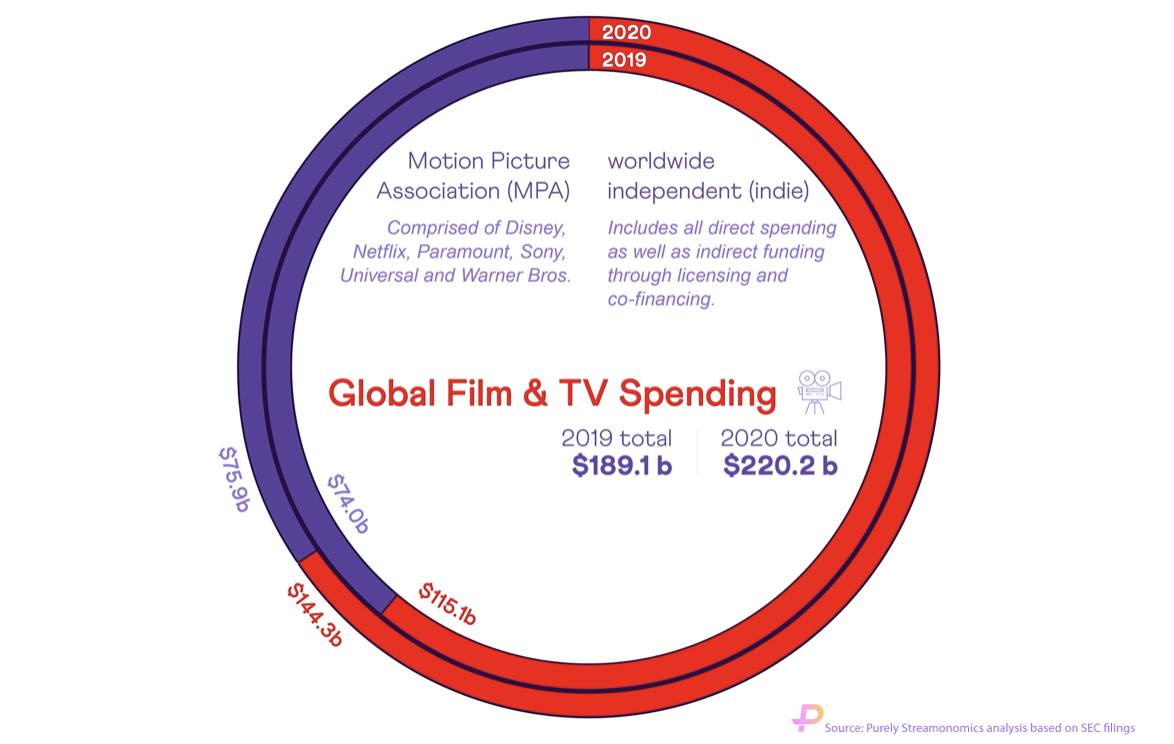

If you thought spending on content was impacted by last year’s COVID-ravaged schedules, then think again. Budgets for streaming content just keep on going up.

