TL;DR

- Network slicing is a capability of the 5G standard which is being tested and gradually rolled out. It enables operators to carve up their 5G network into slices that can be finely tuned to suit the needs of many customers.

- 5G Network slicing revenues will grow over 100 times by 2029 to reach more than $16 billion in revenue that that would otherwise not be generated.

- Telstra, Ericsson and Qualcomm achieve new download speed benchmark of 7.3Gbps.

READ MORE: 5G Network Slicing Operator Survey (Heavy Reading)

There are signs that operators will commercialize 5G network slicing over the next two years, finds the new 2022 “5G Network Slicing Operator Survey” from consultancy Heavy Reading. The emphasis initially will be on enterprise services, but broadcasters are also eager to use the technology to improve coverage of live events.

Network slicing is a mechanism to isolate a segment of the 5G network end to end in a local area for the specific requirements of a customer.

Rethink Technology Research predicts that network slicing will add revenues of $16.1 billion by 2029 over above what 5G infrastructures would have earned otherwise.

Its report further identified manufacturing as likely to generate the biggest slice of network slicing revenues by 2029 at 19% of the total, with energy/utilities and healthcare joint second on 15% each and M&E media/entertainment on 7%.

Yet “the surge” in revenues will not really begin until 2024 when there is substantial base of 5G Standalone infrastructure to build on.

Standalone (SA) represents the full 5G infrastructure including RAN (Radio Access Network) and Core, which is essential to unleash the full capability of network slices to enable differentiated services catering for multiple user groups and applications sharing the same physical network,” explains Rethink.

Broadcasters are keen to use 5G slicing to augment coverage and reduce the costs of outside broadcasts such as sports matches, mass public celebrations or news gathering. By their nature these are congested areas in which wireless bandwidth is in short supply and for which the only option until now has been expensive uplink by satellite.

READ MORE: Network Slicing revenues to grow over 100 times by 2029 (Rethink Technology Research)

Tests over the past couple of years among broadcasters and telco operators appear to confirm that the technology is on the verge of being viable for practical use.

Ericsson and Telstra Broadcast Services (TBS), for example, trialed 5G SA Slicing for Australian broadcaster Network Ten around live coverage of a major horse racing meet in Melbourne.

TBS regional chief Karen Clark said the tests clearly demonstrated the effectiveness of 5G slicing for uplink of live, premium video feeds “to produce high bandwidth, low latency television from a congested venue, without the need for traditional wired infrastructure.”

Paramount (Australia and New Zealand) also partnered on the project. Its VP of technology, Dean Wadsworth, claimed the success of the trial “demonstrates that coverage of live events can be enriched with reliable links from roving crews, which can be more cost-effective.”

All parties point to exploring further opportunities in the near future.

READ MORE: Telstra Broadcast Services Successfully Trials Live Broadcast Contribution Over 5G (TV Technology)

