TL;DR

- Consistent measurement practices are more important in the age of “build your own bundle” TV.

- Nielsen’s Paul LeFort shared insights into how his company handles audience measurement in this increasingly fragmented era, when it’s common for viewers to watch OTA, streamed and pay TV content in one week (or even one sitting).

- You can learn more from Nielsen at this year’s NAB Show. They will be exhibiting in the Encore Salon.

“Audience measurement has long been at the heart of the media business,” says NAB EVP/CTO Sam Matheny.

That continues to be true in the age of what Matheny calls “BYOB TV,” referring to those who have “stitched together” a modern version of a cable bundle, often combining a variety of streaming and over-the-air offerings.

Matheny discussed the importance of consistent measurement practices in a fragmented market with Paul LeFort, managing director for Nielsen’s local TV business during the latest installment of NAB Amplify’s “Hey Sam!” interview series. Watch the full conversation (above) or read on to learn more about LeFort’s perspective on viewing has — and hasn’t — changed.

Understanding Video Consumption in 2024

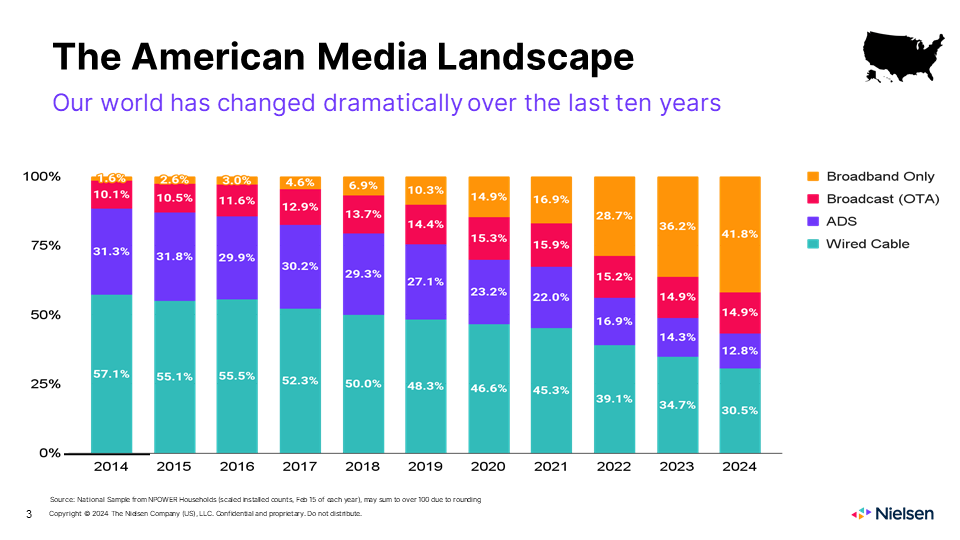

First of all, LeFort points out, “The piece that really stands out is the consistency of over-the-air television. Ten years ago, [it] was about 12% of all households in the US. Now, it’s about 15% of the households in the US receive over-the-air television. So while there’s this tremendous churn in the streaming landscape, in the pay TV landscape, the resilience of over-the-air television remains consistent.”

He concludes, “And clearly, that is a main connection point between viewers and their communities. The local news that broadcasters provide, [they] do a stellar job of covering their local communities.”

One reason for the churn elsewhere in the marketplace is that customers have come to expect a pattern in which “you sign up, you binge it, you blow it out in a couple of weeks, and then you terminate the service,” LeFort says.

Subsequently, “All of these streaming services, they’re making it easier for folks to come in and out of that ecosystem. When there’s a big event, March Madness, Super Bowl, you know, golf tournaments, etc., if there are reasons that you want to sign up, you’ll find those reasons.”

But that convenience-driven fluidity makes understanding metrics more challenging for advertisers (and industry watchers, natch).

“The evolution, the investment, the complexity of what it takes to measure local television in the US, it’s never been greater,” LeFort admits.

He says, “We take that very seriously, the responsibility that we have to measure these audiences, report them in a way that’s comparable, give our clients data that lets them make decisions, not just about their content, but about their revenue and their advertising.”

“Advertisers,” LeFort says, “don’t really care what the platform is. Whether it’s a stream, or whether it’s a broadcaster satellite, they just want to be able to reach their consumers. And conversely, those content creators, whether they’re creating local news and creating premium scripted content, or a reality show, they want to understand, is my impression bigger or more or bigger or smaller than those other providers of the content sources that are out there.

