The opportunity to realize an OTT market without borders, truly global in scope, is a tantalizingly attainable goal, but licensing limitations, differences in device preferences, and delivery hurdles need to be overcome in order to make global OTT a reality.

Strategists at OTT streamers tasked with this job spoke to StreamingMedia about the challenge of making their service available in other parts of the globe.

Rebekah Mueller, Disney Streaming’s senior director of product describes these considerations as “architectural decisions” that are fundamental to building a successful international launch.

CHARTING THE GLOBAL MARKETPLACE:

Big content spends, tapping emerging markets, and automated versioning: these are just a few of the strategies OTT companies are turning to in the fight for dominance in the global marketplace. Stay on top of the business trends and learn about the challenges streamers face with these hand-curated articles from the NAB Amplify archives:

- How To Secure the Next Billion+ Subscribers

- Think Globally: SVOD Success Means More Content, Foreign Content and Automated Versioning

- Building a Better SVOD Platform

- Governments Draw Battlelines To Curb the US Domination of SVOD

- Streaming Content: I Do Not Think You Know What That Word Means

“What I mostly tell folks when they are thinking about taking a domestic product — whatever country that product may originate from — and trying to take it outside of that country is that they need to support things that are hidden within products that you already use,” Mueller says. “How people use payments, for example — there are different legal requirements for payments or content or content ratings. There are different devices that people use and different penetration of devices for streaming in different countries, different language support.”

One noteworthy linguistic example Mueller pointed out is Disney+’s expansion to Japan. “Japanese is a meaning-based language. That means core, fundamental changes to how search works or how the language displays. But most people don’t realize these things because you experienced the products that you have.”

Localization Approaches

Beyond making content available in different languages, there are many strategic approaches, legal requirements, issues around device support, and more that OTT services need to consider when preparing to launch in new international markets.

“Ad localization is actually quite a minefield. It starts getting tricky because with each territory, based on the audience, the advertising requirements are different. When you plug into ad exchanges, that’s kind of straightforward, but when you want to do localized advertising on the content partner channels, that gets a bit tricky.”

— Rajesh Nair, DistroTV

According to Emily Powers, EVP and head of the BBC- and ITV-backed SVOD company BritBox North America, a key part of any international expansion is determining which elements of that expansion should be managed centrally and which aspects require localization. “You need localized languages. You need your editorial team to be able to merchandise differently in different territories. You may have different types of plans available, whether they’re monthly or annual or different promotions,” she notes.

But Powers says it’s also critical for OTT services to leverage core strengths and maintain a degree of unity and brand identity across the product as it establishes itself in disparate markets.

“You want to be able to produce a single app with one set of underlying code that can be populated in any territory that you’re launching in. You might have additional layers or different integrations. But you don’t want to be creating 10 different apps that all live on Apple TV or all live on a Samsung, just in different territories. So, it’s very much about trying to figure out what can be done centrally and then what elements need that localization.”

Another challenges for globalizing OTT services is localizing advertising in different markets. “Ad localization is actually quite a minefield,” says Rajesh Nair, VP of business development and content acquisition at free streaming service DistroTV. “It starts getting tricky because with each territory, based on the audience, the advertising requirements are different. When you plug into ad exchanges, that’s kind of straightforward, but when you want to do localized advertising on the content partner channels, that gets a bit tricky.”

The need to deliver culturally relevant and resonant content is arguably heightened when it’s being marketed in specific countries.

Pixar has localized versions of much of its content. In Zootopia, for example the newscaster is a koala in Australia, but it’s a moose in Canada, and a panda in China, because those animals make sense in those countries. That form of content localization is much easier to do with an animated asset, though.

“If I’m based in London and I’m producing an English documentary, I have to think, ‘When this is hosted in the U.S., or if it’s hosted in Canada, or if it’s hosted in Africa, how will that audience react to it?’” says Nair. “Even though I’m producing content locally for the local markets, I have to think of those territories reacting, because, ultimately, the monetization comes from the audience engagement in those markets. It’s kind of a hit-and-miss thing, but still it needs to be planned.”

Mobile First

Given how much OTT content is watched on mobile devices, knowing which devices are used to consume OTT content in new territories and understanding the bandwidth constraints under which those devices are being used are other critical factors in ensuring a smooth launch in a new country.

“Everything is going to mobile in some of the up-and-coming markets so you have to pay attention to bitrates, and you have to provide different formats to handle all of these types of nuances from a delivery standpoint,” says Carlos Morell, VP of sales for edge cloud service provider Zenlayer.

Morell explains how Zenlayer handles it: “For us, having some local infrastructure and being connected locally to every ISP is the main thing, because through the ISPs and having a great backhaul, you’re focused on the first mile, which most people handle with their origin; the middle mile, which is that long haul; and the last mile, which is really from the ISP all the way down to the end user. You have to really make sure that your service is able to address all of those.”

Rights and Licensing

Another inescapable factor in expanding OTT services on a global scale is navigating rights and licensing issues in each new territory. Global rights restrictions may inhibit an OTT service’s ability to distribute identical content everywhere.