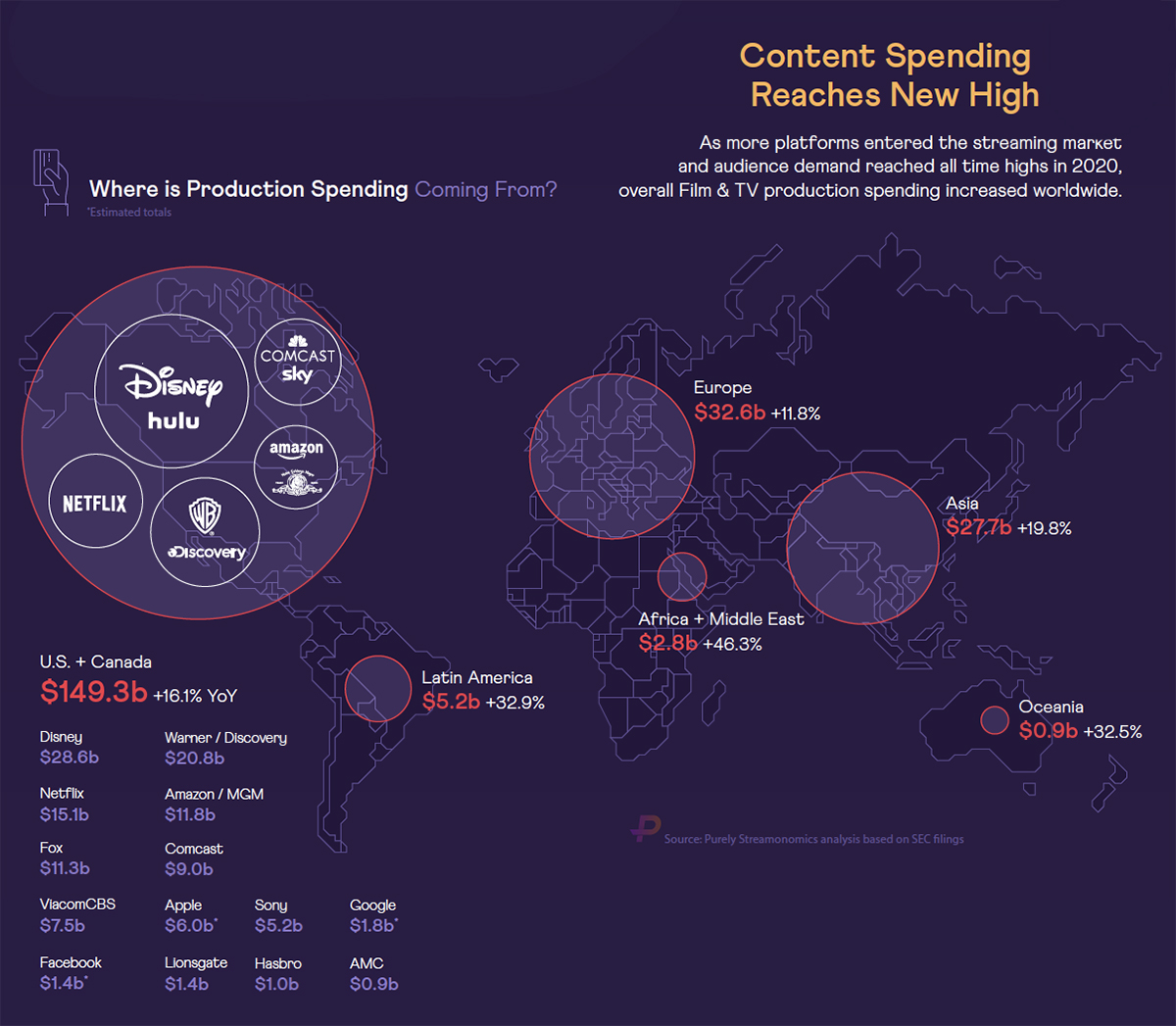

Fresh data from London-based fin-tech platform Purely reveals that the total global pot of money for producing and licensing new content rose 16.4% to $220.2 billion in 2020 and it’s on course to top that by the end of 2021.

What’s more, Netflix has been knocked off its perch as number 1 big spender. It’s now in third place behind Disney which grossed $28.6 billion for 2020 and the combined Warner Media-Discovery empire whose content spend totaled $20.8 billion. Netflix’s outlay was a paltry $15.1 billion.

Presented in the form of a infographic created by digital publisher Visual Capitalist, the Purely Streamonomics data shows how audience demand, content expenditure, and TV budgets all reached all-time highs.

Based on current trend lines, Purely expect production spending to top $250 billion by the end of 2021—and to keep rising beyond that Warner Media-Discovery, Amazon-MGM and Televisa-Univision start to impact the business.

“It is only a short matter of time before we see the $50 million television episode.”