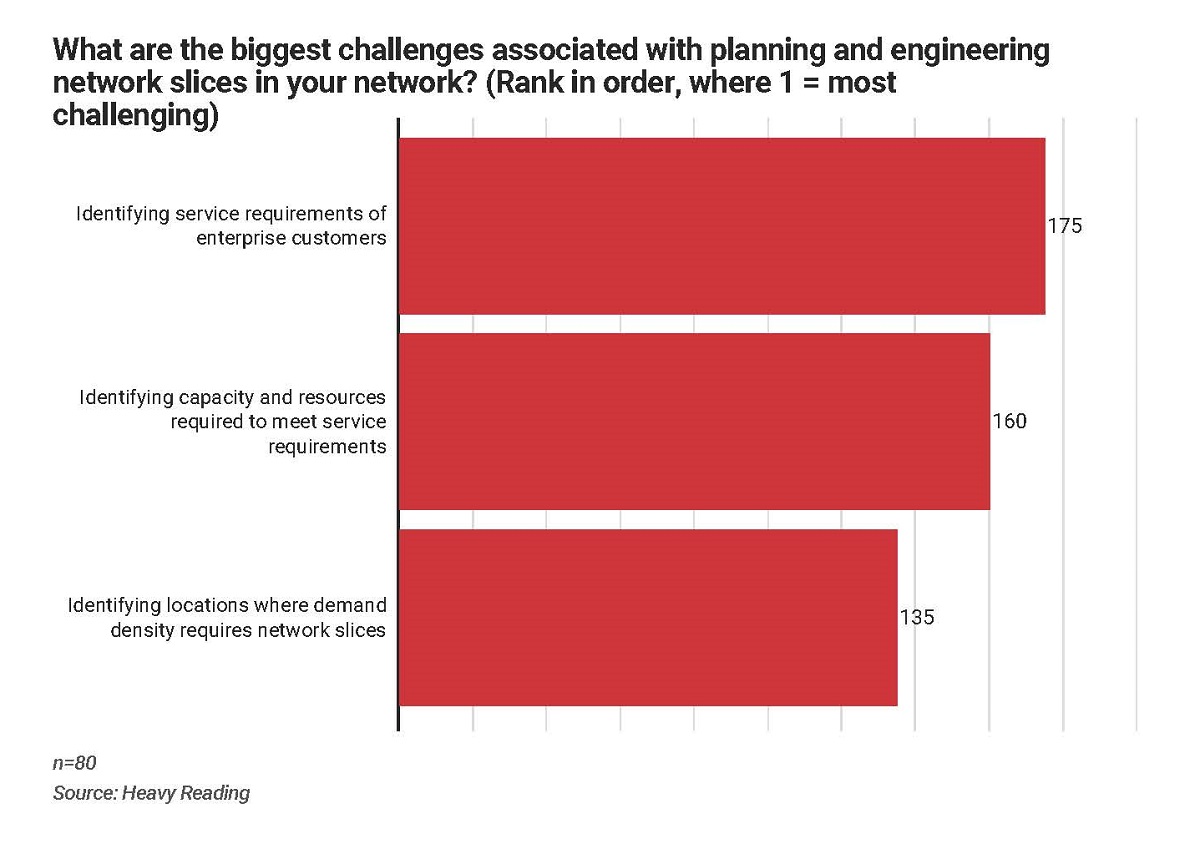

Yet such event-based scenarios are deemed the lowest priority among telcos, as reflected in a Heavy Reading survey conducted last summer. Principal analyst Gabriel Brown suggests this may reflect the challenges with addressing demand that is short term/transient in nature with a relatively immature technology stack.

“Short term, network slice instances will have greater requirements on automation. Perhaps as slice management technology matures, this use case will rise higher on operator priority lists.”

