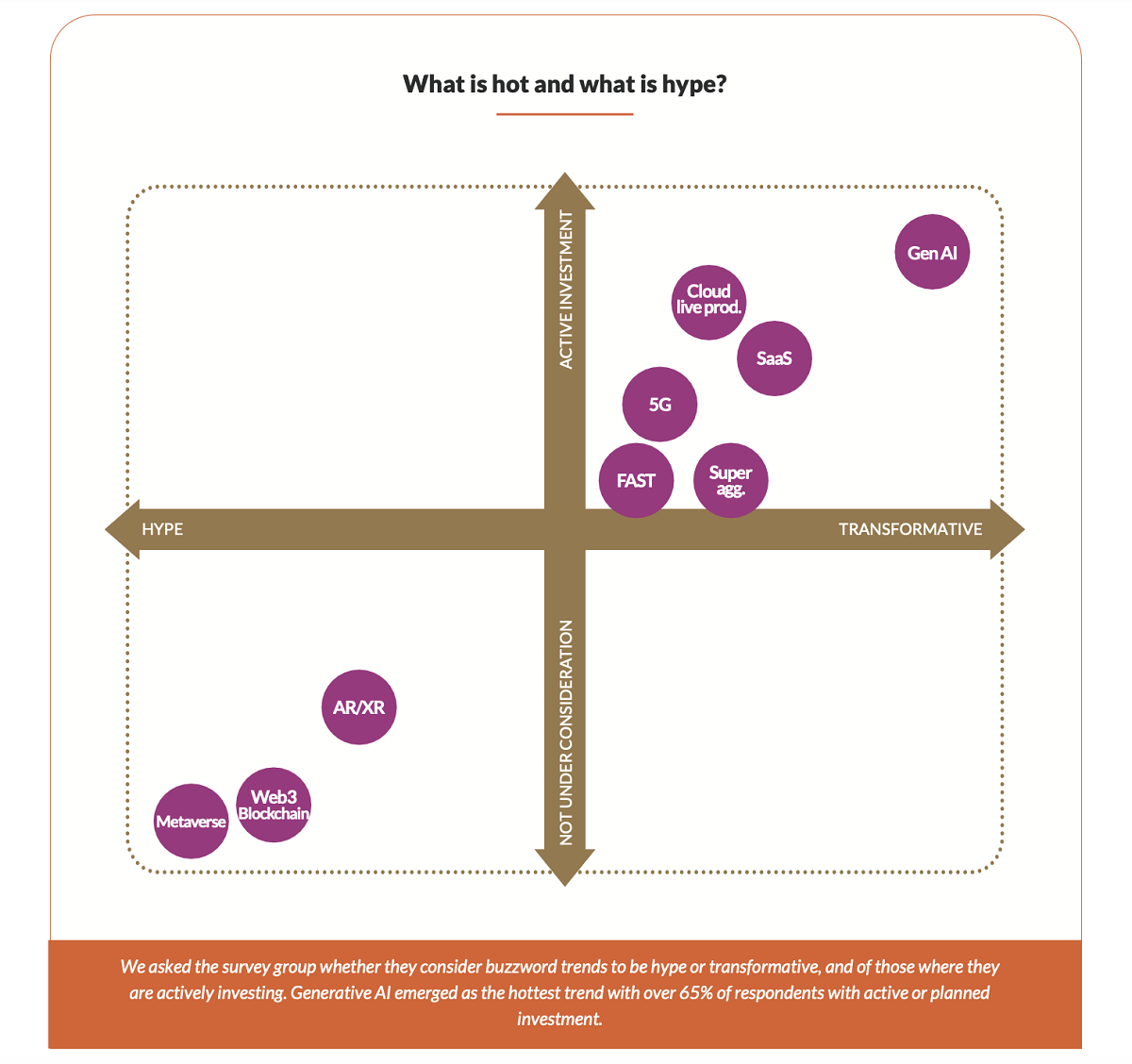

They are not easily swayed by buzzwords and, although open to persuasion, buyers will not consider futuristic technology without a strong business case and product fit.