— Wayne Marc Godfrey, Purely

While the actual number of films that went into production dropped last year, and TV series across the board experienced various shooting delays depending on location, more cash than ever was committed to content last year. Purely suggest this is a reflection of continually rising production budgets, of accounting methods for delayed titles that had already received the green-light, and of greater rights-buying activity as platforms sought to plug their programming gaps with content made by others.

What is remarkable about these record numbers is that the industry’s spending has yet to bump up against any natural ceiling.

According to Wayne Marc Godfrey, founder and CEO of Purely, “Streaming is not just displacing traditional sources of entertainment revenue such as pay-TV and linear broadcasting, it is actually expanding the global marketplace for video. The big question then becomes whether there are enough good stories out there, and talent to tell them, to keep fueling this transformation.”

READ MORE: An Industry Transformed – Global Streaming Business Reaches “Escape Velocity” (Streamonomics)

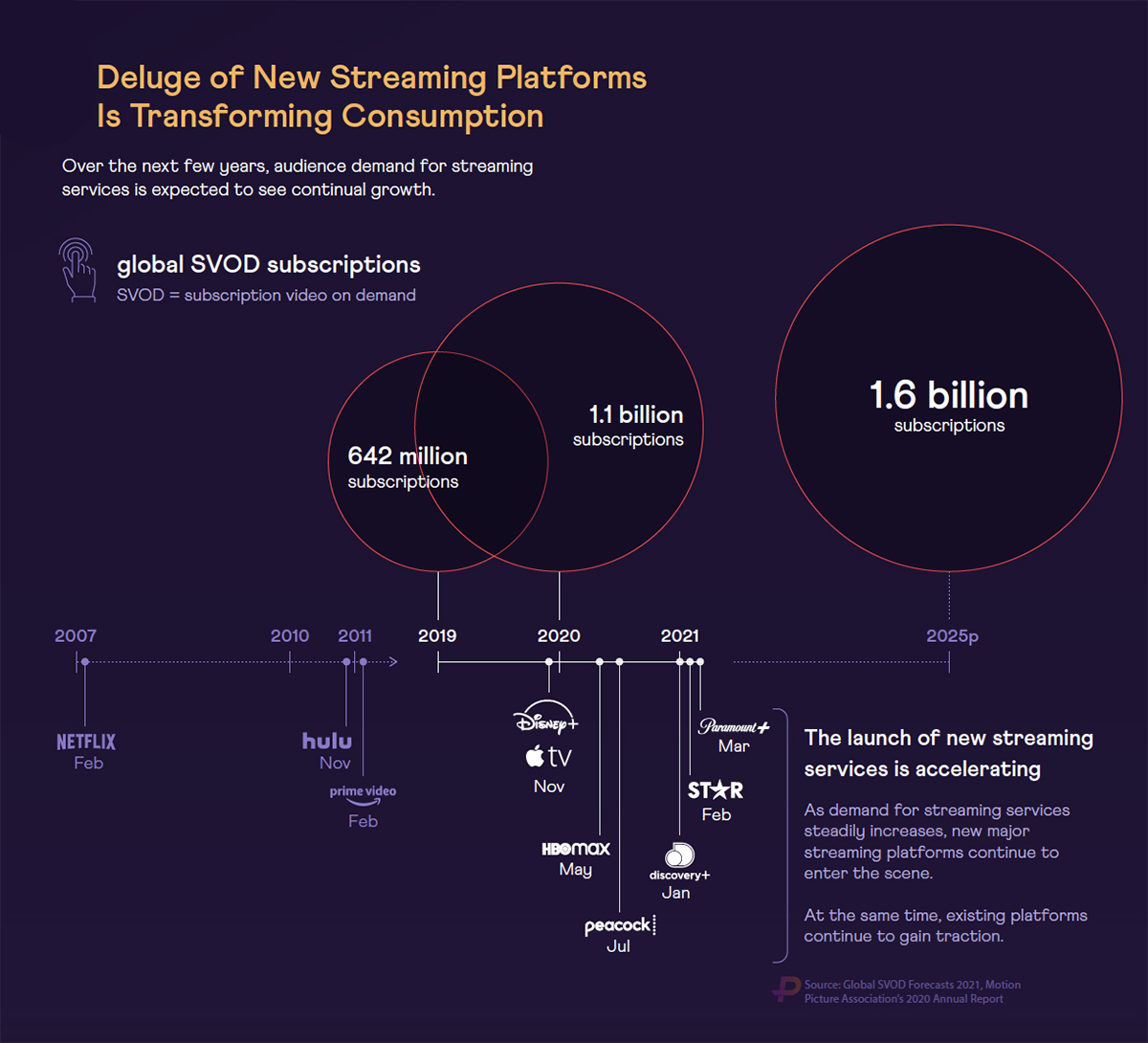

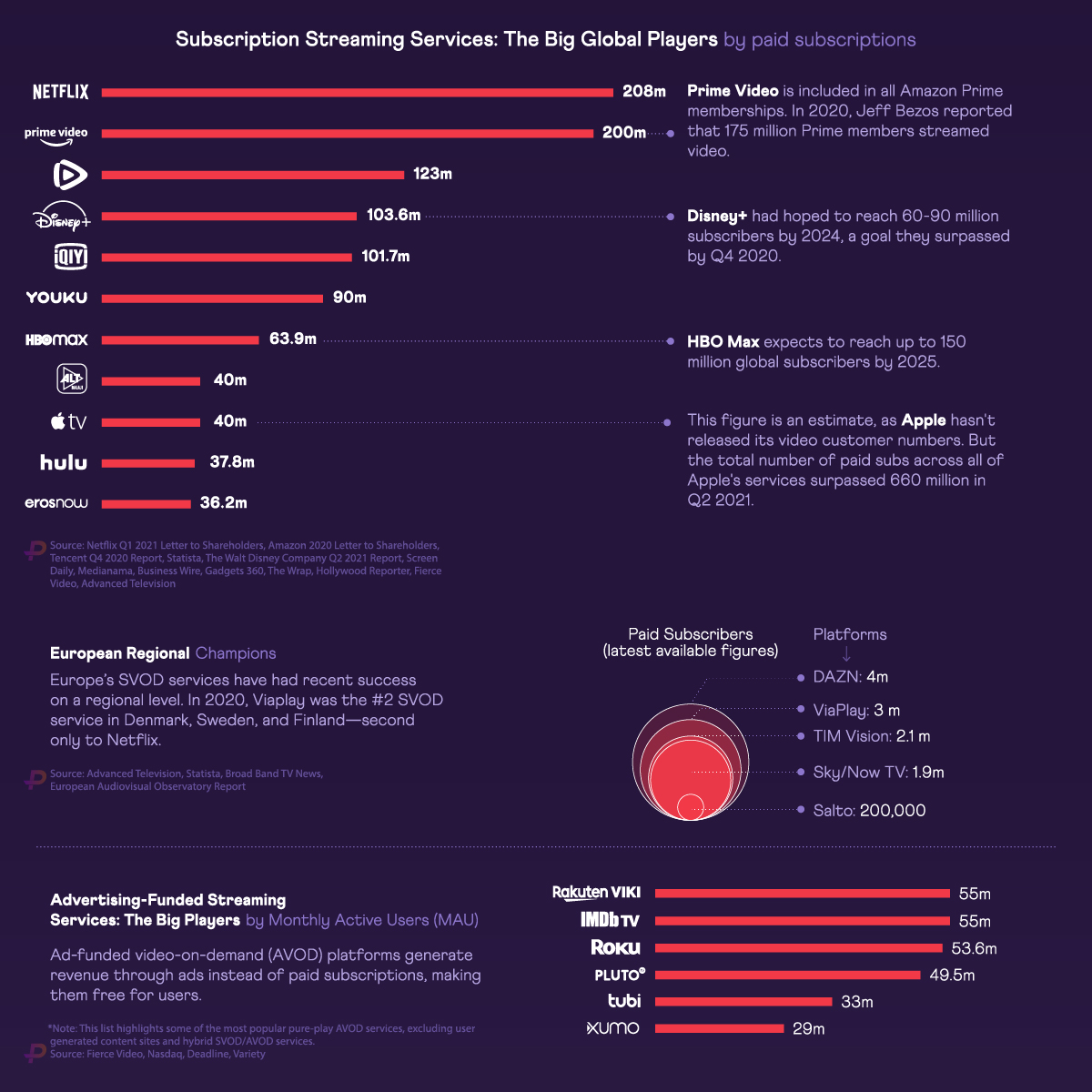

Since 2019, the number of global customers subscribing to streaming video platforms has grown from 642 million to more than 1.1 billion, a 71% leap that has been turbo-charged by months of enforced lockdowns at home, per Purely.

It’s not just the most familiar global SVOD platforms leading growth. Joining the hunt for monthly customers are several regional champions including France’s Salto, Scandinavia’s Viaplay, India’s Eros Now and ALT Balaji as well as the Chinese mega-platforms, iQIYI, Tencent Video and Youkou.