“When I sign up a content creator, the initial discussion is quick,” says Nair. “Everyone is excited, and then legal comes in. And then the to and fro begins, with discussions going on for each clause, how to position the licensing rights. It’s a bit tricky because content creators are looking to monetize their content, and the traditional models are changing drastically. A few years back, it was very straightforward: the theatrical release, then the DVD release, then in-flight entertainment. With the pandemic, everything has changed in this landscape. Theatrical rights have just gone out. It’s not even discussed. What’s important now is the territories, and within the territories, what are the rights that are being given to us? For us, it’s the AVOD rights, because we are advertiser-driven, and that itself is a long discussion because generally, content creators like the subscriber model, and we are not in that space.”

READ MORE: OTT Beyond Borders: Reaching Global Audiences (StreamingMedia)

ALSO ON NAB AMPLIFY

What’s Driving the OTT Push?

Recent deals have highlighted the importance of sports programming to propel OTT subscription growth, and studies from Ampere Analysis predict that this will continue apace through 2027.

According to RapidTVNews, “Although sports rights remain a local market, with some downward pressure on top-tier rights, as competitions become more visible overseas, there are more chances for international commercial growth, especially for European football leagues.”

READ MORE: International expansion, local content, sports rights key for OTT (Rapid TV News)

You Know How. How About Where?

The Indian subcontinent and Southeast Asia are primed for OTT takeovers.

According to reporting in the Business Standard, “The Indian OTT streaming industry is expected to grow to USD 13-15 billion over the next decade at a CAGR of 22-25%, according to a joint report on media and entertainment.”

In India alone, CII and Boston Consulting Group estimate that there are more than 40 OTT providers vying for eyeballs and subscriptions.

Timing and technology are key, as high-speed mobile internet has become both more affordable and accessible, resulting in a twice as many Indian internet users in 2022 as there were in 2016.

Digital payment technologies have also begun to enter the mainstream, enabling more of those interested in OTT to actually pay for those subscription services.

And on the subject of money, it’s worth noting that successful localization strategies apply to cost as well as content. In India, Netflix, Prime Video and Disney+ subscriptions cost 70-90% less than their U.S. equivalents, reflecting the different economics and a desire to offer an affordable entry point for new viewers.

READ MORE: Indian OTT Industry to Grow $13-15 Bn in Next 10 Years: Report (Business Standard)

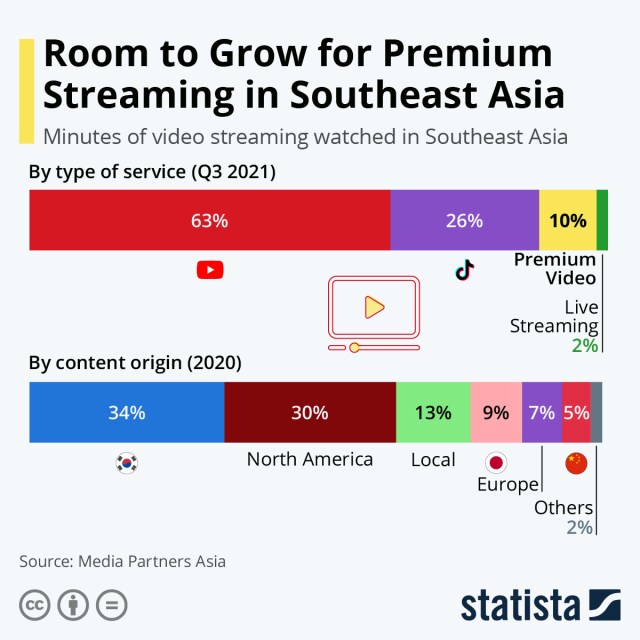

Statista’s Katharina Buchholz notes that “free or freemium models like YouTube and TikTok reign supreme when it comes to video viewing” in Southeast Asia. “As data from Media Partners Asia shows, only ten percent of the time spent watching video in Southeast Asia was on premium platforms in Q3 of 2021.”

Not surprisingly, localization presents one of the greatest challenges in this diverse and populous region. North American or European streaming services cannot just rely on existing content to be a sufficient draw.

Buchholz writes, “Just over a third of the content watched in Southeast Asia was North American or European, while the rest was split between videos out of different local markets. Korean was the most popular, followed by content out of the viewers home country, Japanese content and Chinese content.”

In light of that, for example, Disney+, whose 2021 expansions included Hong Kong, Malaysia, Singapore, South Korea, Taiwan and Thailand, has licensed Korean and Japanese content in an effort to boost engagement.

Of course, streamers that double-down on a local content strategy are likely to experience benefits in other markets as well. The recent success of Netflix’s Squid Game and notable Oscar wins (2021’s Minari and 2019’s Parasite) and nominations have proven the appeal of K content far outside the region.

READ MORE: Room to Grow for Premium Streaming in Southeast Asia (Statista)

Emily M. Reigart contributed to this article.