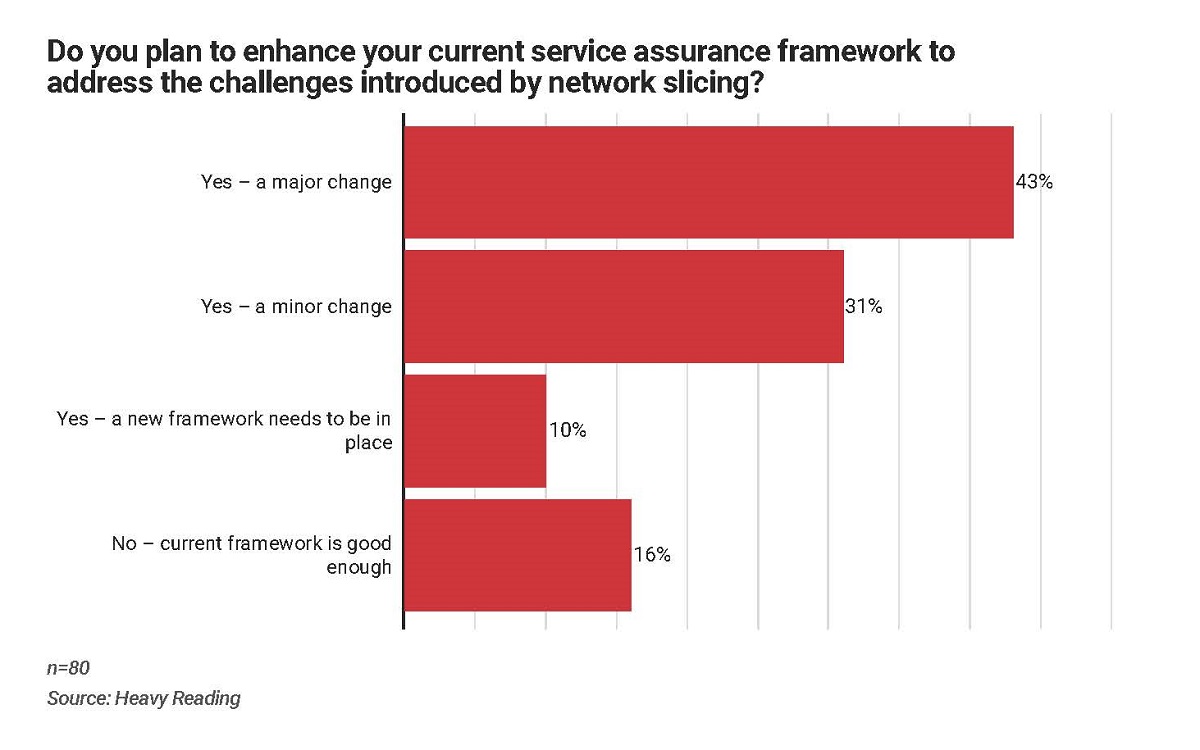

A survey of staffers at telcos (or communications service providers) by Heavy Reading earlier this year found that the industry had a job to do to educate potential customers about the benefits of the tech.

Less than a third of respondents said “most customers understand the concept and see value in it,” which implies that two-thirds did not.

“Operators, and their vendor partners, will need to invest in customer education to demonstrate the value of network slicing,” advised Brown.

READ MORE: 5G Network Slicing Operator Survey: Results and Analysis (Light Reading)

As an aside, Telstra and Ericsson partnering with Qualcomm Technologies just recorded a new 5G download peak speed benchmark of 7.3Gbps achieved at a Telstra live mobile site located at the Gold Coast, Queensland Australia.

This improved peak speed capability further will help Telstra to deliver network slicing. By adding improved peak speeds and capacity, Telstra says it can deliver more capable network slices to more customers.

READ MORE: Telstra, Ericsson and Qualcomm achieve new download speed benchmark (Ericsson)

Network slicing could potentially be used to reduce, control and uplift the video performance of major streaming services like Netflix and Google.

As Heavy Reading’s Brown explains, most of the traffic on broadband networks is generated by customer demand for services from OTT. Approximately 56% of global network traffic is generated by six companies, according to Sandvine.

“In mobile networks, it is logical to consider how network slicing may be able to improve the performance, efficiency, and user experience of the most in-demand services or enable new service experiences offered by these types of providers (e.g., virtual reality gaming, metaverse meetings, or similar).

“This is, however, a thorny topic, given issues related to net neutrality and because, in some markets, some telecoms are actively lobbying regulators to levy charges on OTT internet companies to carry traffic.”

Asked if they anticipate working with internet companies “to use network slices to deliver and monetize high volume OTT services,” Heavy Reading’s survey revealed that 40% of respondents say their company plans to do this, ahead of a more equivocal 31% that may do so, depending on the business case.

“Presumably, the thinking is that network slicing will provide a capability that improves the service, and the operator can somehow charge the OTT provider for this or monetize the customer via a revenue share,” surmises Brown. “In this analysis, it is tempting to ascribe this 40% result to wishful thinking by telecom respondents.

“An alternative analysis, therefore, is to be aware that what is normal in terms of telco and OTT working relationships today will not necessarily stay that way.”

As application performance requirements become more stringent, and as customer expectations increase and new services emerge, there will be a need to rethink and re-architect how telcos and internet companies interact. In mobile networks, 5G network slicing will potentially allow a closer working relationship that benefits customers.

Discussion

Responses (1)