“And so while impressions are the great leveler, it’s being able to look at those different viewing sources, in a comparable way that allows advertisers and content readers to understand their worth relative to their competitors.

But in 2024, LeFort says, “There is no one single solution anymore. There’s no one cable lineup, there’s no one broadcast channel, it’s always going to be a blend of technologies and platforms. And we see that all of those datasets that have their own inherent value in amongst themselves. How do you harmonize them? How do you correct them? How do you make them comparable across content owners and advertisers and broadcasters. And that’s the role that we play — is to bring those things together and do it in a way that is transparent, that can be audited, that fully follows MRC accreditation policies and procedures.”

The fragmentation of the video market “almost amplifies the need for that measurement, even more so because everybody has to understand where they sit in this ecosystem, and do so in a comparable way,” he says.

“You’ve got to have similar metrics,” LeFort says. “And they have to mean the same things, whether it’s broadcast television, or a stream or or cable or satellite. And so listen, monthly average users, that’s important, because that shows how many people are finding you clicking once or 100 times you get counted as a monthly average user. So it does have value in my opinion.”

He explains, “It’s fundamentally important to understand how many people touch my content, how many people tune in, how many people launch a stream …However, [MAUs] misses the other really important part of any kind of audience measurement, and you set it as well, how much time do they spend, and at the end of the day, every number you see from Nielsen or any legitimate measurement company, it’s going to involve those two things, how many people tune in how much time that they spent. And from those two measurements, you get the GRPs, you can get the gross rating points, you get share, you get impressions, you get reach, you get all of those things, but you have to start out with those two fundamentals.”

Making Sense of the Mess

So how does Nielsen do it?

First, LeFort explains, “Big data has a ton of value and a lot of benefits. And that’s why we’ve gone full tilt at incorporating those sets of big data.”

“One source of big data is directly from the streaming platforms themselve,” he says. However, “The census data” from streamers and pay TV companies about user habits “exists in most cases behind a wall. So Netflix knows a ton of information about what you look at on Netflix, what I watch on Netflix, and how we’re all different and serves us up things that they think we want to watch.”

Streaming video “platforms have Nielsen technology built into them,” LeFort explains. “So when you sign up for Disney+, or sign up for TV, or Peacock, go into your user settings, everybody clicks right through …you’ll see Nielsen measurements specified in those in those settings.”

Also, “We’re working with Comcast, and Charter and Rush, DirecTV and Dish, obviously to collect their big set top box data. But the Dish TV looks very different than the DirectTV customer does, right?”

That’s where Nielsen’s audience panels come in. He says, “Panels have such a fundamental role to provide full market coverage and representation across ethnicities, geographies, different households, kids, household language, all of those things that are so relevant to measuring video, Spanish speaking household viewed very differently than non-Spanish speaking household, older households viewed very differently than younger household with kids. And so those panels provide really the foundational truth set that we can correct for the biases that we see in big data.”

LeFort says, “It’s the combination of those big datasets, whether it’s from the streamers, whether it’s from pay TV set top boxes, or from Nielsen’s panel that allow us to harmonize and provide things that are representative and comparable between those different.”

Nielsen then “harmonizes all of that big data from census providers [streamers], like you mentioned, with the fully representative panels that we create.”

NextGen TV to Change OTA Measurement

Additionally, Matheny points out, “Seventy-five percent of the U.S. television households are now in a market where a NextGen TV signal is being broadcast. NextGen TV was designed, you know, from a blank sheet of paper to be both an over-the-air broadcast transmission as well as a connected television solution that leverages the internet.”

“NextGen TV, and its ability to collect privacy protected information from those households from those viewers is tremendously exciting,” LeFort says, “because it’s going to give broadcasters for the first time ever really first party first party data at scale that can be used for a whole bunch of different applications, right? Whether it’s behavioral targeting, digital target, making television — linear, live, local linear television — a lot more like digital for advertisers to buy. That’s incredibly exciting. A ton of potential there.

“And then finally, from a measurement perspective, one of the really exciting things about that first party big data is it will for the first time ever provide a big data source or over the air household, this important resilient, sizeable section of the marketplace. And so as we look at always adding more big data sources to our measurement, as NextGen grows and scales, we think there’s an opportunity to build a big data source for over-the-air based on that.”