“All these SVOD platforms are fighting over the bragging rights to distinctive content as they spend billions of dollars trying to attract and then retain subscribers for the long-term,” Purely states.

It expects the total number of subscribers to reach at 1.6 billion by 2025 — representing about a fifth of the planet’s total projected population.

There is blowback from households wanting to cut the cost of their SVOD bundles. Rather than turn to linear TV or cable networks, they are likely to sign up to free of charge ad-supported streaming services.

“Streaming is not just displacing traditional sources of entertainment revenue such as pay-TV and linear broadcasting, it is actually expanding the global marketplace for video. The big question then becomes whether there are enough good stories out there, and talent to tell them, to keep fueling this transformation.”

— Wayne Marc Godfrey, Purely

AVOD is particularly prevalent in Asia where AVOD accounts for the majority of sector revenues outside China and where ad-funded players such as YouTube have become the destination for professional content in Korea, Japan and Southeast Asia.

Not only is the deluge of new streaming platforms transforming consumption, it is also turning the economic calculus for film and TV producers on its head.

The research shows that, in the US, average budgets across scripted, unscripted, daytime and kids rose 16.5% in 2020. In TV and film, this budget inflation has largely been created by the fight for talent exclusivity, especially with regard to contracting top names and locking them in for future seasons of a show, together with “the necessary hike in production costs in order to deliver lavish, glossy and impactful shows that act as subscription drivers to a platform,” such as Disney+’s The Mandalorian or WandaVision.

The cost of introducing and monitoring COVID protocols in 2020 also added 20%-30% to production budgets, per the report. Even if these costs subside, industry talk of introducing “green production initiatives” could see a further 5-10% added over time. Either way, costs keep creeping up.

CHARTING THE GLOBAL MARKETPLACE:

Big content spends, tapping emerging markets, and automated versioning: these are just a few of the strategies OTT companies are turning to in the fight for dominance in the global marketplace. Stay on top of the business trends and learn about the challenges streamers face with these hand-curated articles from the NAB Amplify archives:

- How To Secure the Next Billion+ Subscribers

- Think Globally: SVOD Success Means More Content, Foreign Content and Automated Versioning

- How Does OTT Gain Global Reach? Here’s Where to Start.

- Governments Draw Battlelines To Curb the US Domination of SVOD

- Streaming Content: I Do Not Think You Know What That Word Means

“It is only a short matter of time before we see the $50 million television episode,” says Godfrey, who urges producers to “follow the money.”

“Now that the tables have well and truly turned, a domestic public service broadcaster or local linear network should no longer be the main goal for an ambitious production business. I think the time has come for [producers] to take their biggest and best ideas — whether scripted or unscripted — to the streamers.”