“Flashy new technology does not sway buyers,” the report states. “Despite the hype that trade press and industry events create around buzzword trends, buyers are not easily convinced.”

This approach rules out technology that is considered futuristic like the metaverse, Web3 applications and even AR/XR.

Buyers perceive such technology to have “a modest impact in the industry broadly,” and most are not currently considering it in their strategies, the report found.

“Buyers talk to other buyers in order to evaluate whether trendy technology is something to look out for. Few are willing to hedge their bets on unproven solutions.”

Nor do buyers want vendors to overly-influence their own technology strategy and roadmap. “There is skepticism of relying too heavily on vendors to deliver large parts of their supply chain and most are moving away from end-to-end services,” says Caretta. Instead, buyers would prefer to implement modular solutions which integrate with their existing stack.

Cloud is another casualty of this pragmatism. Cloud been an enduring trend since before the pandemic and many consider it to be standard technology in a modern stack. But the report confirmed other recent surveys, including from the IABM, that there is pushback against the idea that everything can and should be run from the cloud.

There are concerns over the cost of cloud, particularly where parts of the supply chain have not been optimized for deployment, the report finds.

Other concerns lie in the readiness of cloud solutions, that certain parts of the supply chain simply work better on-premise. This is particularly true of concerns relating to latency in live playout.

Some buyers still have security concerns about the cloud, “which means that their stack will remain on-prem for the time to come,” the report predicts.

“Vendors will have to prove that cloud native solutions are capable and reliable, if not better than on-premise deployments to sway buyers who may have these and other concerns.”

Buyers are looking for hybrid solutions. Generally, if it makes sense to do something in the cloud versus on-premise, then that is the approach buyers will take.

The Economy of SaaS

Here, SaaS-based platforms are considered to be a “transformative trend” allowing buyers to have flexibility in their architecture, but also ongoing support and incremental improvements to service.

There is a concern, however, over the lack of support given by some vendors to their customers. “Like with traditional licensing models, a one-off sales approach is no longer sufficient. Buyers have an expectation that support will be continuous and that products will continue to roll out new features over time.”

There is also a perception that the industry has stopped innovating. Particularly with the shift towards SaaS, buyers are able to change suppliers more easily than ever before. Per the report, this means that there’s a lower tolerance for lack of innovation on the buyer side, and less certainty around buying cycles on the vendor side.

“This is a dangerous place for industry vendors to be,” judges Caretta.

Broadly speaking, difficult economic conditions have impacted both buyers and vendors leaving most prioritizing existing revenue and streamlining their operations to do more with less.

Per the survey, 75% of vendors and buyers are seeing the need to tighten belts and 30% have had a hiring freeze, which compounds the widespread feeling of being under-resourced.

Caretta’s conclusion: “Buyers are seeking efficiency when deploying new technology in their stacks and are taking a pragmatic approach to new services, only investing in those which deliver value to audiences.”

Generative AI Interest

Generative AI is identified as the most transformative technology by both the survey and buyer focus group, but most are still not yet clear on how they will use it.

There are some early use cases in news editing and metadata for example, however the true potential of generative AI is still under consideration.

“There is a healthy amount of skepticism towards GenAI, but most see it as an opportunity despite reservations,” Caretta concludes.

Disappointingly it seems that sustainability is not yet having a significant impact on buying decisions, the report finds, although it is becoming a consideration for parts of the supply chain where vendor products and services are similar in terms of feature and price.

Trade Show Value

Of particular interest to trade show organizations like IBC and NAB is that in-person meetings are still considered valuable, with the trade show itself among the very best places to do business.

“Buyers consider industry events as one of their most important sources of information, and vendors consider it their most important channel for promoting their products to buyers.”

Yet half of buyers and vendors in the survey group have scaled back on investment in events since the pandemic and only 5% of vendors have increased their investment.

“Manufacturers may be left with a conundrum of how to get in front of new customers if investment in events by buyers continues to decline. Fewer buyer attendees will make it harder to get sales people in front of prospective customers.”